Construction stocks reflect investors’ high expectations

Construction stocks began this year with high P/E ratios, signaling investors' big expectations in their prior valuations.

In the first nine months of 2024, the construction industry is estimated to have grown by 7.48% compared to the same period last year. (Illustrative photo)

The government's efforts to speed up the disbursement of public investments have started to show noticeable effects on the financial performance of construction companies, according to a recent analysis on the industry from Mirae Asset Securities. In particular, construction companies listed on the HSX and HNX had an increase in revenue of 18.3% and a growth in post-tax profit of 84.6% as of the first nine months of 2024.

With gross profit margins rising by 37.3% during this time, Mirae Asset observed that core business operations were the main source of the post-tax profit rise. Among these, VCG was the most lucrative construction company in the industry, with a post-tax profit of over VND 641 billion for the first nine months, up 176.5% from the previous year.

Major listed firms in the sector, such as HHV, CTD, and CII, have shown robust recoveries in both revenue and post-tax profits. For instance, CTD reported a 47.4% increase in revenue and a 124.5% rise in post-tax profits. Similarly, L18 saw a 68.8% rise in revenue and a staggering 522.3% growth in post-tax profits, while CTI’s revenue grew by 40.9%, and post-tax profits increased by 59.6%.

Additionally, Mirae Asset said that public investment equities have largely corrected lower in 2024 (as of November 1) following an excellent growth period in 2023. Many public investment equities saw steep drops, including C4G (-28.2%), HHV (-20.8%), LCG (-12.5%), and FCN (-10.1%), even though the VN-Index continued to rise by 11.1%. Even the infrastructure construction business CTD had a 1.31% decline in its stock price. DPG, on the other hand, distinguished themselves with a noteworthy 30.6% growth.

“One key factor we consider crucial is the high P/E ratios of these construction stocks at the start of the year, mostly above 20 times. High P/E ratios reflect prior valuations that already incorporated substantial investor expectations. Meanwhile, starting the year with a P/E of 12.1 times, DPG has bucked the trend with a strong price increase in the first nine months,” Mirae Asset assessed.

According to Mr. Hoang Gia Huy, an analyst at Vietcap Securities, who spoke at a recent online seminar on the prospects of the building materials and construction industry for 2024–2025, the construction industry contributed 6–7% of Vietnam’s GDP between 2013 and 2023, demonstrating a strong correlation with GDP growth. He anticipates both short- and long-term growth in all construction segments, while the residential segment's recovery might be slower.

In the near future, it is anticipated that the residential building sector would progressively rebound in line with the housing market. Residential building will continue to rise in the medium and long term due to Vietnam's urbanization process and GDP growth. As per the 2021–2030 National Master Plan, Vietnam's urbanization rate is expected to increase from 43% in 2023 to 70% by 2050.

In the infrastructure segment, the government’s goal of accelerating infrastructure development during 2021–2030 will serve as a primary growth driver. Vietnam is currently undertaking several large-scale infrastructure projects, including the second phase of the North-South Expressway, Ring Road 3 in Ho Chi Minh City, Ring Road 4 in Hanoi, Long Thanh International Airport, the North-South High-Speed Railway, Cai Mep Ha Logistics Center, and Can Gio International Transshipment Port.

The new Bidding Law, which goes into effect on January 1, 2024, and a low loan rate environment are also expected to help the overall construction industry, according to Vietcap experts. Nonetheless, the sector continues to confront a number of immediate difficulties, such as intense rivalry, volatile material costs, and pressure from bad debt on residential building contractors.

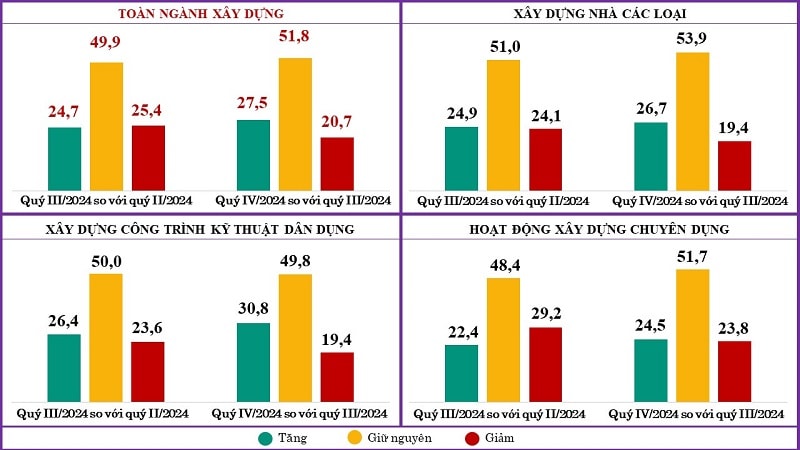

Storms No. 3 (Yagi) and No. 4 additionally affected the construction industry in Q3 2024, disrupting construction activities in many northern and central provinces in September 2024, in addition to the two main issues of high material prices and a lack of new contracts, according to the General Statistics Office's Q3 2024 construction industry report and Q4 forecast.

Looking ahead to Q4 2024, businesses will continue to face significant challenges, including securing new construction contracts, the potential for further increases in material prices, and concerns over adverse weather conditions potentially affecting project timelines and completion.