Forces will shape the future of the banking and capital markets

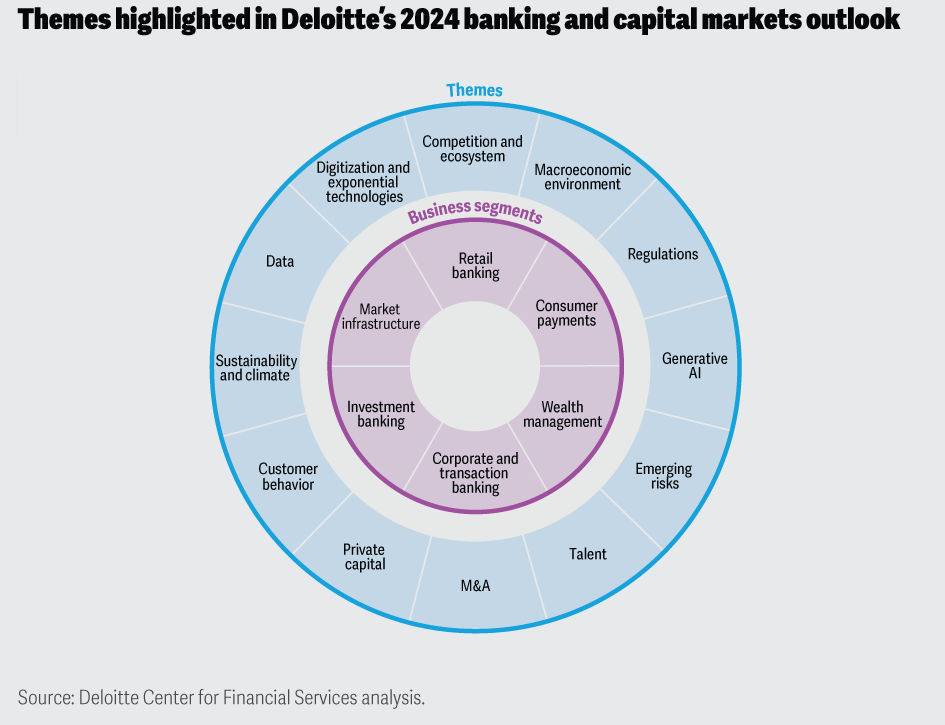

In addition to the macroeconomic factors, the banking and capital markets industry must contend with various fundamental and disruptive forces challenging incumbent institutions’ business models in 2024.

Banks, particularly in the United States, could face stricter capital requirements under a proposed overhaul to capital rules as part of Basel III “endgame” starting July 2025.

Not only are competitive dynamics shifting, but the pace and intensity with which rivals are challenging banks is unprecedented. Banks are now more intensely pitted against traditional and new rivals as more customers become open to having their needs met by nonfinancial institutions.

Deposits, for example, have become a ferocious battleground. Retail banks are competing with digital banks, which offer higher deposit costs. And in the payments arena, digital wallets and account-to-account payments are fast becoming the de facto payment options in many countries, while buy now, pay later (BNPL) is more widely accepted as a mainstream offering and alternative to credit card financing.

Deloitte said capital markets and investment banking businesses would not be immune to new competitive forces, either. Scale has helped bulge-bracket investment banks in the United States grow market share. However, a resurgence among European banks might be underway as they focus on specialized services, and boutique firms increasingly participate in bigger deals. Meanwhile, private capital could pose a greater threat to credit provisioning and talent. Hedge funds are also increasingly penetrating more of investment banks’ value chains. In market infrastructure, traditional exchanges see increasing competition from niche exchanges and the growth of trading venues in emerging markets.

At the same time, the relationships between banks, fintechs, and bigtechs are evolving rapidly. Fintechs are largely no longer seen as adversaries; collaboration with incumbents is now commonplace. With increasing industry convergence, strategic partnerships between banks and franchised brands in technology and other nonfinancial industries are becoming the norm for customer acquisition and retention.

Concurrently, customers are becoming more vocal about their evolving expectations. They want their banks to balance digital-first experiences without compromising the personal touch. Information is also becoming democratized, with technology and social media empowering customers in ways not seen before. “Banks should heed these new demands as retail customers are spoiled for choice and many will be willing to switch accounts and diversify their relationships across multiple platforms with a tap on their smartphones. Younger consumers, in particular, are clamoring for a superior experience that some technology firms and fintech platforms offer. Wealth management clients are increasingly vocalizing their desire for omnichannel experiences at lower costs. And corporate and institutional customers, for their part, seem more intent than ever to broaden the number of banking relationships to diversify risk," Deloitte said.

On the regulatory front, Deloitte will continue to observe a divergence in laws and policies, with some jurisdictions typically charting a more assertive path, as in the EU’s new AI Act. As a result, there is still a lack of a coordinated, global approach to crypto, digital assets, data privacy, artificial intelligence, and even climate risk. But regulatory scrutiny is on the rise, with governments increasingly focusing on consumer protection, industry resilience, and open competition. More regulators and policymakers around the world are now probing banks’ lending practices and calling on them to do more to help consumers.

In addition, banks, particularly in the United States, could face stricter capital requirements under a proposed overhaul to capital rules as part of the Basel III “endgame” starting July 2025. These rules could impact banks’ ability to support some capital markets activities, such as prop trading. They could also impede retail banks’ ability to lend in the residential mortgage space.

In Deloitte’s view, regulatory pressures will be particularly acute for regional and small banks, especially those that are concentrated in their investment and lending portfolio and deposit mix. Many banks will spend the bulk of 2024 trying to tighten lending standards and diversify their balance sheets away from risky assets such as CRE loans and even safe assets such as long-term treasuries.

Meanwhile, open banking regulations in the United Kingdom, Europe, Australia, Saudi Arabia, Brazil, and Mexico are reducing the barriers for data sharing and offering customers more choice for financial products and services. The US Consumer Financial Protection Bureau (CFPB) is mulling similar rules. US consumer watchdogs are also sounding the alarm on the proliferation of artificial intelligence (AI)-driven chatbots in banking.

Scale and diversification, greater regulatory oversight, and the desire to shed low-yielding assets should drive further consolidation and M&A in the banking industry.

In the technology arena, Deloitte said it would be hard not to get caught up in the excitement surrounding the incredible potential of generative AI. By all accounts, it can be a hugely transformative force. But more broadly, AI and automation are not new to banking. In fact, machine learning/deep learning algorithms and natural language processing (NLP) techniques have been widely used for years to help automate trading, modernize risk management, and conduct investment research. However, despite the billions of dollars spent on automating the various functions across the transaction life cycle, there are still a fair number of tasks that are conducted using precious human capital. But large language models (LLMs) could help automate many tasks, from generating marketing products to coding. Generative AI can not only save money, but also improve worker productivity. It could also free up resources to spark innovation and enable employees to focus more on productively interacting with clients.

Scaling generative AI will take time. In the short term, one of the biggest challenges in 2024 will be determining the focus. In assessing the many potential use cases, leaders should choose the ones that will be the most impactful. The benefits of LLMs may not be uniform. They should also consider the potential ease of execution and any associated risks.

But for any of these technologies to have maximal impact, having the right data—and making sure it can be accessed and shared across the enterprise—will be key. While banks have been building out their data capabilities for years, the pressure to derive insights to gain a more holistic view of customers has never been greater. There is a growing appetite among customers for real-time data about their payments, cash positions, trading, and valuations.

In addition, advances in open banking globally are gradually eroding what was once traditional banks’ competitive edge. It is becoming increasingly important for banks to meaningfully harness both traditional and alternative datasets, as well as forge new partnerships with third parties, to create new value in the form of personalized insights, tailored product offerings, and enhanced customer experiences.

Deloitte stressed that the proliferation of new technologies is opening banks to risks they may have never had to grapple with before. Open banking and the increase in partnerships with technology partners, for example, can expose banks’ infrastructure to new vulnerabilities and cyberattacks. Fourth-party risks are also becoming more of a threat as banks engage in more partnerships with service providers that have their own vendors. The speed with which these threats take shape is also accelerating. Generative AI has gained the sophistication needed to create “deepfakes,” which makes it more challenging for financial institutions to differentiate human customers from digital media imitating their likenesses. Collectively, this fast-moving risk environment is proving to be a huge obstacle to maintaining customer trust.

And, of course, one cannot ignore what climate change is already doing to our planet—the multiple heat waves, floods, and wildfires in the first half of 2023 are a precursor to what is likely to be the norm in the future. Banks, as key financial intermediaries, play an important role in bending the arc of climate change. But looking beyond that, banks have a unique opportunity to support climate innovation through green finance and carbon markets. Not only can they provide early-stage financing to startups piloting carbon capture and storage and carbon dioxide removal technologies, but they can also help direct more capital to carbon project developers in emerging economies.

Finally, how well banks manage their talent will be one of the most critical success factors in 2024 and beyond. The war for talent in technology remains a pressure point for many banks. Banks may have to pay dearly to hire specialized tech talent from outside businesses or train their own employees to become more tech savvy, especially as innovations from and within AI expand. Bankers should be empowered with the knowledge and resources they’ll need to adequately advise clients amid market uncertainties. As with other industries, banks may also have to instill a culture that reconnects employees with their corporate identity and creates a sense of belonging that can be conveyed in a hybrid work environment.