Headwinds for Vietnam economy

There are growing external headwinds hindering Vietnam's economic growth in 2023.

Logistics and transportation of Container Cargo - stock photo

>> Vietnam needs radical solutions to revive growth

External impacts

The increasing likelihood of a global economic crisis might harm Vietnam's manufacturing and export industries throughout the remainder of 2023. Unrest in the banking sector enhances the prospect of a recession in the United States, which is already viewed as susceptible by many analysts. According to the Federal Reserve Bank of New York, the likelihood of a US recession is now 57.8% (as of March 31), up from 54.5% at the end of February 2023. Furthermore, Fidelity (a global top investment firm) increased the chance of the US economy entering a recession from 55% to 95%.

Meanwhile, Goldman Sachs experts who believe the US economy is less likely to enter a recession increased the chance of this happening to 35% from 25% earlier. The bleak picture for the US economy in the coming year has harmed Vietnam's manufacturing and export activity. In particular, Vietnam's export turnover to the United States fell 6% year on year to US$23.7 billion in 1Q23. Key export items to the United States declined drastically in 1Q23, including iron and steel (-56% year on year), fisheries (-51% year on year), wood & wooden products (-42% year on year), footwear (-37% year on year), textiles (-30% year on year), and phones and components (-17% year on year).

Across the Atlantic, the European economy is likewise experiencing rising inflation, pushing central banks to continue hiking interest rates. High interest rates and tighter financial conditions would have a detrimental impact on corporate growth and consumer spending, lowering demand. Due to the bleak prognosis in key export markets such as the United States and Europe, which account for over half of Vietnam's total export, VNDirect has reduced our projection for Vietnam's export growth in 2023 to -2% from 5% before. It also reduced the manufacturing sector's growth prediction for 2023F to 5% from 7% before.

Outlook for 2023

Due to the increasingly uncertain global economic outlook, tight global financial conditions, and a recession in the domestic real estate market, private investment and foreign direct investment (FDI) may stay sluggish. According to the GSO, social realized investment capital grew by 3.7% year on year in 1Q23, headed by public investment (18.1% year on year). Furthermore, private investment capital increased by 1.8% year on year in 1Q23, compared to 9.2% in 1Q22, while foreign direct investment (FDI) capital decreased by 1.1% year on year in 1Q23, compared to 7.9% in 1Q22.

>> Việt Nam's economic recovery remains bumpy in Q1 2023

Mr. Dinh Quang Hinh, Senior analyst at VNDirect said there would be three main reasons for the decline in private investment and FDI in 1Q23: (1) Businesses delayed new investment projects and expansion plans due to gloomy global economic growth prospects and tightening consumer spending; (2) Tight global financial conditions make it difficult for businesses to access capital to invest, and rising interest rates increase financing costs; and (3) Many businesses operate in a volatile environment.

“We do not expect major changes in the global economic outlook, global financial circumstances, or the local real estate market in the next quarters, thus we are afraid that private investment and FDI will remain sluggish in 2023”, said Dinh Quang Hinh.

Given the context of Vietnam's economy facing challenges as a result of lower orders for Vietnam's manufacturing and exports, tight global financial conditions, and a recession in the domestic real estate market, VNDirect reduced its GDP growth forecast for Vietnam in 2023 to 5.5% (/- 0.3% pts) from 6.2%.

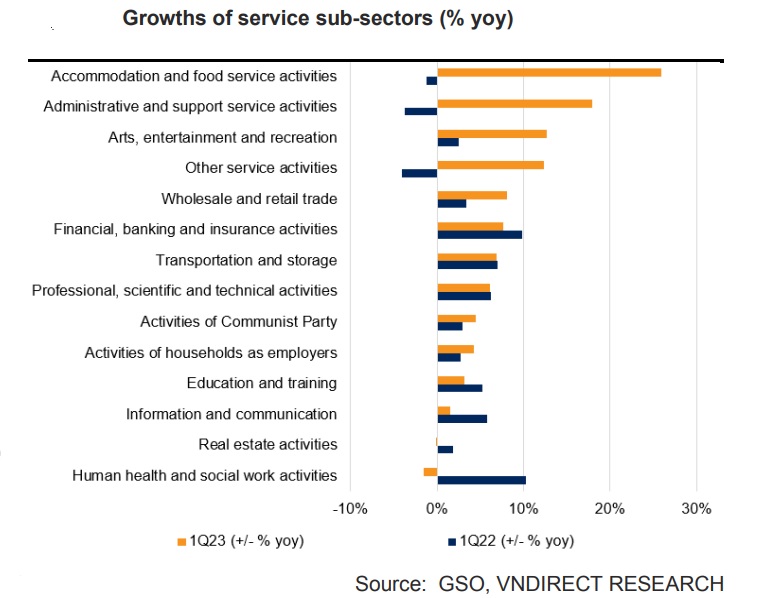

“We predict Vietnam's GDP will rise 4.5-5.0% year on year in the second quarter of 2023, up from 3.3% in the first quarter. With a 6.5-7% growth estimate in 2Q23, the service sector remains the key growth engine of the economy. Meanwhile, the industrial and construction sectors are expected to rise by 2.8-3.2% year on year in 2Q23, up from 0.4% in 1Q23, mainly to increased public investment and a shift in domestic monetary policy. We expect Vietnam's GDP will rise by 3.9-4.2% year on year in the first half of 2023, down from 6.4% year on year in 1H22”, said Mr. Dinh Quang Hinh.