Gas-fired power to rebound from its low base

After a promising outcome in 1Q22, Vietnam's gas-fired electricity could continue to recover in 2022.

Nhon Trach gas-fired power plant.

Recovery from low base

Due to the Russia-Ukraine conflict, Brent oil prices began to rise in 2020 and eventually topped US$100/bbl in 2022. Since the domestic gas price in Vietnam is linked to the Singapore Platts oil price and moves in the same direction as the Brent oil price, outstanding gas-fired power plants in Vietnam, such as Nhon Trach 2 (750MW) and the Phu My cluster, have experienced a similar upward trend (2,540MW). NT2 gas prices, in instance, increased by 66 percent year on year, from US$5.9/mmbtu in March 21 to US$9.8/mmbtu in March 2022. Phu My saw a same trend, with its gas price skyrocketing from US$5.5/mmbtu to US$9.3/mmbtu.

The gas price spike was exacerbated by gas-fired power output mobilization as a result of an increase in the electricity average selling price (ASP), particularly during the rigorous quarantine period in the last two quarters of 2021. When manufacturing and business are severely curtailed, especially in the south of Vietnam, it limit s the expansion of electricity consumption. Despite the fact that ASP increased by 20% year over year in 1Q22, total gas-fired output increased by 1.7 percent year over year and was 40% higher than in 4Q21.

According to VNDirect's analyst, Mr. Nguyen Ha Duc Tung, the reason for rising gas prices still leading to lower ASP from 3Q21 to 1Q22 is that in 2H21, several gas-fired plants experienced significant low output, severely affecting plant operating efficiency, and had to compensate with a higher ASP (at some point reaching VND2,500-3,000/kWh). However, some exceptional gas-fired power plants, notably Phu My cluster, Nhon Trach 1&2 and Ca Mau 1&2, reported a robust recovery from moderate output in 2H21 in 1Q22, thanks to power consumption rebounding substantially 7.8% yoy in 1Q22, leading to higher mobilization among power plants.

Furthermore, the Ministry of Industry and Trade (MOIT) announced a coal shortage for thermal power plants in 1Q22, which might result in a very real future risk of power outages in hot weather. As a result, a proposal has been made to deploy an additional 3,700MW of different power sources, including around 1,000MW of renewable energy, 300MW of hydropower, and 1,200MW of gas-fired electricity.

For the following reasons, Mr. Nguyen Ha Duc Tung predicts that gas-fired companies would rebound in 2022F after a low base in 2021, especially after the limit ed mobilization in 2H21.

First, the Brent oil price is expected to stabilize and fluctuate between US$95 and US$85 per barrel, easing the pressure on gas-fired power prices in 2022F.

Second, due to moderate electric-load and ASP surges, gas-fired mobilization declined in the two Covid years 2020-21, reaching a low-base of only 8-10 percent of total capacity in 2021, significantly lower than its pre-pandemic component of 15-20 percent, resulting in reduced competitiveness of this energy.

Third, following two small growth years in 2020-21, electricity consumption will rebound significantly, especially in the coming hot weather, and the growth rate will return to the projected level. Furthermore, we anticipate a power shortfall beginning in 2022, leading power plants to operate at a higher rate.

Global LNG price has dramatically surge, raising concern about the financial viability of upcoming LNG gas-fired power projects

However, because EVN chose not to raise retail electricity prices in 2022 due to inflation concerns, gas-fired power mobilization could face a potential downside risk, as its selling price (ASP) is likely to remain high this year.

LNG-to-power as an important source

Along with renewable energy, the PDP8 emphasized the importance of gas-fired power in Vietnam's capacity development plan for the period 2020-45F. Over the course of the year, domestic gas input will be depleted, while worldwide LNG prices will fall due to weaker demand in the long run. As a result, Vietnam has a great chance to build gas-fired electricity utilizing imported LNG, which is a more reliable supply.

According to the latest PDP8 draft's high electric-load case, overall gas-fired thermal power capacity will expand from 7,185MW to 14,386MW in 2025F, and combined cycle gas turbines utilizing modern LNG/Hydrogen will begin switching. The new plan included a 5,100MW flexible LNG/Hydrogen source starting in 2035F. Overall, total gas-fired capacity will grow at a 10.6 percent compound annual growth rate (CAGR) to 73,630MW in 2045F. To fulfill the COP26's "net-zero" promise, all newly constructed gas-fired power plants must gradually switch to hydrogen after 20 years of service.

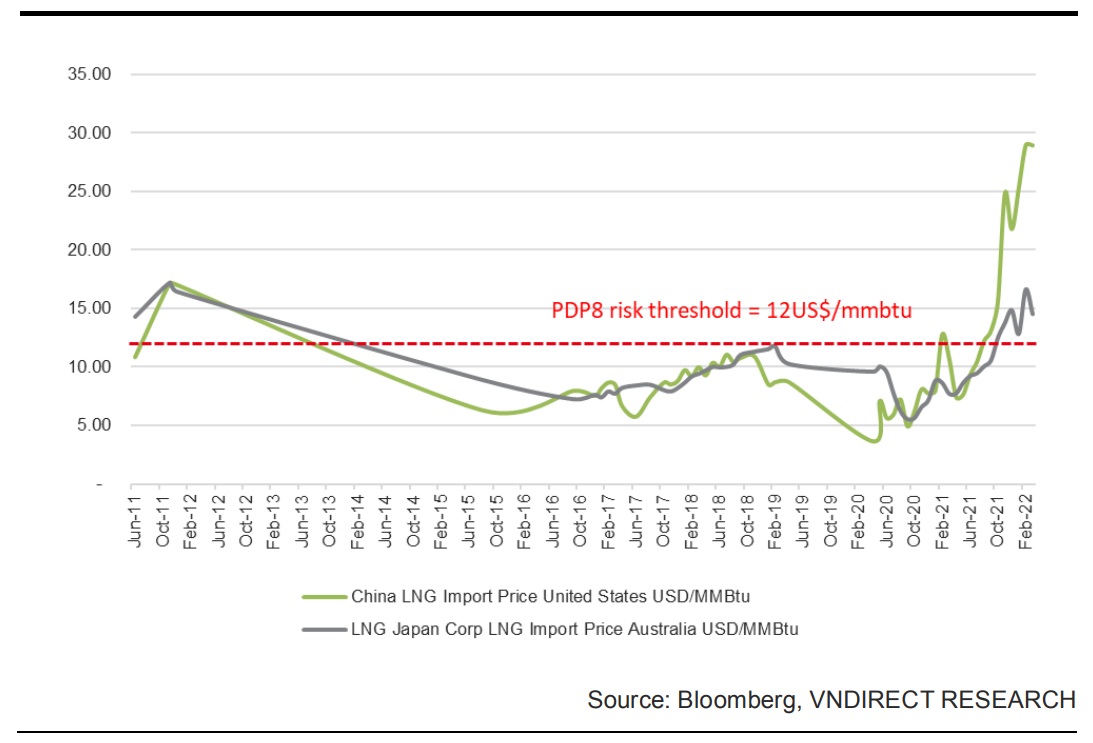

According to the IEA's natural gas price 4M22 report, high gas prices are expected to continue until 2022. In 2022, Asian spot LNG is expected to cost US$32/mmbtu, whereas Henry Hub will cost US$5.5/mmbtu. Uncertainties about Russian gas supply, as well as large restocking needs in all important gas locations, are expected to keep gas prices high in 2022.

Despite the lack of specific information about future LNG suppliers in Vietnam, PVN is currently negotiating framework contracts with a number of suppliers from a variety of regions, including Asia-Pacific, America, and the Middle East, and the company expects to begin importing LNG in 2023F, depending on LNG price conditions. As a result, the spike in LNG prices raises questions about the financial feasibility of planned LNG projects.

According to the Scientific Council Vietnam Energy, an LNG gas power plant's input LNG price must be around US$12/mmbtu in order for it to sell energy for 8 to 9 cents per kWh. However, because LNG prices are predicted to remain stable at US$30-40/mmbtu in 2022, the power price cannot fall below 15 cents/kWh, making it doubtful that EVN will buy it anytime soon.

However, Mr. Nguyen Ha Duc Tung believes that gas prices will revert to a more acceptable level in the long run as supply recovers from the recent disruption, and we believe that gas-fired power will continue to play an important part in Vietnam's electricity generation. Notably, LNG-fired electricity will become the predominant trend, and Nhon Trach 3&4 are the first facilities in Vietnam to use imported LNG.

"We expect that new gas-fired plants will be prioritized, resulting in increased power output and benefits for gas-fired power plant investors." POW, in our opinion, is one of the top corporations benefiting from the LNG development trend because it has two of the first LNG-fired power plants. The plants are planned to start operating in 2024-25, according to Mr. Nguyen Ha Duc Tung.