Inflation pressure: The need for monetary tightening

Amid high inflation, the million-dollar question is, how will regional central banks respond?

The State Bank of Vietnam (SBV) is also on track for monetary policy normalisation.

Well, inflation is a key consideration, but much will also depend on prospects for growth. Broadly, ASEAN is on track for a promising economic recovery, fuelled by the relaxation of pandemicrelated restrictions. Domestic demand has seen a strong rebound, with mobility indicators exceeding pre-pandemic levels sharply in Indonesia and the Philippines.

Meanwhile, despite headwinds in global trade, shipments from a number of ASEAN economies are likely to hold up well: Indonesia and Malaysia, for example, will benefit significantly from soaring commodity prices, while Singapore, Malaysia and Vietnam will continue to be able to take advantage of the strong, though moderating, momentum in the extended tech cycle.

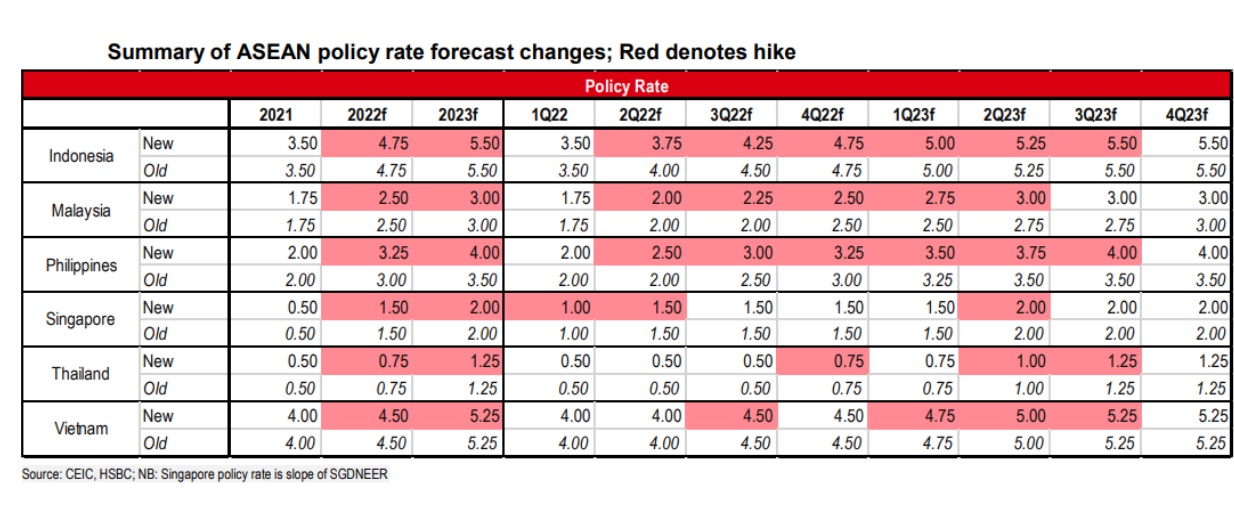

On top of that, the grand border re-opening will not only attract tourists back to ASEAN, but should further facilitate business travel and cross-border investment. While the recovery in international tourism will provide extra tailwinds, the lift needs to be kept in perspective: ongoing travel restrictions in mainland China, for example, and lingering hesitancy in other places such as Japan, are bound to dampen any bounce in arrivals, something that will prevent Thailand’s significant tourism industry, for example, from reaching its pre-pandemic size for quite some time. Considering both inflation and growth, HSBC has thus made some adjustments to its policy rates.

Singapore’s Monetary Authority of Singapore (MAS), has been one of the early and aggressive central banks to push for monetary normalisation in Asia. It “slightly” raised its SGDNEER curve three times in six months, possibly by 50bp each time. The message is crystal clear: it is all about inflation. But this won’t be the end of this tightening cycle: the current SGDNEER slope of 1.5% is still below the terminal slope of 2%. The question is when the MAS’ next tightening move will be.

“We believe this will be data dependent, particularly on how core inflation evolves. Our baseline is for the MAS to remain on hold in the upcoming October meeting, if inflation pressure abates in 2H22 as the MAS forecasts. It will likely further tighten in April 2023, taking the SGDNEER curve to 2%. That said, an early move in October 2022 cannot be ruled out, if inflation continues to surprise on the upside”, said HSBC.

Among the emerging markets in ASEAN, Malaysia and the Philippines were the first ones to hit the brake. Bank Negara Malaysia (BNM) recently surprised the market, raising its policy rate by 25bp. Given rising inflation, it decided to act sooner than later, making a ‘pre-emptive’ move. Monetary policy will be tightened further, but we only expect to see this proceed in a “measured and gradual manner”. HSBC expects another 50bp in hikes in the policy rate in 2022, followed by another 50bp throughout 2023. This will likely bring the policy rate back to its pre-pandemic level of 3.00%.

Meanwhile, the Bangko Sentral ng Pilipinas (BSP) also delivered a 25bp rate hike to re-anchor inflation expectations. With inflation rising and growth trending stronger-than-expected, the BSP plans to rein in its pandemic interventions and hike rates further. HSBC expects another 25bp rate hike in June, followed by a 50bp hike in 3Q22 and then a 25bp hike in each of the subsequent quarters until 3Q23.

While HSBC expects the Bank of Indonesia (BI) to join the club, even if it held its policy rate steady at 3.50% in the May meeting. Still, BI delivered a surprise reserve requirement ratio (RRR) hike to 9%, from 6.5%, a quicker and bigger move than its earlier guidance. The RRR hike highlights the need for strengthening a hawkish bias, amid heightened global financial market volatility and the notable pick-up in sequential price pressures locally. As a result, HSBC expects BI to start tightening its monetary policy in the upcoming June meeting, with a 25bp rate hike. It also expects 100bp rate hikes in 2H22, followed by another 75bp one in 2023, bringing the policy rate to 5.50% by end-2023.

“The State Bank of Vietnam (SBV) is also on track for monetary policy normalisation. Thanks to impressive exports and recovering private consumption, Vietnam’s growth is poised to return to its pre-pandemic pace. While inflation remains well below the SBV’s 4% inflation target for now, we expect persistent high energy prices to continue driving up headline prices, likely temporarily breaching the SBV’s 4% ceiling in 2H22. This may prompt the SBV to deliver a possible 50bp rate hike in 3Q22, before delivering three more 25bp hikes in 2023”, HSBC forecasted.

Unlike the rest of the region, Thailand is an outlier. Despite high inflation, the Bank of Thailand (BoT) is more concerned about the subdued growth picture. Monetary officials have also argued that fiscal relief should do the heavy-lifting to alleviate rising living costs. Therefore, we maintain our view that the earliest time the BoT will likely hike is 4Q22, when GDP is expected to pre-pandemic levels, based on our growth projections. Undoubtedly, a delicate balancing act for the BoT.