China to relax COVID-19 lockdown: Impacts on Vietnam

It might be argued that China's relaxation of COVID-19 lockdowns has had some impacts on Vietnam's economy.

Residents queue for a round of COVID-19 testing during a lockdown in Shanghai

Since the COVID-19 pandemic broke out in Shanghai in late February, the Chinese government has enacted lockdowns and severe restrictions in response to growing daily cases and low vaccination rates among the elderly. It swiftly spreads to key Chinese cities like Guangdong, Shandong, Jilin, and others, which are home to numerous factories and bustling seaports that are crucial to the global supply chain.

In April, China's cargo throughput at its container ports decreased by 2.8% YoY. After eight weeks of lockdowns, Shanghai was particularly hard hit, with cargo throughput declining 27.1 percent YoY. Additionally, the container yards in the seaport and dry ports were closed to vehicles, which made it difficult to load and unload, and many ships had to wait offshore. According to statistics, it now takes 107 days to ship a container by sea from China to the US in the first quarter of 2022, an increase of more than three weeks.

As social distance-inducing measures were being gradually lifted, the number of illnesses in China gradually declined from a peak of 9,000 cases/day in mid-April to more than 100 cases/day at the end of May. Chinese citizens can now travel freely despite several constraints, and in the near future, production and commerce activities should continue to advance. The lifting of lockdowns, in Mr. Tran Duc Anh, Head of Macro & Strategy at KB Securities’s opinion, would be said to have some effects on Vietnam's economy in general and Vietnam's stock market."

In the oil and gas sector, China's average daily oil consumption was 13.3 million barrels in 2021. China's overall oil usage decreased by 1.3 million barrels per day in April as a result of social isolation policies implemented in large cities. Despite recent price increases, Mr. Tran Duc Anh stated that when China gradually reopens its economy, there would be a rise in consumption demand, which will raise oil prices.

Prior to the epidemic, there were around 14.3 million international visitors from Asian nations visiting Vietnam in the aviation and tourism sectors, with 5.8 million of them being Chinese (accounting for 40 percent of the total number of visitors). In comparison to 370 flights/week/route in mid-February 2022, the number of international flights during the winter flight schedule in 2019 was 4,185. (down 92 percent compared to 2019). Compared to 5M21, the number of visitors from Asia increased (3.2x YoY), but Chinese visits decreased by 5.2% YoY. According to Mr. Tran Duc Anh, the end of flying limit ations in 2H22 would result in an increase in Chinese tourists, which would help the performance of the aviation and tourism industries.

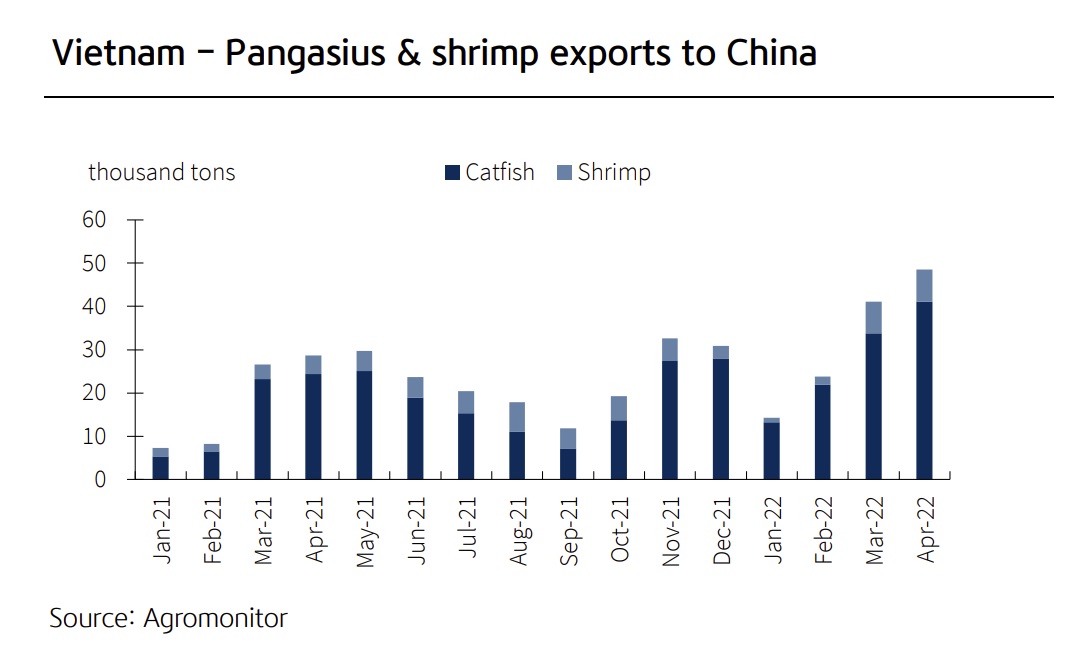

In the fisheries industry, Vietnam exported 736 thousand tons of pangasius in 2021 (down 6.5 percent year over year), but only 326,9 thousand tons of shrimp (-1.5 percent YoY). For both shrimp and pangasius, China is Vietnam's second-largest market behind the United States. Vietnam's seafood exports to this market continued to show signs of expansion despite COVID-19 lockdowns in many major Chinese cities and stricter inspection of imported and exported commodities. It represents the enormous consumer demand in the Chinese market, which is anticipated to increase in the future following the easing of lockdowns in major cities.

Regarding the textile and apparel industry, Vietnam imported over USD23 billion worth of textile yarns, fabrics, and other materials in 2021 to fill domestic demands, with over USD13.6 billion, or 60% of the import value, coming from China. Input material imports from China increased in value by 16.5 percent YoY in the first four months of 2022, mostly as a result of cotton and cotton yarn prices that reached five-year highs (22 and 20 YoY, respectively).

Besides, soaring freight rates in line with spiraling oil prices amid modest increases in garment product prices dampened the profit margin of domestic textile enterprises. Mr. Tran Duc Anh expects China's relaxation of Covid lockdowns will help resolve supply chain bottlenecks, ensure raw material supply, and improve gross profit margin for Vietnamese textile and garment enterprises.