Hana Micron's ambitions in Vietnam

Hana Micron, South Korea's biggest contract chip maker, has invested a total of USD 525 million in Vietnam since 2016.

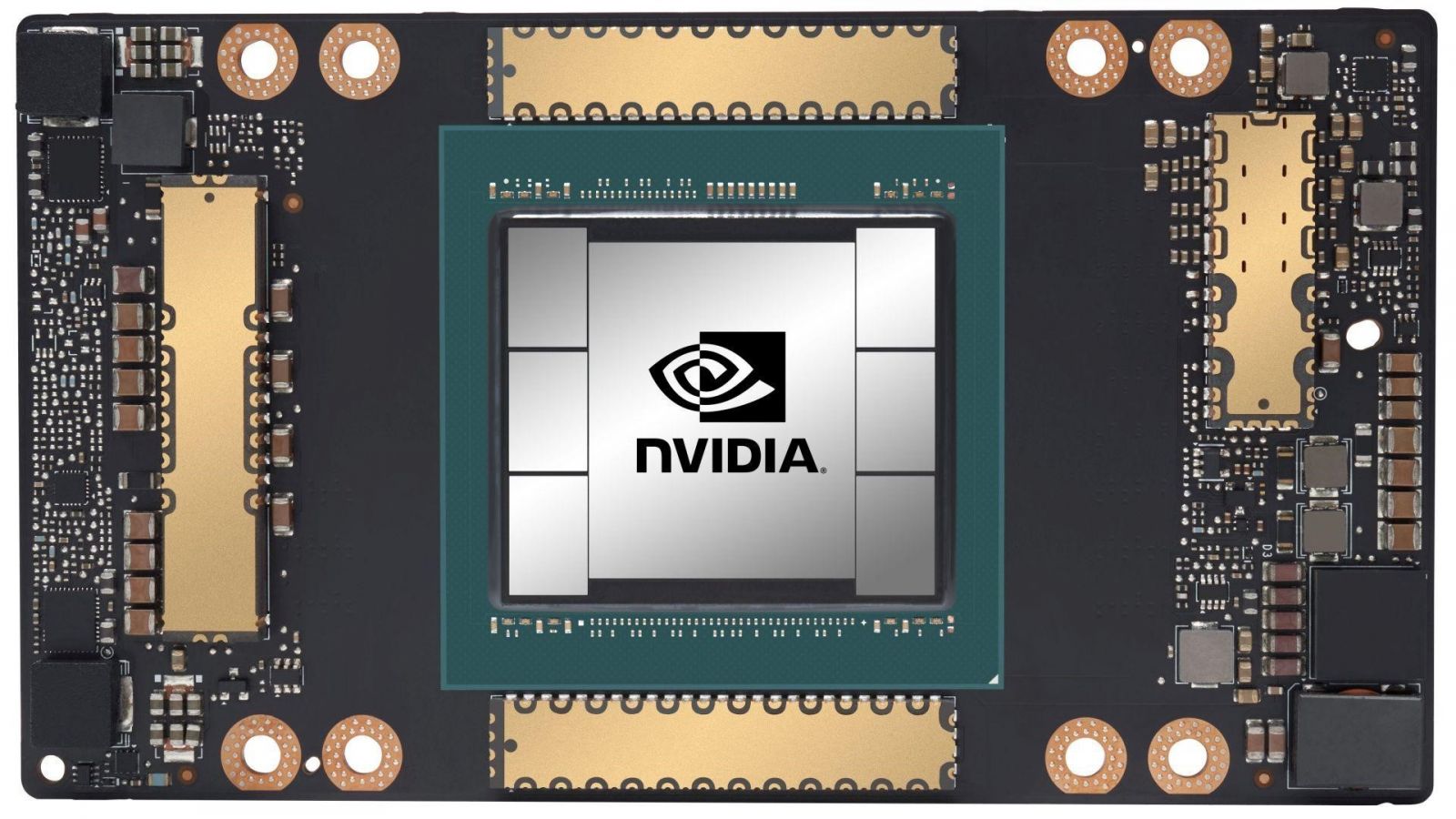

Amidst the rise of generative AI, such as ChatGPT, which is pushing up demand for high-performance artificial intelligence processors, chip packaging technology is seen as a critical technique for developing AI chips like Nvidia's H100 AI accelerator.

In actuality, packaging that places chips in safe, corrosion-resistant enclosures and provides interfaces for integrating and linking chips is already being manufactured. Leading chip makers, including TSMC, Samsung, and Intel, are actively fighting for sophisticated packaging, which allows numerous components to be consolidated and packaged into a single electronic device.

Analysts believe that chip packaging technology may improve semiconductor performance without requiring further reduction into nanometers, making it one of the most complex technologies that separate contract chip makers' capabilities.

According to consultancy company Yole Intelligence, the worldwide chip packaging business, which includes 2.5D and 3D packaging, is predicted to increase from USD 44.3 billion in 2022 to USD 78.6 billion by 2028.

This has created a strong battle among the world's major contract chip makers, ranging from TSMC and Samsung to SK Hynix, to enhance or secure breakthrough technology for chip packing, which is one of the final phases in semiconductor manufacturing.

Hana Micron, South Korea's biggest contract chip maker, operates as an outsourced semiconductor assembly and testing (OSAT) firm. The business is actively developing 2.5D packaging techniques for horizontally assembling several types of AI devices, including High Bandwidth Memory (HBM).

In a recent interview with the Korea Economic Daily, Hana Micron CEO Lee Dong-cheol said, "We are wagering our future on sophisticated 2.5D packaging technology for HBM and other AI chips."

In the same interview, Lee Dong-cheol stated that the largest South Korean contract chip maker has great expectations for its operations in Vietnam, where the business has invested USD 525 million since 2016. "We estimate our income from activities in Vietnam to exceed a trillion won shortly," Lee Dong-cheol said.

Hana Micron now maintains production sites in South Korea, Vietnam, and Brazil, as well as international sales activities in the United States, Vietnam, and Brazil. However, the corporation is focusing on developing its commercial activities in Vietnam.

Hana Micron's factory in Vietnam

Last October, the firm announced plans to spend $1 billion in semiconductor manufacture in Vietnam by 2025. The project is planned for the Van Trung Industrial Park in Bac Giang province. Hana Micron Vina, the South Korean conglomerate's affiliate, will open its second facility in the northern provinces. The first factory began operations in 2022, producing integrated circuit boards for mobile phones and other smart electrical devices.

Choi Chang Ho, Chairman of Hana Micron, indicated at the time that Hana Micron Vina will become the group's largest manufacturing facility in the globe, with Vietnamese professionals accounting for 70% of the overall workforce. He also stated that the business plans to grow its investment from about USD 600 million to more than USD 1 billion by 2025, producing yearly sales of USD 800 million and creating 4,000 employment for Vietnamese people.

Hana Micron states that after entering the Southeast Asian market in 2016 by establishing a plant in Bac Ninh province, Vietnam, it has made considerable expenditures, raising its monthly chip packaging output to 50 million units.

Vietnam has emerged as an attractive destination for global semiconductor businesses due to to its high political stability, vast labor force, and particularly simple access to Asia's high-tech supply chain.