High exchange rate and worries of import-export enterprises

In the foreign currency market in recent days, the USD/VND exchange rate has fluctuated sharply. This poses a problem of competitive pressure on Vietnam's import-export enterprises.

|

|

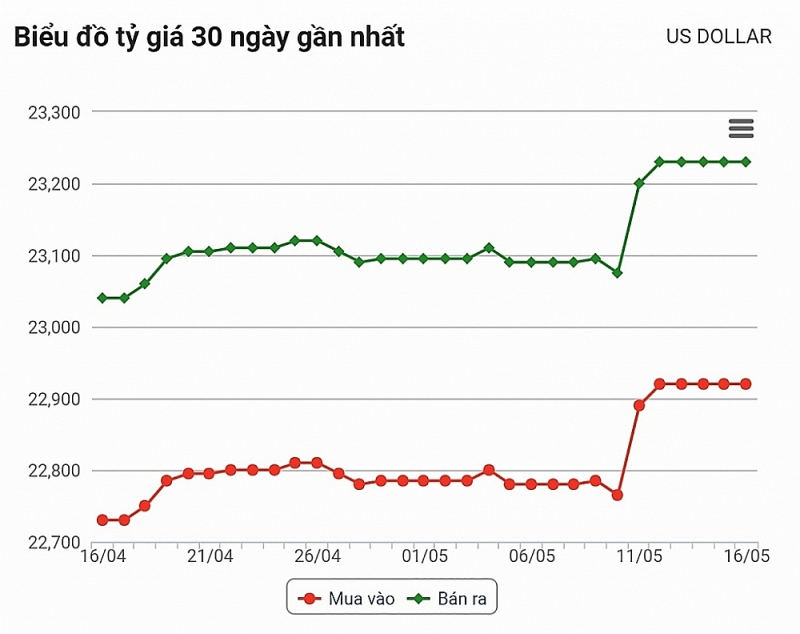

Movement of VND/USD exchange rate in the past 30 days. |

Exports benefit from exchange rate differences

From the beginning of May, the US Federal Reserve (FED) decided to increase the basic interest rate by 0.5 percentage points, to 0.75-1%. It has been the largest interest rate increase since May 2020 to curb inflation.

Earlier, in the mid-March meeting, the FED raised interest rates by 25 basis points from 0-0.25% to 0.25-0.5%. Thus, after two adjustments, the current basic interest rate of the Fed is 0.75-1%.

Banking and finance expert Dr. Can Van Luc, a member of the National Financial - Monetary Policy Advisory Council, said that these moves had a direct impact on Vietnam's economy and finance, although not much.

The Fed's interest rate hike would make the US dollar appreciate compared to most other currencies, including the Vietnamese dong, creating greater pressure on the USD/VND exchange rate.

Sharing the same opinion, economic expert Dr. Le Xuan Nghia said that the move of the Fed would have a direct impact on exchange rates, interest rates and especially Vietnam's exports.

The US dollar would strengthen, the Vietnamese dong would not appreciate against the US dollar but would increase against many other currencies like RMB (China), Baht (Thailand), Won (Korea), because the dong was anchored to the US dollar.

"Moreover, if the VND did not adjust the exchange rate according to market movements, the US would think that Vietnam was involved in devaluation and currency manipulation. This made Vietnam's exports to these markets more expensive. Thereby, putting pressure on Vietnam's exports to other markets beyond the US,” Dr. Nghia said.

A survey of reporters in the market showed that the VND/USD exchange rate on the interbank market from March 16 (the first time the Fed raised interest rates) has increased by 0.36% since the USD index (DXY) increased 6.02% compared to March 16.

Talking about the impact of the rising exchange rate on imports and exports, Mr. Nguyen Xuan Duong, Chairman of the Board of Directors of Hung Yen Garment Corporation, said that this would be beneficial. For example, in 2020, the general average exchange rate decreased by more than 3%, which meant that enterprises exporting US$1 million lost nearly VND6 billion. But currently, the exchange rate was anchored at a relatively high level, averaging around VND23,000 per USD, which meant it had increased by about 1.76% compared to the beginning of 2022, so it would be beneficial for exporters if it could be maintained at this level. With the extra money from the exchange rate difference, enterprises had more revenue to solve problems of salary increases, increase in raw material prices, and petrol prices, thereby contributing to reducing pressure on cost problems for enterprises.

The pressure is still great

According to the forecast of Dr. Can Van Luc, the exchange rate in Vietnam in 2022 would increase by about 0.8-1.2%. The reason was that the USD index now had a very large increase, up 7% compared to the end of 2021. In addition, domestically, Vietnam's foreign exchange reserves were reaching a fairly high level (over US$110 billion); The supply of foreign currency such as remittances and FDI disbursement was forecast to grow steadily, the trade balance was forecasted to have a surplus of US$4-8 billion in the whole of 2022, along with the State Bank's policy of the flexible exchange rate control. This would help cushion against external shocks and stabilize the exchange rate.

However, compared with currencies in countries in the region such as CNY (China), Baht (Thailand), Won (Korea) the exchange rate fluctuations of VND are more modest, only increasing by 0.53% in April and 0.57% compared to the end of 2021, while the Won or CNY sometimes increased by 3-4%. According to experts, the dollar is increasing in value, so many countries have had to devalue their currencies to increase the competitiveness of goods. Therefore, enterprises believe that the low fluctuation of the exchange rate in Vietnam will benefit the macroeconomy, but it may make Vietnam’s exports to these markets more expensive, reducing competitiveness.

In this regard, a representative of Big Phone Vietnam Co., Ltd. Said that keeping the stable exchange rate between VND and USD was beneficial if enterprises traded with partners in the US and use USD as the payment currency. But if the partner required the enterprises to convert to the local currency, it could create a big difference if the currency of that country was under the impact of strong devaluation. Therefore, Vietnamese goods when traded in that market would see an increase in price. In addition, the high domestic exchange rate would help limit imports, thereby reducing competitive pressure for domestic goods. But this meant that great pressure from the cost of importing raw materials for production would increase accordingly.

Currently, the international market is still volatile, especially when the Covid-19 pandemic and the Russia-Ukraine conflict show no signs of ending, so the currency market will still be volatile.Therefore, enterprises need to be proactive in issues related to exchange rates, through risk hedging products, in order to take the initiative in provisioning and stabilizing liquidity, ensuring smooth business operations. In addition, the authorities need to closely monitor market movements to be proactive in balancing many goals such as money supply regulation, inflation, exchange rate, to help raise the value of the Vietnamese dong.