A legal impetus needed for the corporate bond market

The issuance of privately placed corporate bonds in 2024 may be slowed unless there is an alternative approach to Decree 08/2023.

There were 166 successful domestic corporate bond issuance in the fourth quarter of 2023.

>> Corporate bond market stays quiet at year beginning

Corporate bond issuance continues to recover

There were 166 successful domestic corporate bond issuance in the fourth quarter of 2023. Total issuance value increased by 22.3% quarterly and approximately 700% year on year to VND146,277bn (US$6bn). 159 private business bond issuances totaled VND131,970bn (US$5.4bn), or 90.2% of the total issuance value. There were seven public offers totaling VND14,307bn (US$586m), accounting for 9.8% of the total issuance value. In 2023, the total value of corporate bonds issued reached roughly VND335,721 billion (US$13.76 billion), up 25.6% year on year. The total value of private placement bonds was about VND300,610bn (US$12.32bn), representing a 21% increase year on year.

Corporate bond issuance continued to increase in 4Q23, rising by 22% quarter on quarter and more than 1,600% year on year. The revival in private corporate bond issuance is mostly due to increasing activity in the banking sector. In 4Q23, the Banking sector issued roughly VND92,203bn (US$3,78bn) in private corporate bonds, making up nearly 69.9% of total issuance.

Pressure on corporate bond maturities

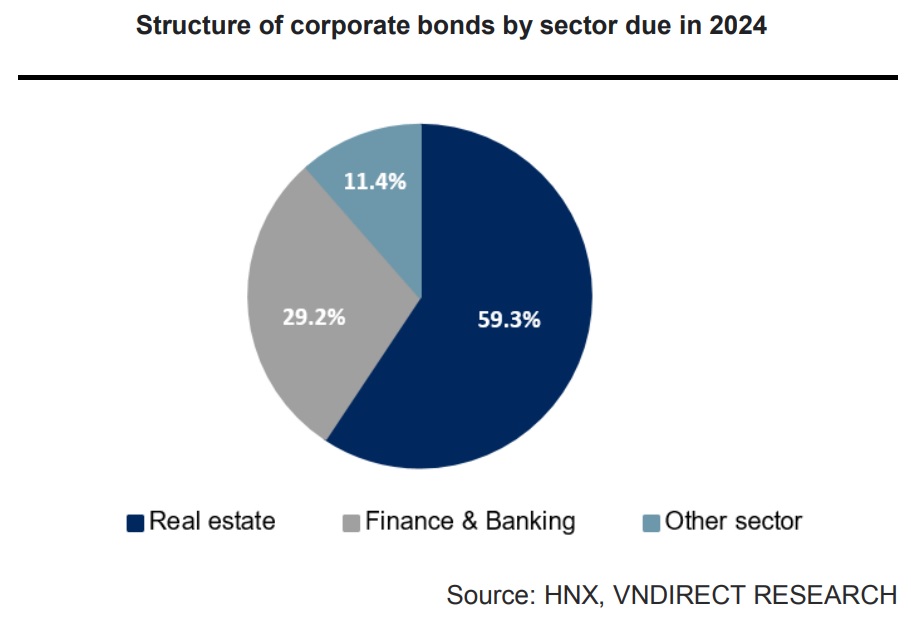

VNDirect estimated the total value of individual company bonds expiring in 2024 at roughly VND207,000bn (US$8.48bn), down 3% year on year. The real estate industry is the greatest contributor, accounting for 59.3% of total maturity value, followed by the financial-banking sector at 29.2%. The maturity value of the real estate industry has climbed by 23.7% since 2023, while that of the financial-banking sector has increased by 69%.

In the backdrop of a slow real estate market, legal obstacles in project clearance persist, and difficulties in business operations for real estate organizations are projected to continue in the future year. Mr. Nguyen Ba Khuong, an analyst at VNDirect, believes that cash flow concerns and aging corporate bond problems will continue to be important challenges for the real estate sector in 2024.

>> Corporate bond market gradually recovers

Corporate bond issuance may slow

The issuing of private corporate bonds may decelerate as the terms of Decree 65/2022, which were delayed until December 31, 2023, go into force. These include legislation governing professional securities investors and the mandated use of credit ratings. Mr. Nguyen Ba Khuong stated that these laws must be implemented in order to accomplish the long-term aim of improving quality for the stability and development of the corporate bond market.

However, he also urged that the government investigate and implement other supporting measures to replace Decree 08/2023, which expires on January 1, 2024. These measures can assist support and encourage the long-term revival of the corporate bond market. "We believe that with the efforts of both market regulators and players, particularly issuing businesses, the corporate bond market will see a clear and sustained rebound by the end of 2024," said Mr. Nguyen Ba Khuong.