1Q22 earnings: a robust start for 2022?

As of 10 May 2022, 1,089 listed businesses on Vietnam's stock exchanges had issued 1Q22 results, accounting for 94.3 percent of the market capitalization.

Food producers' net profit growth surged to 44.5 percent year over year in 1Q22, compared to 13.8 percent year over year in 1Q21.

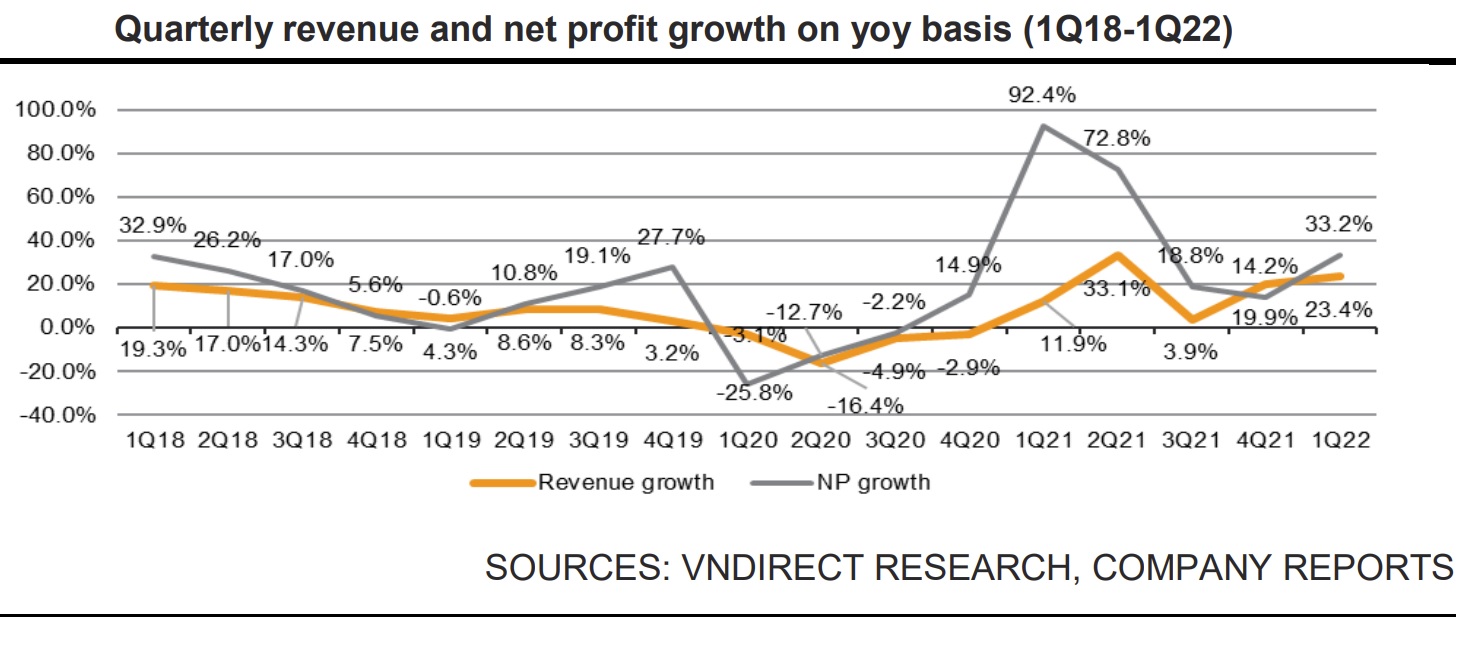

According to VNDirect's estimations, aggregate earnings of listed businesses on three bourses (HOSE, HNX, UPCOM) climbed 33.2 percent year over year in 1Q22, compared to 14.4 percent year over year in 4Q21. Due to the low base in 1Q20, the market's net profit in 1Q22 expanded slower than in 1Q21 (92.2 percent yoy) (-25.9 percent yoy).

Out of the 46 firms covered by VNDirect that have released their 1Q22 results, 58 percent met expectations, 28 percent exceeded forecasts, and 13 percent fell short of expectations.

Banks' aggregate net profit increased by 31.7 percent year over year in 1Q22, compared to 7.7 percent year over year in 4Q21, adding 12.3 percent to market earnings. However, excluding VPB's one-time gain, banks' NP increased by 20.0 percent year over year. Following the surge in fertilizer and phosphate prices, chemicals, led by DPM, DCM, and DGC, posted exceptional earnings growth of 304.1 percent year over year. Food producers' net profit growth surged to 44.5 percent year over year in 1Q22, compared to 13.8 percent year over year in 1Q21. As a result, banks, chemicals, and food manufacturers contributed a combined 21.0 percent to market earnings increase in 1Q22.

Notably, telecommunications returned to profitability in 1Q22 after a loss in 1Q21, owing mostly to VGI's strong performance of VND1,189bn in 1Q22's NP.

Meanwhile, because to outstanding business results from GAS (68.9% yoy), 1Q22 utilities earnings growth surged to 52.0 percent yoy, substantially higher than the 1.9 percent yoy in 1Q21. After a 35.8% yoy loss in 4Q21, electricity earnings rebounded 56.4 percent yoy in 1Q22, mainly to (1) post-Covid-19 power consumption recovery and (2) an additional wind power plant that began operations on November 21 and began to generate profit.

Due to price increases in building glasses, quartz, and plastic pipes, Construction & Materials earnings grew 33.1 percent year over year in 1Q22, with gross margin improving to 17.3 percent from 15.5 percent in 1Q21. Following rising coking coal prices and transportation expenses, manufacturers' earnings growth slowed to 12.4 percent yoy in 1Q22, substantially lower than in 4Q21 (36.0 percent yoy) and 1Q21 (281.8 percent yoy).

Besides, forest & Paper‘s 1Q22 earnings fell 11.7% yoy due to rising input raw wood prices and high shipping costs. Property developers extended the downward trend with a 5.7% yoy slide in 1Q22 net profit, (-36.9% yoy in 4Q21) due to a fall in sales volume of condos and landlord segments.

It is noted that, for 1Q22, 25 corporates out of VN30 had shown positive growth, led by MSN (752%) yoy), VPB (171% yoy), and NVL (101% yoy). The stellar growth of MSN came from good results from business segments, and financial income surged 365.2% yoy. VPB recorded an upfront fee from AIA, all in 1Q22. Increased NVL revenue due to significant property handover

Among banks, besides VPB, STB and BID recorded the highest earnings growth of 59.0% and 34.9% yoy, respectively. On the other hand, the laggards are named PLX (- 63% yoy), VRE (-52% yoy), and CTG (-28% yoy). CTG was the only large bank that had negative 1Q22 NP growth due to a high base in 1Q21 and an increase in provision of 227.9% yoy.

VRE launched a supported package of VND464bn in 1Q22. Higher PLX input gasoline prices as a result of the shift to imported sources to compensate for Nghi Son's shortage.

Many firms have increased their activity since reopening to get back to where they were before the COVID-19 outbreak. As a result, 1Q22 profits could be regarded as a promising start for 2022.