Green shoots for Vietnam’s economy

After a lacklustre GDP print of 3.7% in 1H23, green shoots have quietly emerged. Alas, challenges are not fading, but high frequency indicators point to some positive stabilisation, according to HSBC.

Shippng along Siagon River,Siagon, Vietnam - stock photo

>> Vietnam expects more positive economic recovery in H2

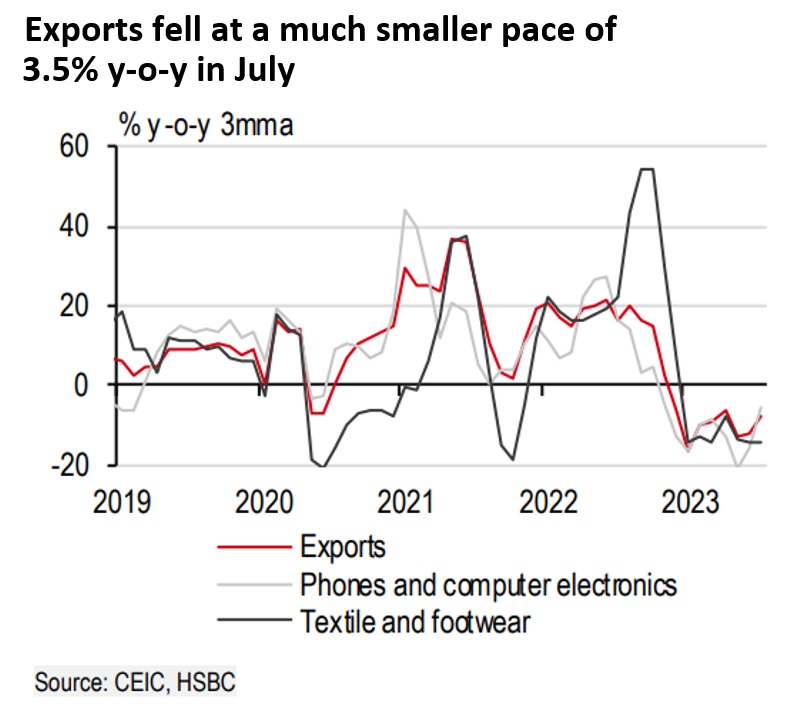

The biggest surprise lies on the external front. While exports did not cease to fall on a y-o-y basis, the magnitude was much smaller at 3.5%. Although this was in part due to favourable base effects, the level of exports in July rose to the highest in nine months. While major exports, including textiles/footwear and phones, continued to suffer from double-digit declines, computer and electronic components shipments surprisingly offset some weakness, jumping 32% y-o-y.

Granted, base effects came to the partial rescue, but signs are pointing to some valuable stabilisation – especially from computer-related imports. That said, the same cannot be said for the smartphone cycle, which continues to face intensifying headwinds. Despite still at an early stage, forward-looking PMI indicators point to some stabilisation in Vietnam’s near-term trade prospects – no further deterioration is the first step before a meaningful trade rebound.

Despite the ongoing external drag, Vietnam’s FDI prospects remain intact. New FDI stood at 3% of GDP in 2Q23, on par with that in 2022. While it slowed from Vietnam’s peak of over 7% in 2017, tighter global monetary conditions in recent years partly explain the slowdown. But compared to its peers, Vietnam still remains the second largest FDI recipient in ASEAN, measured as a percentage of GDP, just after Malaysia. Tech giants across the world, including Infineon, LG, Foxconn, continue to announce their expansion plans in Vietnam. All of this provides hope for Vietnam’s external sector to rebound strongly once the trade cycle turns.

>> Positive economic outlook predicted for Vietnam in H2

Outside of trade, Vietnam’s domestic services continue to act as a pillar of support. A large part of the support was thanks to the uplift from international tourists, with mainland Chinese visitors continuing to steadily flock to the country, reaching around 45% of 2019’s level. For the first time in more than three years, Vietnam, once again, has welcomed more than one million visitors in a month.

Interesting to note that the pace of Chinese visitors’ recovery is the highest in Vietnam, exceeding that in Thailand, which is a traditional market for outbound Chinese tourism in ASEAN. This is perhaps thanks to Vietnam’s steady flight recovery with China, now standing at 53% of 2019’s level, just after Singapore (75%) and Malaysia (57%). In addition, with the recent policy change in visa relaxation, which is expected to be implemented from mid-August, Vietnam’s tourism outlook continues to be favourable.

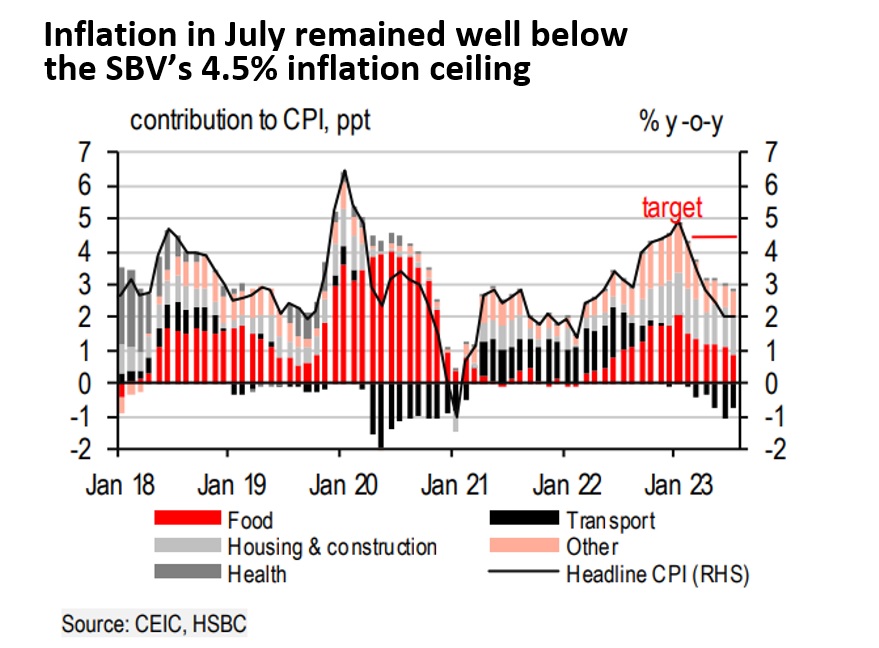

Elsewhere, inflation continues to deliver some good news. Headline inflation only rose 2.1% y-o-y in July, well below the SBV’s 4.5% inflation ceiling, thanks to continuing energy disinflation. While robust services mean that inflation will likely decelerates at a slower pace than headline inflation, inflation dynamics have become less of a concern for the SBV, warranting further monetary support. HSBC expects the SBV to deliver another 50bp rate cut, the last one in the current easing cycle. Recently, the SBV has also signalled its openness to do more if “market conditions allow”. That said, HSBC remains cautious of potential upside risks to inflation, not least due to the evolving El Niño phenomenon. Indeed, food inflation momentum has been strong for the past two months. Another factor stems from any subsequent energy price hikes, with the EVN recently seeking the government’s permission to hike electricity prices once again due to financial difficulties.

“All in all, although the tide has not turned fully, it is positive to see Vietnam start 2H23 with some improvements in its economic activity”, said HSBC.