Asian ESG investing to experience growth challenges

Environmental, social and corporate governance (ESG) adoption in Asia has been slower than other regions, and a shortage of experienced talent is symptomatic of that.

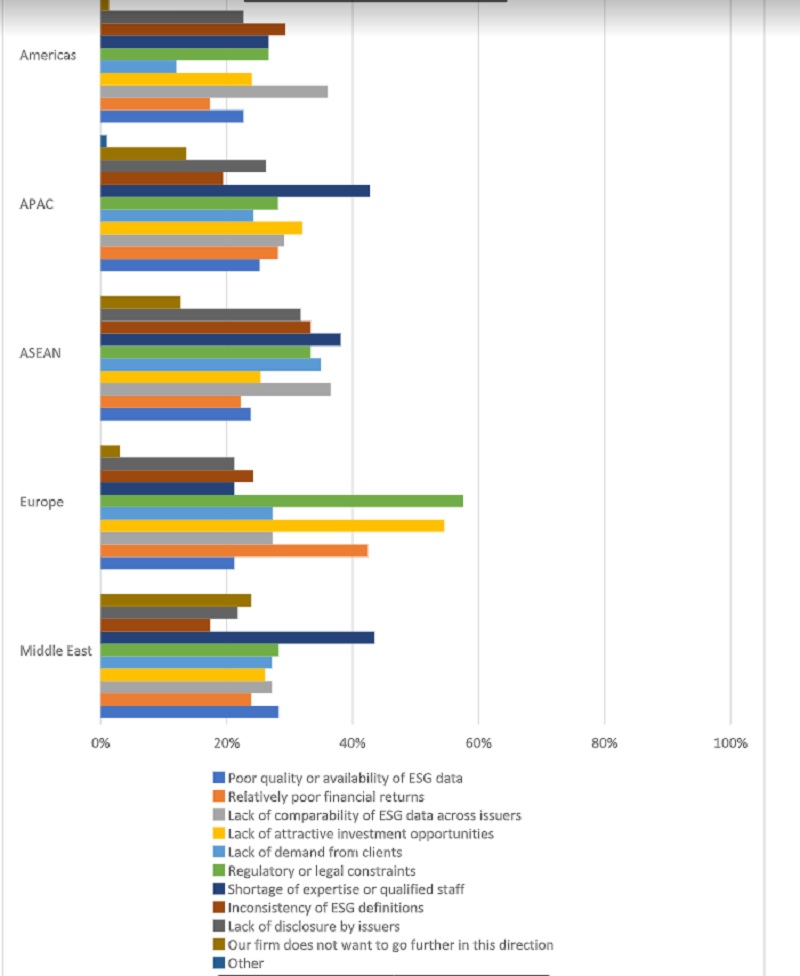

What is holding back your organisation from pursuing ESG investing more fully and broadly?

Dr. Celine Herweijer, Group Chief Sustainability Officer, HSBC said that institutional investors across Asia woule be embracing ESG and more responsible investing, and this commitment would be likely to grow even stronger – about half (49%) of the investors we surveyed say there is nothing holding them back from pursuing this type of investing more fully and broadly.

Yet, as with all developing financial markets, investors will encounter challenges. For the other half (51%) of investors who said they are being held back by certain issues, most of them (41%- up from 26% last year and the second highest regional percentage) said the shortage of expertise and qualified staff was the main reason why.

By country or territory, this issue seems to be less of an issue in Hong Kong (27% of issuers there say the shortage is a problem) than it is in China (43%) and Singapore (41%).

In general, this is a global and cross-industry issue as soaring demand for ESG talent has outstripped supply. But clearly some regions, especially Asia and MENAT, are seemingly more adversely impacted than others such as Europe and the Americas, according to our survey, said Dr. Celine Herweijer.

It is difficult to pinpoint exactly why this is. It could be that ESG adoption in Asia has been slower than other regions, and a shortage of experienced talent is symptomatic of that.

Other issues holding Asian investors back include a lack of attractive investment opportunities (32% - up from 11% last year), a lack of comparability of ESG data across issuers (29% - down from 46%), and regulatory or legal constraints (21% - down from 28%). These are some of the same issues encountered by investors elsewhere.

Such challenges may frustrate progression, but they do not prevent it. And Asian investors are continuing to embrace ESG investing, albeit at their own, slower pace; some 39% of them this year say their organisation has a firm-wide policy on responsible investing or ESG issues – the second lowest percentage regionally after MENAT – while a further 36% say they intend to have one in place in the future.

Interestingly, across the Asian countries HSBC surveyed, Chinese investors seem to trail their peers elsewhere in the region. While a third of them have a policy in place – lower than the regional average of 40% – this is notably fewer than investors in Hong Kong (42%) and Singapore (48%).

Of the key components composing their policies, or that are expected to compose their policies, most Asian investors (50%- up from 40% last year) say an approach for identifying material ESG issues for investments – the leading response in most other regions except for the Middle East.

Other key areas include stewardship principles (40% - up from 26%), disclosure on the ESG characteristics of selected portfolios (36% - up from 33%), and impact goals or metrics used as part of investment decision-making (36% - up from 33%).

All these points to ESG becoming increasingly core to the investment decision making of Asian investors, but there is still some way to go before it is; 20% say they always take into account the issuer’s ESG credentials and performance when making an investment.

This is notably higher than for investors in MENAT (16%), somewhat closer to Europe capital providers (26%), but significantly lower than for investors in the Americas (44%).