Headwinds for real estate: Challenges of fundraising

Property developers may experience financial issues in the coming quarters as commercial banks tighten lending standards and the government tightens oversight of corporate bond issuance.

Real estate developers in Vietnam could experience problems in the context of tighter bank lending to the property industry and stronger corporate bond issuance supervision.

>> Banks do not completely cut credit for real estate

Tightened capital flows

The State Bank of Vietnam (SBV) has gradually channeled credit flows into industry, services, agriculture, and other sectors in recent years, while reducing lending exposure to the property sector. Commercial banks were supposed to lower the ratio of short-term funding utilized for medium-to-long-term loans to 34 percent by October 2021 and 30 percent by October 2022 under Circular 22/2019/TT-NHNN, which has been in effect since 2020. As a result, loan growth in the property sector has slowed from 26 percent at the end of FY18 to 12 percent at the end of FY21, and is expected to decrease further to 9–10 percent in FY22.

SBV mandated banks to closely monitor credit flows into the real estate industry in April 2022, in order to combat property speculation, and to restrict credit to those investing in premium properties, tourism and resort properties, and those hoarding assets.

In addition, the government has encouraged prudence in the corporate bond market due to an increase in the number of infractions detected in land use rights issuances and auctions.

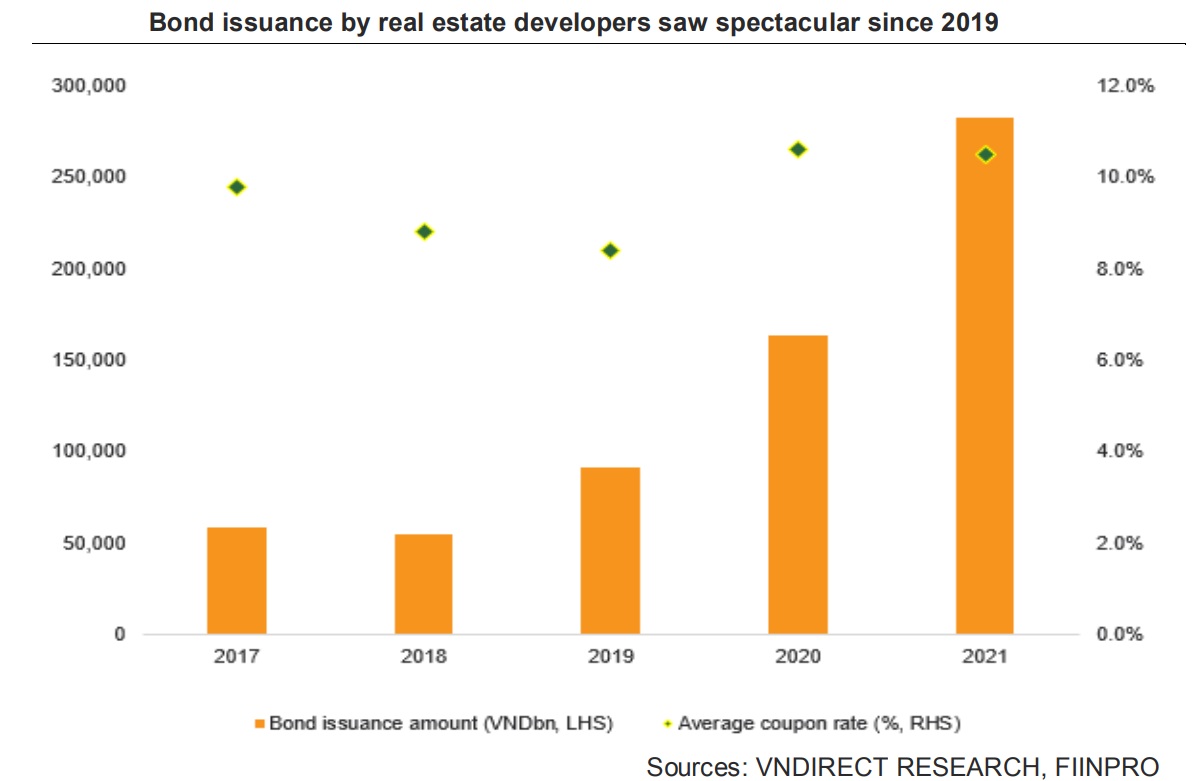

Property corporate bonds, which account for 40% of new issuance, grew at a significant rate of 73.1 percent yoy in 2021 and 25.2 percent yoy in 1Q22, according to VNDirect's market analysis.

In order to mitigate any further risks and enhance the transparency of the corporate bond market, the Ministry of Finance has reviewed and modified the Circular No. 153/2020/TT-BTC with more stricter requirements for issuers, especially in private placement.

SBV is responsible for supervising and inspecting credit institutions that invest in corporate bonds and provide underwriting securities, investment, and distribution services for corporate bonds, particularly bonds issued by real estate companies, companies with high issuance volumes and high interest rates, and companies with negative financial results and no collateral.

>> Capital flow into real estate should not be blocked

As a result, VNDirect expects corporate bond issuance, particularly in the real estate sector, to be constrained in the coming quarters.

"We expect real estate developers will experience problems in the context of tighter bank lending to the property industry and stronger corporate bond issuance supervision," VNDirect stated.

Faster presales and slower land bank acquisitions

In 2022F, VNDirect anticipates a volume-driven recovery in the property sector, believing that real estate developers will speed up their contracted sales to increase cashflow. On the basis of the FY21 low base and the reinstatement of the postponed projects from FY21 owing to COVID-19, this is illustrated by the robust presales growth projection in FY22F, with KDH (14x yoy), DXG (300 percent yoy), and NLG (105 percent yoy).

Furthermore, real estate developers are likely to be more cautious when purchasing land banks and cut their land acquisition budgets. In 2022F, VNDirect believes that due to existing finance constraints, developers may pursue codeveloping projects with large cash balances or international developers through more JV or associate projects. Overall, it sees the SBV's strategy of constraining real estate loan growth as a positive because it pushes developers to speed up sales and project development, implying that the residential real estate market in 2022F will be viable.