Bright prospects for Vietnam’s yarn manufacturers

Vietnam's yarn producers could continue to be the biggest beneficiaries of US-China trade tensions.

US-China trade tensions could impact positively on Vietnam's yarn producers.

Increased demand in the US and EU

According to the European Apparel and Textile Federation (Euratex), the EU textile and apparel industries continued to recover from the COVID-19 crisis. For example, the value of textile output has already reached its pre-pandemic level by the end of November 2021. VNDirect expects that the outlook of the Vietnam T&G industry in 2022 will be followed by the recovery of the US and EU markets.

Additionally, large T & G companies such as M10, STK, and TCM have enough orders until 2Q22F or 3Q22F. The International Monetary Fund (IMF) and the World Bank (W.B.) forecast global GDP growth of 4.9% in 2022F, and global textile demand will return to 2019 levels in 2022F, reaching around $740 billion.So Vietnam T&G export turnover could fulfill the government’s guidance in FY22F (US$43bn, 10.2% yoy).

US-China tensions as a driver

At the end of 2021, US President Joe Biden signed a new law banning the import of cotton material made in Xinjiang (China) after current tension between China and the US.

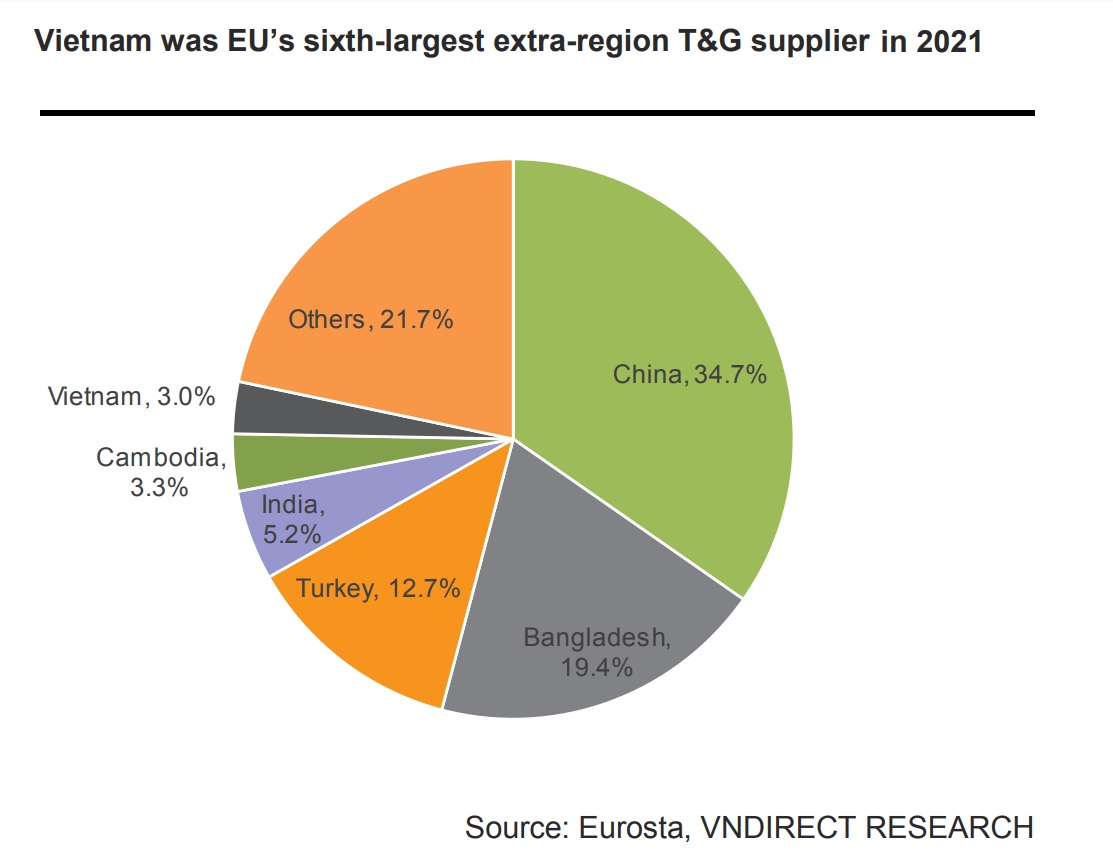

Customs and Border Protection estimates that about US $9.9 billion in cotton products were imported to the US from China in 2021. VNDirect believes that large cotton yarn manufacturers such as VGT, ADS, and PPH take advantage of the refusal of the US to buy cotton from China when they tend to switch to buying fabric and yarns from Vietnam. Same as in Europe in March 2021, after a series of major international fashion brands such as Nike, H & M, Uniqlo, Zara, and others announced they would stop using cotton material from Xinjiang (China), China's market share of fabric and yarn exports to Europe has decreased from 52.4% in 2020 to 44.7% in 2021. As the EU’s sixth-largest extra-region T & G supplier in 2021 (accounting for 3% in value), Vietnam could clearly take advantage of the EU market from 2022F.

Currently, VGT's yarn sales accounted for 50% of gross profit in FY21. VNDirect forecasted yarn revenue from the US market to account for 10% and 20% of export revenue of ADS and PPH, respectively. Additionally, the US-China tension could positively impact STK in the long term when large brand fashion tends to use eco-friendly materials. This stock company expects STK’s recycled yarn volume in FY22 and FY23F to increase 25.9% and 15.8% yoy, respectively.

The impact of increasing input prices

Cotton prices hit a 10-year high in September 2021, reflecting a gradual improvement in the global consumption outlook. According to Trading Economic, cotton prices are expected to reach US107.4/pound (15% yoy) in 2022 due to poor harvests in the US and India. The US Department of Agriculture forecast US cotton production to reach 17.6 million bales (-3.2% yoy), while India’s cotton volume in FY21-22 is forecasted to decline by 4.0% yoy as crops in the main producing states are damaged by rain during the harvest season. VNDirect thinks that the high cotton price will hurt the GM of garment companies that use cotton yarns for production processes such as MSH, TNG, and TCM. It forecasted GM’s garment company to edge down 1% pts to 1.3% pts yoy in FY22F.

In addition, textile enterprises such as GIL, ADS, TCM, and TNG have expanded their business into real estate and industrial parks. VNDirect expects the new business segment to support T & G enterprises' earning growth in 2022–25F.