Identifying bad debt risks for banks in 2024

According to Ms. Pham Phuong Linh, an analyst from KBVN Securities Company, the source of bad debt risks in the banking industry is a subject of concern in 2024, especially with a considerable difference in Net Interest Margin (NIM) across various banks.

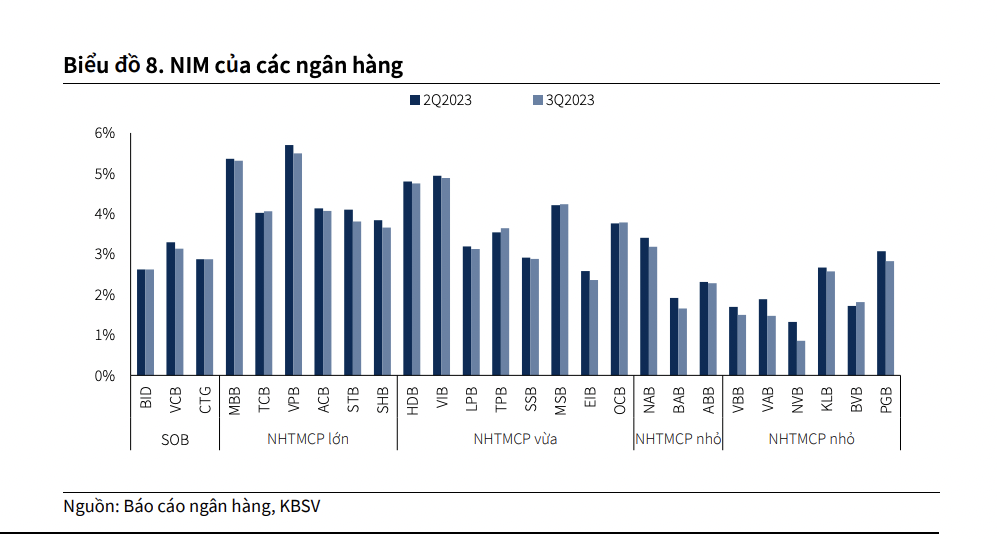

Differentiated NIM among banks

The pace of Net Interest Income (NIM) recovery is predicted to be slower than planned due to varied tendencies among banks. NIM recovery is slow, and there is variation between bank groups. Most banks in the monitored portfolio continue to have lower NIM than the previous quarter, with TCB, TPB, MSB, and OCB showing minor gains.

The asynchronous pattern among banks suggests that the NIM recovery has not been as anticipated. High-interest deposits with a one-year maturity until the end of 2023 or the beginning of 2024 continue to put pressure on financing costs. As a result, banks will require another 1-2 quarters to match their Cost of Funds (CoF) with their operational interest rates.

Current deposit interest rates, on the other hand, have hit the low established during the Covid-19 period, leaving little space for additional cuts. This emphasizes the potential of a return to higher deposit interest rates, which would stymie the rate of CoF development.

Recent findings show that several banks have raised deposit interest rates to enhance long-term funding ratios, therefore achieving the short-term capital ratio requirements for loans with maturities of less than 30%, as specified in Circular 06. Simultaneously, they prepare resources for year-end credit expansion. In terms of lending interest rates, the monitored portfolio's banks' Interest Earning Assets (IEA) fell by 17% in Q3.

Notably, customer assistance rules cause considerable drops of 20-30 basis points for state-owned banks (SOB) and several big joint stock commercial banks (ACB, STB). As a result, the IEA is projected to continue declining as banks fight on lending rates to solve credit growth issues. The loan portfolio structure is trending toward corporate customers, who have lower yields than retail customers.

The NIM recovery rate is predicted to be slower than planned due to the difference between the Cost of Funds (CoF) and the Interest Earning Assets (IEA). Some banks may continue to decline until the fourth quarter of 2023. The low-interest-rate environment will be completely represented in CoF by 2024, whereas loan rates will gradually drop, producing a delay. Based on this, it is projected that the banking sector's Net Interest Margin (NIM) would increase more noticeably in 2024, while it will not recover to the levels observed in 2022. Because of their role in supporting the economy, state-owned banks (SOB) and ACB will see a minor NIM gain when compared to other banks.

Risk pressure from bad debts

In the third quarter of 2023, the banking sector's asset quality continues to worsen. In 2024, bad debts might skyrocket. Bad debts for the overall industry have climbed for the fourth quarter in a row since Circular 14 on the restructuring of Covid-19 debts expired, reaching 2.2% (a 6.9% increase year on year). However, excluding State-owned banks (influenced by VCB recognizing a high rise in Group 4 loans), the growth rate is reducing in Q3 2023. The introduction of Circular 02, which allows banks to keep clients' debt classifications, has helped to limit the rise in bad debts.

According to the State Bank of Vietnam (SBV), the entire restructured debt under Circular 02 will reach 140 trillion VND (1.09% of total system credit) by the end of September 2023. Among the banks, VPB has restructured debt totaling 14.9 trillion VND (almost 2.86% of total outstanding debt) and BID has about 20 trillion VND (nearly 1.5% of total outstanding debt), assisting in containing the quarter's growth in bad loans.

Other banks have a relatively modest amount of restructured debt in total outstanding debt (VCB 0.14%, ACB 0.4%, TCB 0.27%, MSB 0.25%, HDB 0.5%) due to minimal bad debt pressure and a lack of priority in implementing Circular 02 (since it needs greater provisioning). The positive feature of the sector's asset quality in this quarter is seen in the 7.7% decrease in delinquent tier 2 loans, which had climbed constantly in previous quarters. In all bank groups, bad loans are forming more slowly than in the previous quarter. Bad debts are currently placing pressure on Large and Medium-sized Commercial Banks (MBB, TCB, TPB, MSB...) as a result of negative effects from the domestic market, real estate, and challenges in the retail client segment.

According to the foregoing study, bank asset quality will be temporarily managed at the present level till the end of 2023. However, care is advised as we approach 2024.

The expiration of Circular 02 in June 2024, when previously restructured debts would revert to their appropriate categorization, is one of the dangers that might trigger a rise in bad debts next year. The reduction in bank reserve buffers in 2023 affects banks' ability to absorb obligations the following year. The Loan Loss Coverage Ratio (LLCR) among banks is now markedly different, with the SOB group retaining a buffer of 200% while other bank groups have already gone below 100% by Q3.

Thus, banks with broad client portfolios, adequate provisions, strong reserve buffers, and limit ed exposure to real estate and non-production business divisions are more likely to reduce credit risk costs than others. Lower-tier banks with low coverage ratios (below 50%) would experience more pressure and less space to eliminate problematic loans from their balance sheets.