Bond maturity effects on the real estate market

The cash flow of listed real estate corporations would not be significantly affected by the approaching maturity of corporate debts.

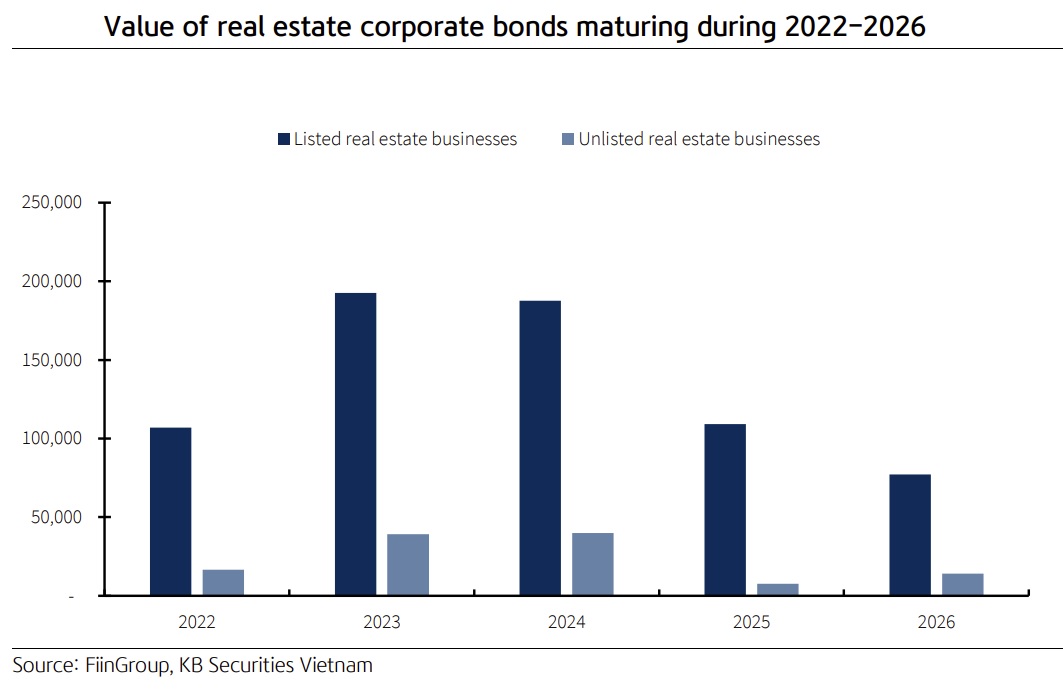

Only 15.5 percent of the 123,400 billion VND worth of real estate corporate bonds that will mature in 2022 will come from listed firms.

>> Capital mobilisation through corporate bonds may decrease sharply

Only 15.5 percent of the 123,400 billion VND worth of real estate corporate bonds that will mature in 2022 will come from listed firms, and 84.5 percent will come from unlisted companies. According to Mr. Tran Duc Anh, Head of Macro & Strategy at KB Securities, tougher oversight of corporate bond issuance as well as tighter supervision over real estate credit will have a significant impact on the property sector's ability to raise capital over the next quarters. Additionally, the cash flow of real estate businesses may be under a great deal of strain this year due to the necessity for substantial sums of money to pay for the maturities of corporate bonds.

The good news is that big businesses are encouraging sales to increase cash flow. With VND16,500 billion at Vinhomes (VHM), VND28,000 billion at Novaland (NVL) (62 percent YoY), VND7,880 billion at Nam Long Group (NLG), and VND400 billion at Dat Xanh Group (DXG), the total value of newly signed contracts climbed significantly in the first half of 22.

Listed firms have been expanding their capital sources outside the two conventional capital channels of corporate bonds and credit, such as through M&A, overseas joint ventures, and investment funds. Particularly, NVL successfully sold USD 250 million worth of convertible and warrant-linked bonds to foreign investors, and DXG is expected to issue USD 300 million worth of international convertible bonds in the third quarter of this year.

“We believe the large-scale listed real estate firms are fully capable of repaying debts when corporate bonds mature, despite the challenges of the real estate industry in the current context. As for small and medium businesses, it will take time for further assessments”, said Mr. Tran Duc Anh.

>> Loopholes in corporate bonds market

Despite the fact that there have been no significant occurrences that have had a significant impact on large-cap stocks in the real estate sector, Mr. Tran Duc Anh anticipated that the strict regulation of credit and corporate bond issuances would have a negative impact on the performance of listed and unlisted real estate companies in the last two quarters of this year. Following the economic reopening, some of the speculative flow has returned to production and business operations, particularly in light of the recent two-year strong rise in real estate values in several places.

Statistics show that the issuance value of real estate corporate bonds decreased steeply, with no issuance recorded in April and only VND1,300 billion from corporate bond issuance recorded in May (-91% YoY).

The total amount of outstanding real estate loans at credit institutions as of the end of April 2022 exceeded VND2.28 quadrillion, up 10.19 percent from the end of 2021, according to the State Bank of Vietnam (SBV). It makes up about 20.44 percent of the economy's total outstanding loans, and this sector's bad debt ratio is roughly 1.62 percent, or VND37,000 billion. In order to quickly identify potential dangers and take the necessary action to ensure the security of the banking system, the SBV has been regularly monitoring the increase of outstanding loans and credit quality in the securities and real estate sectors.

In the pessimistic scenario, if the real estate market turns gloomy and faces challenges in sales and fundraising to repay debts, it will lead to cash flow disruption and spillover effects on the banking operation, given the close relationship between these two sectors.

Generally, Mr. Tran Duc Anh said the problems would surround a few small and medium-sized enterprises facing bad financial health, which will hardly create strong spillover effects. The real estate sector contributes nearly 8% of GDP annually and impacts 40 other key sectors of the economy. Therefore, credit control by the SBV is necessary to stabilize and help the market take regulatory steps to maintain sustainable development in the long term.