How to invest in industrial real estate stocks

Are industrial real estate stocks still providing possibilities for investors, given the good environment of increased FDI inflows into Vietnam?

Industrial Real Estate Stocks Benefit from Growing FDI Inflows

Experts believe that industrial real estate (IRE) in Vietnam continues to attract FDI due to its low prices in comparison to other nations in the area. As a result, the Vietnam Industrial Real Estate Stock Group gains as well.

According to the Ministry of Planning and Investment, foreign direct investment remains a driving factor for growth. In the first half of 2024, registered FDI increased by 13.1% to USD 15.2 billion, while disbursed FDI increased by 8.2% to USD 10.8 billion. Bac Ninh has moved to the top of the country's investment rankings, with Amkor's semiconductor component manufacturing project raising USD 1.07 billion.

Thus, the industrial real estate stocks are thought to offer several chances. This group is led by IDC - IDICO Corporation, which now operates ten operating industrial parks and has 554 hectares of residual leasable land in Phu My 2, Phu My 2 Expansion, Huu Thanh, Que Vo 2, and Cau Nghin.

IDC intends to lease 145 hectares this year. The firm has just been accepted for the investment policy of Tan Phuoc 1 Industrial Park in Tien Giang province, which has a total area of 470 hectares and is slated to begin leasing in late 2025. The firm records land leasing revenue using both yearly and one-time techniques, and it is in the process of switching from annual to one-time.

SIP - Saigon VRG Investment Corporation, a promising stock in the group, is one of the major listed industrial park developers in the South. SIP has nearly 1,000 hectares of leasable property in four industrial parks in Tay Ninh, Ho Chi Minh City, and Dong Nai. The firm rents around 20-40 hectares each year, which is likely to rise when infrastructure projects such as Vietnam Long Thanh International Airport and the HCMC-Moc Bai Expressway come online. The land leasing proposal for 2024 includes 47 hectares, an increase of 153%. SIP tracks land leasing revenue on a yearly basis, delivering solid business results with less influence from investment capital swings than other developers.

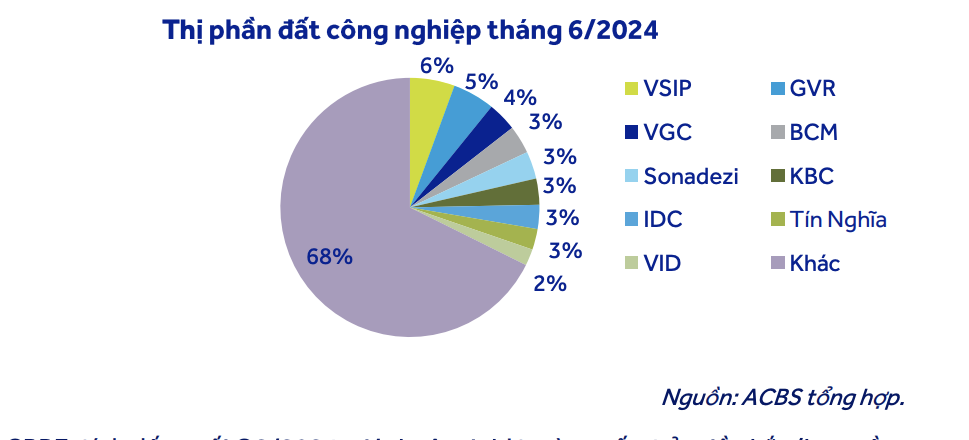

Industrial Land Market Share in June 2024

Similar to IDC, SIP is one of the few companies licensed by the Ministry of Industry and Trade to build 110kV substations to distribute electricity directly to tenants in industrial parks. Therefore, SIP's electricity distribution profit margin is higher than that of other industrial park developers. SIP has 4 substations with a total capacity of 567 MVA and operates nearly 50 MWp of rooftop solar power with a gross profit margin over 40%, expecting to invest an additional 8 MWp annually.

BCM - Becamex IDC Corporation, has 7 industrial parks with a total area of over 4,700 hectares in Binh Duong province, accounting for more than 30% of Binh Duong's market share and 3.5% nationwide. The company still has about 848 hectares of remaining leasable land. Cay Truong Industrial Park is a key project in the near future, expected to start leasing from 2025. BCM holds a 49% stake in VSIP - the leading industrial real estate company in Vietnam, with 15 industrial parks totaling over 7,500 hectares and 5.6% of the national market share.

As of Q2 2024, land lease prices in the North reached USD 134/m2/lease term, up 4.5%, while the South reached USD 173/m2/lease term. Lease prices are expected to grow by 3-7% annually during 2024-2026. The occupancy rate in the North reached about 83%, up 0.4%, while the South increased to 92%, up 6.5%.

Currently, workshop rental prices increased by 1.9% in the North and 1% in the South, reaching nearly USD 4.9/m2/month in Q2 2024. Warehouse rental prices decreased by 1% in the North and increased by 2% in the South, reaching about USD 4.5-4.6/m2/month. Rental prices are expected to increase slightly by 0-3.5% annually during 2024-2026.

Assessments of the industrial real estate land fund suggest that there isn't much residual leasable property, particularly in the South. As a result, companies are actively expanding to find new land funds, with advantages leaning toward companies permitted to convert rubber land to industrial land, such as Vietnam Rubber Group (GVR), Phuoc Hoa Rubber (PHR), or enterprises that have long attracted large international corporations, such as Kinh Bac (KBC), Viglacera (VGC), and IDICO (IDC).

Land speculation and fast urbanization can be linked to higher compensation costs, longer site clearance processes, and potentially rising industrial land leasing prices. Additionally, growth rates are an appealing incentive for investment capital in Vietnam.

According to CBRE Vietnam, the Hanoi Ring Road 4, HCMC Ring Road 3, Bien Hoa - Vung Tau Expressway (expected completion 2025), Long Thanh International Airport (expected completion 2026), and Ninh Binh - Hai Phong Expressway (expected completion 2027) are key infrastructure projects that will boost the industrial real estate market in the near future. This gives a foundation for anticipating the industrial real estate stock category to prosper.