Global inflation could ease in 2023

The Global Supply Chain Pressures Index (GSCPI), a barometer to determine global supply chain pressure, hit a 22-month low of 0.89 points in September 2022.

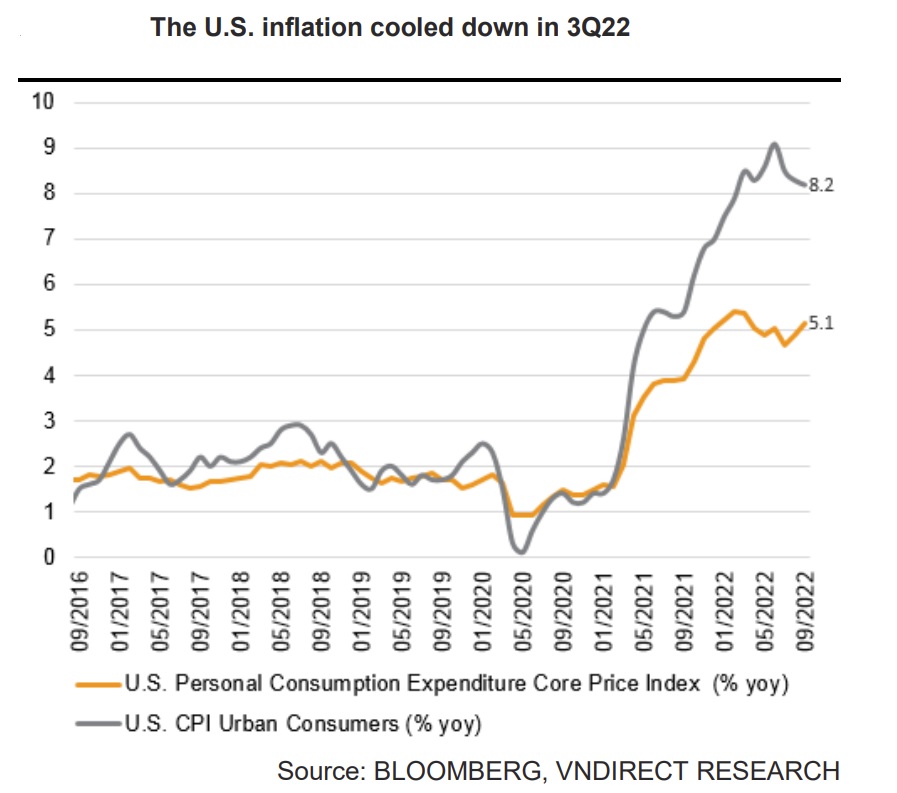

The U.S. annual inflation rate rose by 6.5% yoy in December 2022, the lowest since October of 2021

>> Picture of inflation control in 2023

Since mid-2022, the COVID-19 restrictions in China have been eased, leading to a decrease in global supply chain pressures. Nevertheless, the index scores were still higher than pre-pandemic levels. VNDirect expects this trend to persist following China’s gradual loosening of its "zero COVID-19" policy.

Global commodity prices are declining sharply on the back of recession fears and potential growth moderation. The Bloomberg Commodity Index was down 10% since the end of May, and on a segmental basis, crude oil and industrial metals lost 23% and 17%, respectively.

China’s producer price index is declining 1.2% monthly in August 2022 following a cooling of input material prices. China's producer price index (PPI), which measures costs for goods at the factory gate, went up 2.3 percent year over year in August 2022, the slowest pace since February 2021 and slower than 4.2% a month prior. The main reason for China's PPI slowdown is due to the price volatility of bulk commodities, including international crude oil and non-ferrous metals. The cooling of the producer price index in China, along with the sharp decline of international sea freight rates, would help reduce global import inflation pressure in the coming months.

>> Three scenarios for price administration of 2023

U.S. housing prices are falling. In August 2022, the non-seasonally adjusted month-to-month index posted the second consecutive month of declines, down by 1.1% in August from a 2.6% peak increase in March and a 0.5% decline in July, suggesting further and potentially quicker deceleration in home price growth, according to the CoreLogic S&P Case-Shiller Index.

In addition, it posted a 13% year-over-year increase, down from a 15.6% gain in July, marking the fifth straight month of decelerating annual home price appreciation. Home prices posted their biggest month-on-month decline since 2009, showing that rising mortgage rates have rattled homebuyer demand.

In addition, the U.S. Conference Board’s Consumer Confidence Index fell to 102.5 in October 2022 from 107.8 in the previous month. The actual data in October is also lower than the previous market’s expectation of 106.5, showing that U.S. consumers are worried about stubborn inflation as well as the U.S. economic outlook.

Recent U.S. data shows that inflation is starting to cool down. Specifically, the U.S. Gross Domestic Product Price Index, an inflation measure of the prices paid by U.S. consumers, businesses, and the government, including the imports they buy, rose by only 4.6% year over year in 3Q22 after increasing 8.5% year over year in 2Q22. Additionally, the U.S. annual inflation rate rose by 6.5% yoy in December 2022, the lowest since October of 2021, in line with market forecasts. It follows a 7.1% reading in November.

Vietnam recorded year-on-year growth of 3.15% in the 2022 consumer price index (CPI), while core inflation increased by 2.59%, the General Statistics Office (GSO) said on December 29, 2022. Pointing out some contributors to the CPI growth, the GSO said domestic gasoline and oil prices have been adjusted 34 times, increasing by 28.01% from a year earlier, while gas prices were up 11.49%.

As a consequence, VNDirect believes that global inflationary pressure is likely to cool down significantly in 2023F as commodity supply recovers while consumer demand weakens. The bleak economic outlook coupled with a worsening labor market could prompt consumers to tighten their wallets. Therefore, this stock company forecasts that world commodity prices will maintain a downward trend in 2023, except for a few commodities that are at potential risk of a supply shock, such as natural gas and crude oil.