How positive will the banking sector look by the end-year?

2Q21 aggregate earnings of 17 listed commercial banks rose 36.2% YoY on strong credit growth, NIM expansion, and subdued CIR. How positive will the banking sector look by the end-year?

2H21 NIM likely to be compressed

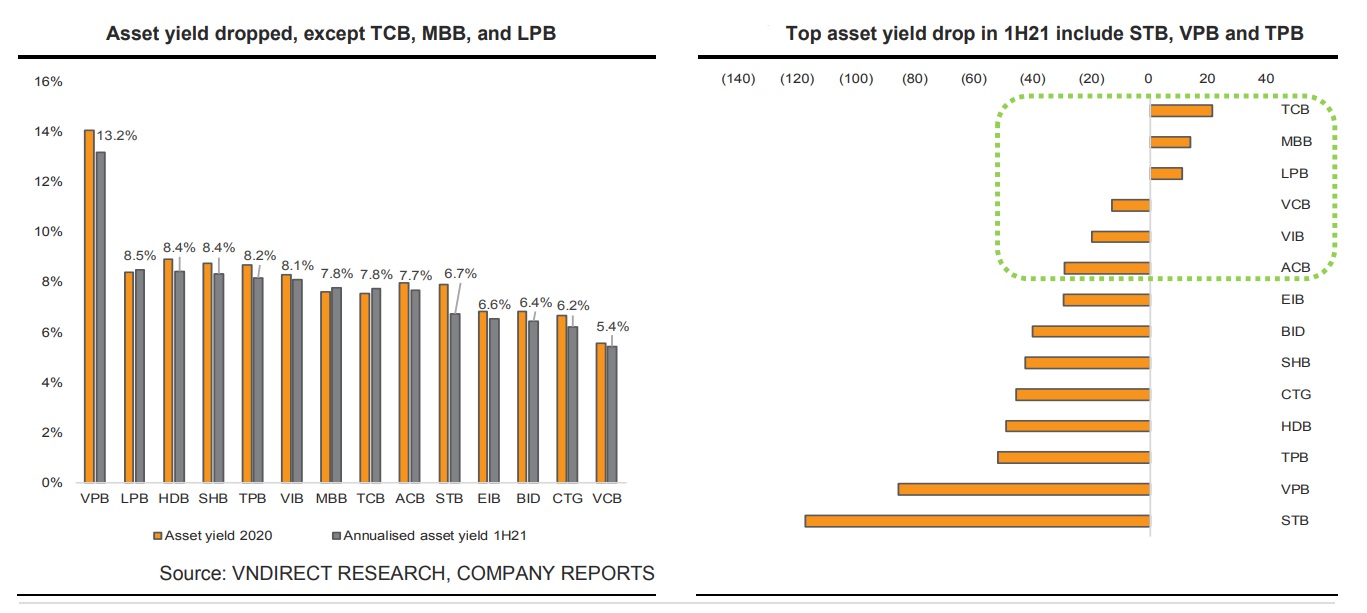

Almost listed banks enjoyed NIM expansion in 1H21 as the drop of funding cost trailed behind the pace of asset yield. Per VNDirect’s estimate, average asset yield subdued slightly 43bp YoY, and be fully offset by a drop of 120bp YoY in average cost of fund. Among top largest listed banks, TCB, ACB, and BID recorded the largest NIM improvement while only HDB experienced a NIM compression in 1H21.

On the funding cost side, deposit rates across banks extended the downtrend since 2020 and dropped about 10-50 bp year to date, following the abundant liquidity and accommodative monetary policy. Thus, all banks enjoyed cost of fund (COF) contraction in 1H21.

On the lending side, VNDirect observed that only TCB, MBB, and LPB recorded asset yield improvement in 1H21 as they accelerated lending activities (higher LDR at end-1H21 than that at end-FY20). VCB, VIB, and ACB also experienced softer asset yield compression as these banks have large exposure to retail lending.

VNDirect believed NIM improvement would slow down in 2H21 as commercial banks were strictly required to lower their lending rates to support clients during the outbreak. Meantime, the NIM improvement trend will likely be rather uneven across individual banks, as their sensitivity to competition for deposits and need for funding mobilization vary widely. Due to the prolonged pandemic impact, VNDirect expected the SBV to maintain its current accommodative monetary policy into 2022F. Hence, banks would continue to get support from lower funding costs. Thus amid the less intense deposit competition and ample liquidity, this stock company prefers banks that have opportunities to increase their exposures to individual lending which will enjoy better asset yield.

Asset quality to continue improvement

Average non-performing loan (NPL) ratio of 17 listed banks fell to 1.49% at end2Q21 from 1.54% at end-4Q20 or 1.81% at end-2Q20. Group 5 bad debt ratio decreased slightly to 0.78% at end-2Q21 from 0.85% at end-4Q20. Best-in-class asset quality banks include TCB (0.4%), VCB (0.7%), ACB (0.7%), and MBB (0.8%). Notably, TCB has aggressively wrote off in 1H21, bringing its NPL ratio to only 0.4%; lowest in its history.

According to banks’ disclosure, total restructured loan of 3 SOCBs (VCB, CTG, BID) and 6 private listed banks (TCB, MBB, ACB, HDB, VIB, TPB) reduced to VND41,170bn at end-2Q21, accounting for 0.4-4.5% their outstanding balance, from VND77,725bn at end-2020.

In VNDirect’s view, almost all banks have aggressively booked provision in 1H21 to prepare for the possibility of a new bad debt surge during the evolution of pandemic due to the Delta variant. Consequently, the average annualized credit cost increased 20bp YoY (or 9bp vs. 2020 average level) to 1.5%. Top banks that posted heavy provisioning include BID (65.5%), VPB (48.9%), EIB (44.3%) Average loan loss reserve (LLR) improved to 123.2% at end-2Q21 from 108.8% at end-4Q20 or 80.8% at end-2Q20. Top banks that had highest LLR at end2Q21 include VCB (351.8%), TCB (258.9%), MBB (236.5%), and ACB (207.7%).

On 07 Sep 2021, SBV issued Circular No. 14/2021/TT-NHNN which allows banks to restructure loans as well as waive/reduce interest payment of loans arising later than those were instructed in Circular No.03/2021/TT-NHNN and Circular No. 01/2020/TT-NHNN. VNDirect said this new policy would partially ease the pressure of banks on provisioning and also support the pandemic-hit businesses. As it concerns the predictable surge in bad debts in a couple of quarters, it prefers banks that have a solid asset quality and a strong provisioning buffer.

Credit growth to outpace deposit growth

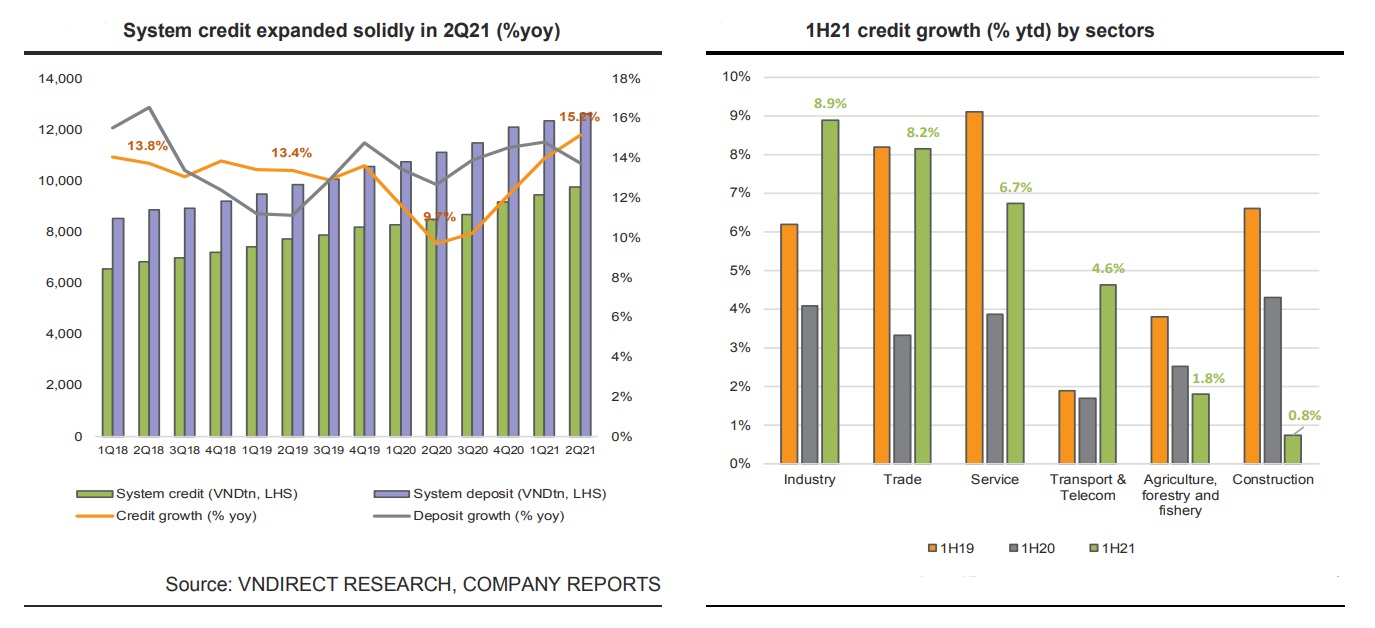

At the system level, country deposit rose 4.4% year to date by end-1H21 from the rate of 2% year to date by end-1Q21, but lower than that of 5.2% year to date same period last year. VNDirect believes that low deposit rates have explained sluggish deposit growth in 1H21. Following three policy rates cuts in 2020, deposit rates of all mature kept declining since Apr last year. Total deposit of customers of 17 listed banks grew to 4.8% year to date at end-2Q21 from 1.4% YTD at end-1Q21, higher than the growth rate of 4.1% YTD at end-2Q20. Top banks that delivered strongest YTD deposit growth include TPB (37.3%), VIB (11.8%), HDB (13.7%), and MBB (10.5%).

Meanwhile, system credit grew 6.44% year to date in 1H21 from the level of 2.95% year to date in 1Q21, nearly doubling that in 1H20. Strong credit growth was driven by industry, trade, and service sectors. At 17 listed banks which accounted for 66% of country lending market share, aggregate loan book expanded 8% year to date at end2Q21, from 3.2% YTD seen at end-1Q21, and much higher than that of 3.5% YTD seen at end-2Q20. State-owned Commercial banks, which accounted for 33.7% country lending market share, delivered 7.4% year to date of credit growth, higher than the system level.

However, system credit slew down since July when daily cases accelerated and stricter nationwide lockdown protocols have been adopted.

VNDirect lowered its credit growth forecast for FY21F to 10-12% from the previous 13% based on weak demand due to prolonged pandemic impact. In the base case, it expects the curve of the daily cases would flatten and movement control will be gradually relaxed since end-Sep. Thus, credit demand will bounce back in 4Q21. It is cautiously optimistic about the FY22F outlook as it believes low-interest rates will lend support for credit growth while domestic consumption will recovery post-pandemic.

Back into buy territory

VNDirect believes investors acknowledged that 2H21 earnings would be hurt by the current Covid-19 wave and now they focus on the FY22F earnings outlook. Some lost growth momentums may also be made up in subsequent quarters as output and social activity normalize. And banking is the best proxy to Vietnam's economic resurgence. Banks’ share prices have discounted 15% from their peak. VNDirect said the correction would partially factor in the downside risks of the current wave. Thus the risk/reward profile of the banking sector is attractive now. Its top picks for this sector are VCB, TCB, and ACB.

Upside catalyst includes better-than-expected credit growth. Downside risks are longer-than-expected social distancing due to Covid-19; or any new variant that hinders credit growth and triggers a new surge in bad debt.