How will USD/VND move in 2022?

A stronger USD may drive the USD/VND exchange rate to increase in 2022, given stable USD supplies, said KB Securities.

The USD supply in 2022 is forecast to be at the same level as in 2021 thanks to the recovery in exports, FDI, and remittance inflows.

>> Upward pressure on exchange rate by end-year

The big gap between exchange rates

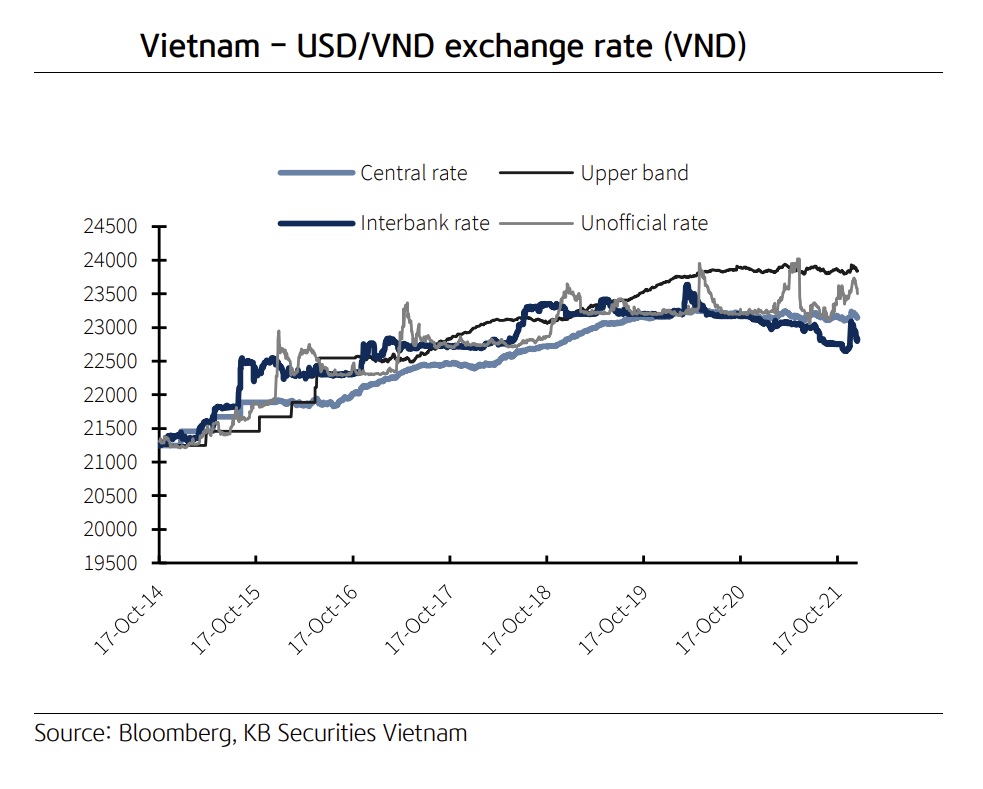

In 2021, the SBV adjusted the USD/VND spot rates down three times after Vietnam continued to reach an agreement with the US Treasury and pledged not to deliberately devalue its currency to gain an export advantage. Furthermore, the USD supply has remained plentiful as a result of remittances, foreign direct investment (FDI), and the return of trade surpluses since September 2021.

As of year-end 2021, the USD/VND interbank rate was down 1.18% YTD to 22,826. The interbank rate continued to stay low in the fourth quarter of 2021 and increased slightly in December 2021, reflecting a temporary shortage of USD in the banking system. The SBV lowered the asking price of the USD to 23,150 shortly thereafter to support liquidity and stabilize the exchange rate. For the whole quarter, the USD/VND interbank rate improved 0.29% QoQ from 22,761 to 22,826.

Meanwhile, the unofficial rate tended to rise as the gap between domestic and global gold prices widened, leading to an increase in demand for gold smuggling (the gap hit VND11 million/tael on December 31). In the fourth quarter, the USD/VND unofficial rate rose 1.0% to 23,503 from 23,270.

The NEER and REER curves of VND showed an upward trend in 2021. In particular, NEER and REER increased by 4.89% and 3% YTD, respectively, by the end of 2021. VND appreciated against USD thanks to the abundant supply of foreign currency, much like the stronger VND against the currency basket of trading partners).

However, both the NEER and REER of the VND have moved within a reasonable range and have not posed pressure on VND devaluation since Vietnam applied the central exchange rate regime, pegging the VND to a currency basket since August 2014.

USD/VND exchange rate in 2022F

The USD supply in 2022 is forecast to be at the same level as in 2021 thanks to the recovery in exports, FDI, and remittance inflows. To be more specific, despite a sharp fall during the lockdowns, Vietnam's exports for the whole year of 2021 still reached USD336.25 billion (19% YoY) and surpassed imports after months of trade deficit thanks to rising export prices.

In 2022, KB Securities expects export volume to surge and export prices to remain stable. Manufacturing progressively recovered following lockdowns, and demand in other countries spiked up during the year-end peak season. Vietnamese businesses will continue to boost exports in the coming months to bring in large amounts of foreign currency.

Data from the World Bank also shows that despite being impacted by the COVID-19 pandemic, remittances into Vietnam in 2021 still reached a record high of USD18.1 billion (7% YoY), of which Ho Chi Minh City alone (accounting for 30% of the country's remittances) recorded USD6.6 billion (20% YoY). More capital inflows are expected in the coming months thanks to (1) overseas Vietnamese supporting their pandemic-hit relatives in Vietnam and (2) great demand for investment in Vietnam. In addition, the disbursed FDI inflows are forecast to return when investor confidence improves in the context that the pandemic is under control (as analyzed in the 2021F GDP growth).

KB Securities said a stronger USD may drive the USD/VND exchange rate to increase 0.5%-1% in 2022, given stable USD supplies. In the fourth quarter alone, the US Dollar Index (DXY) traded 1.53% QoQ higher to 95.67, with the increase concentrated in the second half of November, after the FOMC and FED meetings. The message pointed to the trend of tightening (hawkish) as inflationary pressure persists with the US personal consumption expenditures price index (PCEPI) exceeding the target by 2%.

In addition, the US did not label Vietnam as a currency manipulator. Accordingly, the SBV will continue to manage exchange rate policy reasonably to curb inflation, stabilize the macroeconomy, and reboot economic growth, not to create an unfair competitive advantage in international trade.