China presses the USD by promoting currency swaps

China will put more pressure on the global dedollarization process with its recent currency exchange agreements worth over 14 billion USD with Saudi Arabia and Argentina, among other nations.

Business Forum Magazine had an interview with Mr. Nguyen Huu Thao (Tony Nguyen), Lecturer at Edith Cowan University (Australia), Researcher at the CSTRAD Center at the University of Commerce, Financial and Banking Expert of AVSE Global, on this issue.

What has prompted China to intensify currency swaps with Saudi Arabia and Argentina recently?

China's de-dollarization effort is part of its worldwide aim to compete economically and politically with the US. Through the USD, the United States has retained its strength. As a result, the recent currency exchange agreements continue to represent China's endeavor to increase the appeal of the Renminbi (RMB) as a trade and international reserve currency.

However, the USD continues to play a vital role in foreign exchange reserves and international payments. As a result, China's RMB will take a long time to compete with the USD. At the same time, China wants to encourage new partnerships because the value of the US dollar has risen greatly in the last year. The RMB, in particular, has fallen by more than 5% versus the USD. If China does not take explicit steps to boost the value and influence of the RMB, it may result in more nations across the world holding more USD.

Nonetheless, a rising number of countries are depreciating US Treasury bonds, raising gold reserves, and settling bilateral commerce in their home currencies. This originates from countries' concerns about the "weaponization" of the dollar, as witnessed in Russia's instance last year, or the drawbacks of relying on the dollar for many economies during the last decades. As a result, several nations will explore diversifying their foreign exchange holdings with the RMB.

What significance do China's new agreements have for the international financial system?

The currency exchange arrangement with Saudi Arabia is a "win-win" situation for both countries. Last year, China bought over 65 billion USD in crude oil from Saudi Arabia, accounting for 83% of bilateral commerce. As a result, utilizing the RMB for bilateral payments would save a significant amount of money and time.

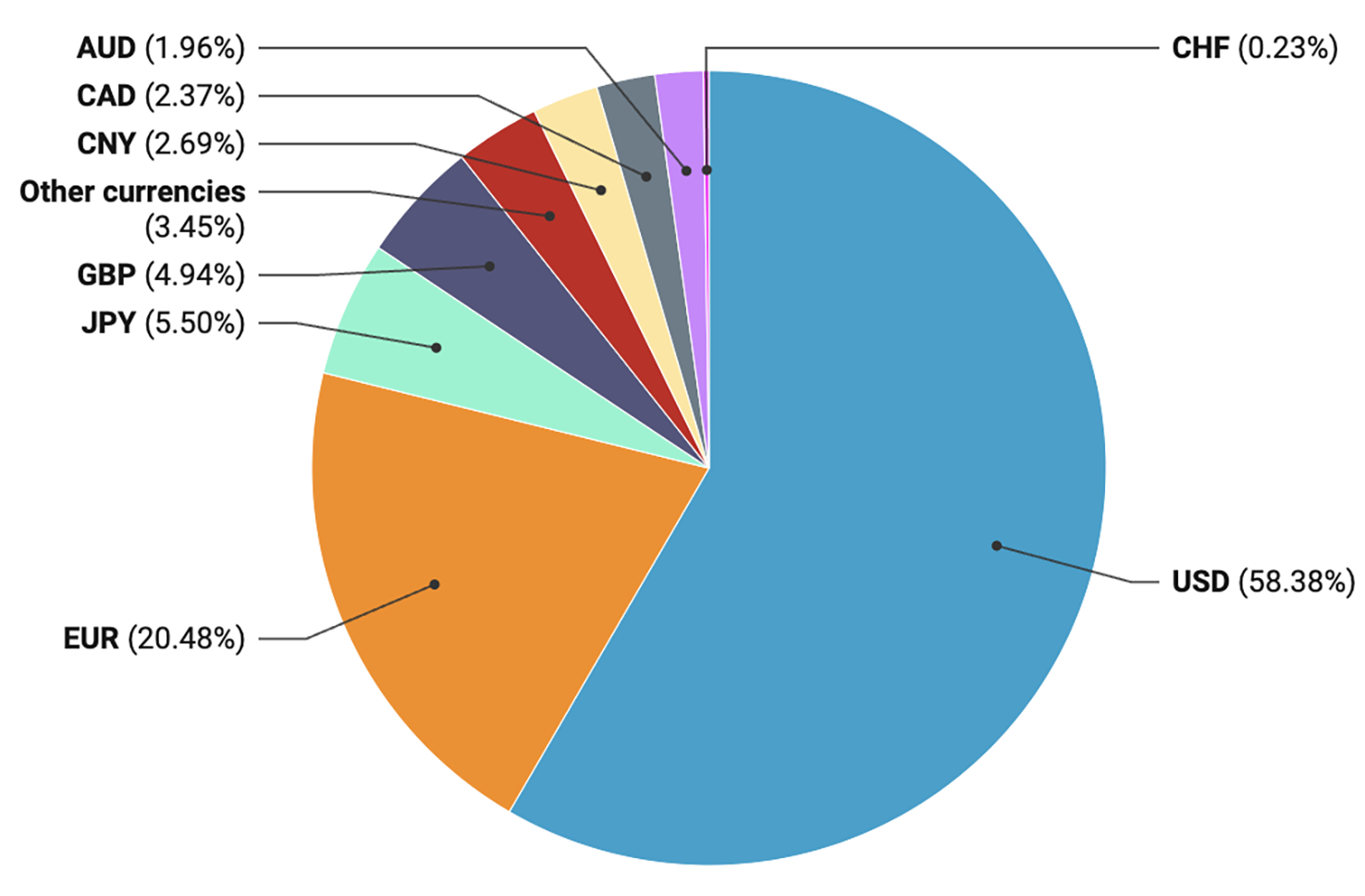

The impact of China's above-mentioned move on the global financial system, however, is rather limit ed, given the USD is still utilized in around 90% of worldwide foreign exchange operations.

As a result, the new collaboration has greater political significance. Because Saudi Arabia is the world's biggest crude oil exporter, a deal with China might assist other oil-exporting countries in following in Saudi Arabia's footsteps. This would be tremendously helpful for China in terms of influence and diminishing the weight of the USD in oil trade—the "petrodollar" being the goal.

The currency exchange arrangement worth 130 billion RMB signed in August has virtually secondary relevance for Argentina. Argentina is a country that is regularly in debt and is presently experiencing significant inflation, making foreign debt payments difficult. The currency swap arrangement with China will help Beijing expand its influence in this South American country.

How will China's new move affect the position of the USD and the U.S. economy?

As China's currency exchange grows, more nations will be able to deal in RMB without requiring USD. This might lower worldwide demand for the USD, resulting in a depreciation of the currency.

If this tendency continues, punitive actions based on the US viewpoint may become weaker, as witnessed with Russia. The RMB has kept the Russian economy from "collapsing," and commerce with China has increased quickly. Approximately 95% of transactions between Russia and China are currently conducted in Rubles or RMB. As a result, it is apparent that the RMB has given a way for countries to escape reliance on the USD.

On the other hand, the likelihood of a USD depreciation might have a variety of effects on the US economy. It has the potential to increase exports by making US goods more competitive in the international market. However, it may result in increased import prices, which will contribute to inflation.

What should Vietnam do in the face of China's currency swaps?

There is no evidence that China intends to enter into currency exchange agreements with Vietnam at this time. However, if this situation arises in the future, Vietnam must evaluate both the positive and negative consequences.

The first advantage is that Vietnam may minimize its reliance on the USD in trade transactions, making bilateral commerce more effective and boosting our country's competitiveness in the Chinese market through transaction simplicity and cost reduction. Furthermore, diversifying our foreign exchange reserves would aid our country's financial stability in the face of global market uncertainty.

However, when it comes to hazards, the currency rate must be addressed. Being too reliant on the RMB may expose Vietnam to dangers when its value changes dramatically, increasing Vietnam's import and export expenses. Furthermore, this might lead to increasing economic reliance on China.

Thank you very much!