A brighter long-term future for Vietnam's renewable energy

Solar power had a greater capacity mobilization rate in 1Q22, but wind power showed signs of instability.

In 1Q22, the solar power, including solar farms and rooftop solar, was mobilized at a higher capacity of roughly 11,400MW (73 percent total capacity), which was significantly higher than the average 7,900MW in 4Q21.

>> Vietnam to cut solar power capacity in draft plan

Since October 2021, the national power system dispatching center (EVN NLDC – A0) has been publishing data on mobilized capacity by energy kinds. As a result of the sharp cut down rate of roughly 20% during Covid-19's low electric load in 4Q21, solar power was mobilized at a small capacity. However, in 1Q22, the situation gradually improved as solar power, including solar farms and rooftop solar, was mobilized at a higher capacity of roughly 11,400MW (73 percent total capacity), which was significantly higher than the average 7,900MW in 4Q21.

Looking for new price mechanism

The wind power FIT competition ended in October 2021, and EVN stated that out of 106 wind power facilities that filed documentation for COD registration before the FIT deadline, with a total capacity of 5,655MW, 3,980MW of 84 operational plants completed COD on schedule. As a result, wind power investors who complete COD before November 1 will receive a subsidized FIT price of 8.5 cents/kWh for onshore wind projects and 9.8 cents/kWh for offshore wind projects.

Several big energy firms have demonstrated their capabilities and potential by owning wind power generators that COD on time and receive favourable FIT prices. Some of the most notable names, such as REE, GEG, PC1, and GEX, have climbed into the top 10 RE businesses in the market by heavily exposing themselves with huge wind power portfolios. Due to the advent of wind power in 2022F, Mr. Nguyen Ha Duc Tung, VNDirect's analyst, predicts these companies will have a favourable profit growth forecast.

Mr. Nguyen Ha Duc Tung stated that methods and regulations to encourage the development of clean energy and renewable energy have not been consistent and have been interrupted, such as the slowing of solar power (from January 1, 2021) and the recent interruption of wind power (after Nov 01, 2021). This is likewise regarded as a bottleneck that must be removed, and a continuous legal corridor is required. Recent methods and strategies have failed to provide a long-term perspective. As a result, despite being identified as a vital energy source in Vietnam's strong green energy transition scenario, RE power investors are still waiting for the government to issue a new policy after the FIT pricing policy expires.

"We hope on a new system that is still advantageous to continue encouraging investors, both local and foreign, to participate in this energy source in the future," Mr. Nguyen Ha Duc Tung said, citing the bright prognosis of RE power and the government's clear direction.

>> Large foreign firms interested in Vietnam’s offshore wind power industry

What to expect from solar power and wind power?

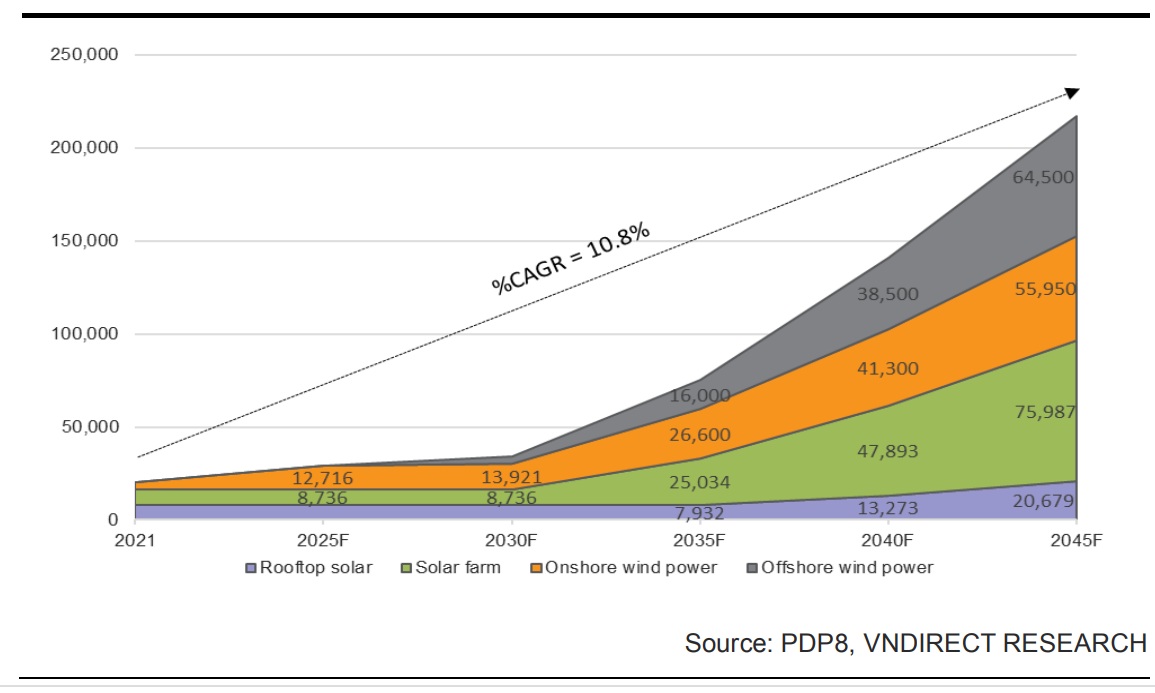

RE power will rise at the fastest rate of 10.8% between 2021 and 45F, from 20,408MW to 217,116MW. However, after a period of rapid expansion in 2020, solar power capacity growth will slow in the 2021-30F timeframe before surging from 16,491MW to 96,666MW in the 2030-45F period. However, Mr. Nguyen Ha Duc Tung noted that the 6,500MW of solar power allowed under the revised PDP7 has yet to be incorporated in the new PDP8 draft and is awaiting the Standing Government's decision. As a result, he anticipates solar power will rise in the 201-30 decade, regardless of the final outcome.

Onshore wind power will be the spearhead for RE growth in 2022-30F while offshore and solar power will accelerate from 2031 (Unit: MW)

Wind power, on the other hand, will become the key growth engine for RE power in the period 2021-30, starting with onshore wind power. Onshore wind power capacity, in particular, will grow rapidly from 3,980MW to 13,921MW by 2030. From 2035F onwards, 16,000MW of offshore wind power will be available, contributing to the rapid expansion of wind capacity. Total wind power capacity will reach 120,450MW in 2045F, accounting for 29% of total power capacity.

According to an IEA analysis on renewable energy, the recent spike in commodity prices will halt the falling trend in renewable electricity Capex in 2022, resulting in higher construction costs for new power plants. However, because to the significant demand for these energy sources, the trend of lower Capex will continue in the long run, notably between now and 2026. Furthermore, because to the global development trend in this energy type, the levelized cost of energy (LCOE) for renewable plants has decreased dramatically. As a result, it will benefit investors in the long run by lowering investment costs for future initiatives.