How the exchange rates impact profit margins across sectors

Hoang Huy, CFA of the Maybank Investment Bank said that the depreciation pressure on the Vietnamese dong (VND) is expected to ease further in the coming year.

Maybank projects the VND will weaken by less than 5% in 2025 and about 3% in 2026

Maybank projects the VND will weaken by less than 5% in 2025 and about 3% in 2026, supported by stabilizing macroeconomic conditions and a more favorable global monetary environment.

Monetary Easing to Continue

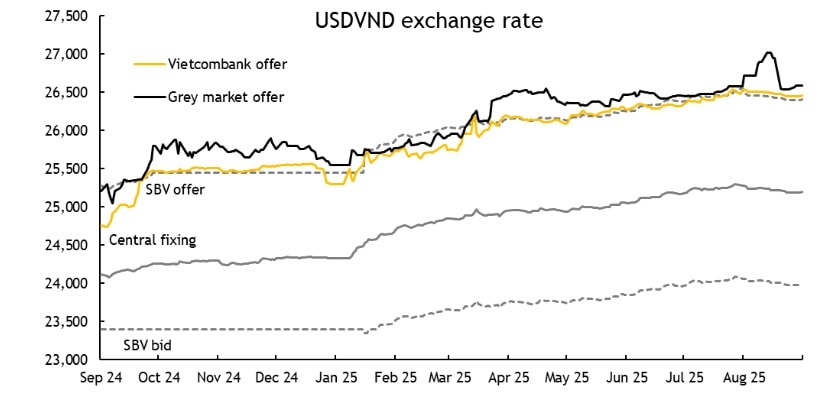

After months of volatility, Vietnam’s exchange rate is showing signs of stabilization. The State Bank of Vietnam’s central rate dropped by about 0.5% in September 2025, while the unofficial market rate fell by roughly 1.5% from its peak two weeks earlier in October.

This comes as global markets remain turbulent, yet Vietnam posted its strongest quarterly GDP growth since 2022. To sustain momentum, Maybank expects both monetary and fiscal policies to remain accommodative through 2026.

Several developments are shaping the policy landscape:

- Taxing gold transactions: The government is considering a new levy, either 0.5–1.5% of transaction value or 20% on profits, to limit speculative flows.

- Digital asset regulation: Under Resolution 05/2025/NQ-CP, Vietnam launched a five-year pilot for digital assets, effectively criminalizing unlicensed trading and tightening cross-border capital controls.

- The Fed turns dovish: The U.S. Federal Reserve cut rates by 25 basis points on September 17, 2025, signaling further easing of 50 basis points in Q4 2025 and another 50 bps in 2026.

With global dollar liquidity improving, pressure on emerging-market currencies — including the VND — is expected to soften. Inflation remains below the 4.5% ceiling and within control. Still, given that GDP grew only 7.5% in H1 2025, meeting the full-year 8.3–8.5% target will be difficult.

As such, Maybank expects the central bank to tolerate moderate depreciation and inflation to maintain easy monetary conditions and sustain growth.

Exchange rate swings affect companies differently

Sectoral Impacts: Winners and Losers

Exchange rate swings affect companies differently, depending on their foreign debt exposure, input costs, and USD-linked revenue base. A weaker dong erodes margins for import-heavy firms but benefits exporters.

- Aviation: Heavily Exposed

Airlines remain the most vulnerable. With extensive USD-denominated borrowings to fund aircraft purchases and leases, carriers like ACV, HVN, and VJC face direct margin erosion. A 5% VND depreciation could reduce profit margins by roughly the same proportion.

- Conglomerates: Financial Strain on Vingroup

Vingroup (VIC) has significant foreign loans, making it highly sensitive to exchange rate movements. FX losses have weighed on results since 2020, and a ±5% change in USD/VND could impact earnings by about 5% of revenue.

- Utilities: Moderate Downside

The power sector, led by POW, bears FX losses mainly from USD loans used to finance capital projects. However, long-term contracts and partial hedging moderate the impact.

- Steel: Improved Resilience

Hoa Phat Group (HPG) and other steelmakers import raw materials priced in USD. Yet, HPG has cut foreign debt to zero and optimized inventory management, keeping FX impact mild — around –1% to –2% on margins.

- Real Estate: Mostly Neutral

Residential developers are largely insulated from FX risks due to their domestic focus and limited foreign borrowing. However, Novaland (NVL) remains exposed after failing to hedge since 2022. Its large backlog — VND 105 trillion in unrecognized revenue, 1.7 times its current debt — could offset short-term FX pressures.

- Energy: Mixed Effects

In the oil and gas sector, GAS and PVS benefit from large USD revenues and minimal FX debt, while PVD faces headwinds from USD borrowings during its expansion phase. Net effect: –0.5% to –1%.

- Consumer Goods (F&B): Cost Pressure

F&B companies such as Vinamilk (VNM) and Quang Ngai Sugar (QNS) import raw materials in USD. A weaker dong raises input costs, though partial hedging mitigates losses. Limited ability to pass costs to consumers means margin pressure of –0% to –0.5%.

- Retail: Concentrated Risk at Masan

Among retailers, Masan Group (MSN) is most sensitive, with foreign debt equivalent to 25% of assets. Others, including PNJ, MWG, and FRT, have minimal exposure, while DGW could even benefit from import price dynamics.

- Chemicals: Export Advantage

Producers such as DGC, DCM, and DPM enjoy stronger USD-linked revenues from exports and limited FX debt. Their main risk lies in the volatility of gas input costs, also priced in USD.

- Industrial Parks: Currency Tailwinds

Developers benefit from a weaker dong, as foreign investors find leases more affordable. Margin uplift is estimated at 0% to 0.5%.

- Technology: Positive Outlook for FPT

FPT, the largest ICT firm, derives over 50% of revenue overseas. Diversified currency exposure (USD, JPY), lower debt (down from >50% to 15% by end-2024), and hedging coverage of 50–100% make it a likely FX winner. Margin gain: 0% to 0.5%.

- Seafood: Export-Driven Gains

Exporters such as Vinh Hoan (VHC) gain from a weaker dong, as USD export earnings offset higher feed costs. Positive impact: 0% to 0.5%.

- Banking: Neutral to Positive

Banks are required by the SBV to fully hedge foreign exposures, making them largely neutral to FX swings. Some institutions may even benefit from FX trading profits, contributing up to 0.5% in margin gains.

- Overall Impact: Contained Volatility, Stable Outlook

Maybank’s estimates indicate that most industries remain resilient to moderate currency movements. The VND depreciated 0.6% in Q3 2025, compared to 2.2% in Q2, suggesting controlled volatility.

Overall, the market-wide profit growth forecast stands at 12.4% year-on-year in Q3 2025, down from 34.3% in Q2, but expected to reaccelerate to 20.6% in Q4 as global conditions stabilize and monetary easing supports domestic demand.

Despite global uncertainties, Vietnam’s exchange rate risks are manageable, and the economy continues to attract capital inflows and maintain macroeconomic stability. The gradual depreciation of the dong—within a predictable and limited range—may well serve as a cushion, supporting both exports and growth in the next phase of recovery.