A period of low interest rates could prolong

The State Bank of Vietnam (SBV) continued communicating with the banking system via administrative and directive measures to encourage the banking system to support affected businesses under widespread infection. This will allow interest rates would remain low, said Kis Vietnam.

Transaction at SeABank amid COVID-19

Monetary accommodation expected to continue

On 7th September, SBV issued the Circulation No 14/2021/TT-NHNN to modify and supplement Circulation No 01/2020/TT-NHNN and Circulation No 03/2021/TT-NHNN, mainly allowing banks to extend the repayment period to 30th June 2022 instead of 31st December 2021. Besides, SBV issued official letter No. 5901/NHNN, requesting the credit institutions to reduce lending rates and fees to share the financial burden with customers affected by the Covid-19 epidemic.

The government has considered ease restrictions gradually in Hochiminh city on 15th September, giving hope for economic activities to return partly to normal. However, enterprises seem to put their new production plans aside and wait to see how the re-opening of the city would be going. Therefore, the financing demand in the first lending market would remain modest, and the short-term liquidity would remain abundant. Hence, Kis Vietnam predicted that the monetary stance in the next month would continue to follow accommodation with the administrative style to prompt commercial banks to share the financial burden with COVID19- affected victims to see how good the re-opening would be.

Interest rates to stay low

Interbank rates in August declined further with a decrease in trading value, reflecting the abundant liquidity in the money market under the sluggish lending market. Lending costs of interbank loans declined in the majority of tenors except for 1-month one. Specifically, 1-week, 2-week, 3-month, 6-month, and 9-month loans declined by 34bps, 45bps, 31bps, 19bps, 37bps and 94bps compared to the previous month to post 0.63%, 0.81%, 0.98%, 1.78%, 2.45%, and 2.89%, respectively. On the opposite direction, the interest rate of 1-month loans increased by 9bps to post 1.66% this month.

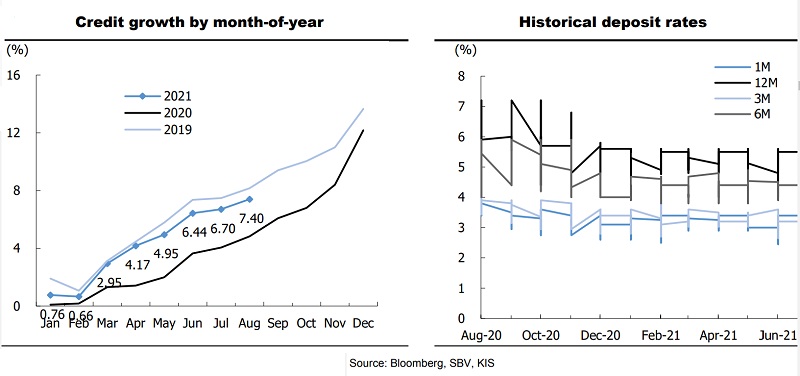

Kis Vietnam said that the slowdown in the first lending market and the low-cost funding environment under the reductions of the domestic consumption and production were the main reasons to drop the interbank rates this month. Lending activities remained slowing down this month as the credit growth was 7.40% YTD, recording an insignificant increase in the outstanding loans of the banking system, loosening the short-term liquidity in the money market. Besides, deposit rates stayed low, allowing banks to lend their short-term funds at reasonably low rates. Furthermore, SBV switched from the forward to spot USD-buying in August-early, injecting more liquidity to the money market.

Kis Vietnam predicted that interest rates would remain low in the next month due to several reasons. First, although Hochiminh city authorities drafted the scenario of a partly re-opening the economic activities in September, it seems to be a trial and error solution with many uncertainties under the complicated infection and slow vaccination. This implied that the production would take several months to operate like the pre-pandemic period entirely. Lending demand, therefore, would slow down further. Second, Vietnam State Treasury announced to add short-term loans with the total amount of VND59tn in 3Q21 to the money market via repurchase agreements of government bonds, increasing the availability of short-term funds in the banking system and putting downward pressure on the interbank rates in the next month.