Exports and PMI: Significant headwinds ahead

A growing number of COVID-19 infections raised concerns over how long near-term disruptions in manufacturing will weigh on Vietnam’s sustained economic recovery.

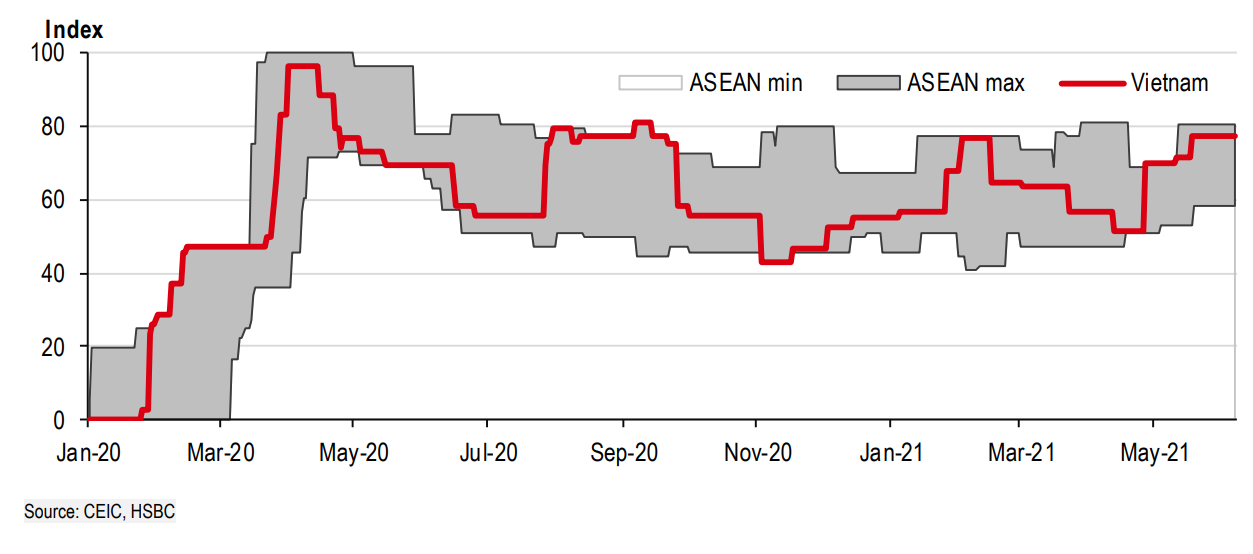

Vietnam’s stringency level is the second highest in ASEAN in this wave

Vietnam is facing its worst COVID-19 outbreak since the pandemic began. Until April 2021, Vietnam had only logged 3,000 cases. However, the total number of cases have tripled in just one month, surpassing 9,000 as of late. While Vietnam has earned a reputation of being able to contain COVID-19 really well, this wave is proving more of a challenge. For one, industrial parks are the new epicentres, raising concerns over the resilience of supply chains. Cases have been concentrated in two Northern provinces (Bac Giang and Bac Ninh), which are home to the manufacturing bases of many tech giants, including Samsung and Foxconn. In Bac Giang, four of the six industrial parks were forced to close on 18 May, 2021. Although they re-opened on 28 May, significant portions of their operations were running below full capacity.

Meanwhile, Vietnam has identified a new COVID-19 variant that combines features of the B.1.1.7 and B.1.617.2 strains (Financial Times, 30 May 2021). While a national lockdown has not been declared – likely due to concerns over growth – the recent surge has prompted the government to further tighten restrictions. Bac Ninh instigated a curfew on 25 May 2021 while partial lockdowns were imposed in HCM city in response to a growing cluster related to a Christian mission. Indeed, Vietnam’s stringency index is already the second highest in ASEAN, leading to as much as a 25% y-o-y decline in people’s mobility.

Apart an imminent threat COVID-19, Vietnam’s progress in relation to vaccinations adds another layer of concern. With a large population of almost 98m people, it has only received 2.9m vaccine doses and only 1% of its population has actually been vaccinated, which is significantly below that of regional peers. The government’s goal is to secure 150m vaccine doses by the end of 2021; however, global vaccine supply constraints and delivery delays still pose notable challenges. The earlier herd immunity can be achieved, the sooner Vietnam will be able to open its border to mass tourism and foreign investors. That being said, it is encouraging to see that the authorities are doing whatever it takes to accelerate vaccine procurement, particularly given recent approval of a COVID-19 vaccine fund worth USD1.1bn.

While a firm delivery date was not provided, Deputy Minister of Health Truong Quoc Cuong indicated that more vaccines would arrive in August. Reportedly, Russia has agreed to provide 20m doses of its Sputnik V vaccine in 2021, and Japan will donate some of its AstraZeneca-Oxford vaccine. Vietnam also approved the emergency use of China’s Sinopharm vaccine, a third option after the AstraZeneca-Oxford and Sputnik V vaccines, suggesting that the authorities aim to tap all available resources.

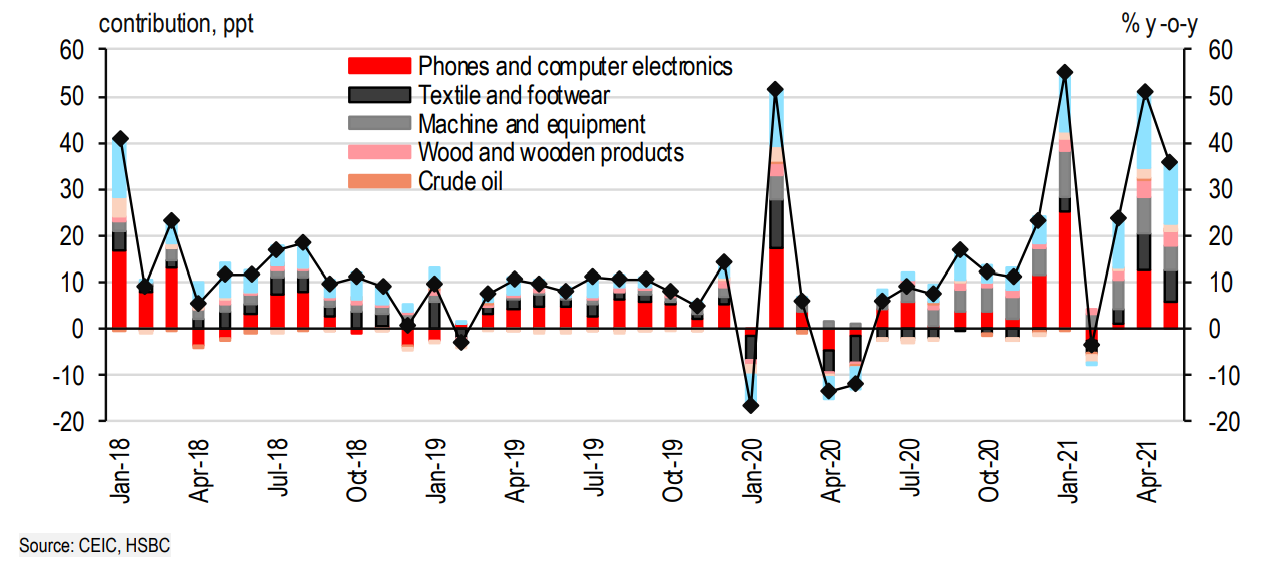

Exports remained relatively resilient in May, thanks to support electronics and textile/footwear shipments

Despite a growing number of infections, external data in May remained resilient, likely due to a full lockdown being avoided. Exports rose 35.6% y-o-y, partly thanks to favourable base effects. Electronics products held up surprisingly well, with computers and phone shipments growing 9% y-o-y and 26% y-o-y, respectively. More encouragingly, textile and footwear exports continued their recovery momentum, rising 41% y-o-y as a result of significant fiscal stimulus in the West that has boosted consumer spending. However, recent clusters raise concerns over how long near-term disruptions in manufacturing will weigh on Vietnam’s sustained economic recovery. Indeed, this has already been reflected in the recent PMI release.

While the PMI decelerated marginally 54.7 in April to 53.1 in May, key sub-indicators nonetheless started to soften. Output, new orders, and new export orders all grew at a 3-month low pace, while staff shortages led to a substantial rise in workflow backlogs. On a positive note, business sentiment, albeit negatively impacted by the most recent wave of COVID-19, remained optimistic about future manufacturing output, once the current wave is contained.