Many catalysts for Vietnam’s economy in 2024

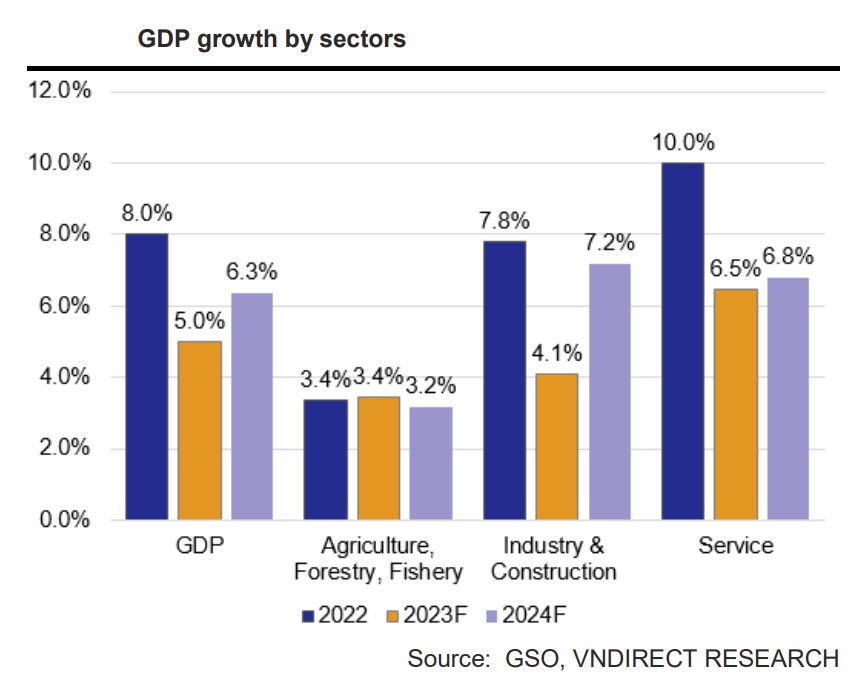

According to VNDirect, Vietnam's economy should strengthen its recovery pace next year, with GDP growth of 6.3% year on year in 2024.

Aerial view of a Ho Chi Minh City, Vietnam with development buildings, transportation, energy power infrastructure. Financial and business centers. Sunset to night. - stock photo

>> Vietnamese Economic Outlook: Projected 5.8% GDP Growth in 2024 Amidst Stable Interest Rates

VNDirect forecasts Vietnam's GDP will expand 7.0% year on year (/-0.2% percentage points) in 4Q23F, bringing the full-year growth rate to 5.0%. The main sources of support for Vietnam's economic growth will be (1) expansionary fiscal policy; (2) lower lending interest rates, which could help revive private investment and domestic consumption; (3) accelerating recovery of the manufacturing sector due to rising export orders amid falling inventories and easing inflationary pressures in developed markets; and (4) low comparative base level of the same period in 2022 (Vietnam's GDP grew by only 5.9% year on year in 4Q22).

According to VNDirect, Vietnam's economy might increase its recovery pace next year, reaching 6.3% year on year growth in 2024. The following are the primary catalysts:

The first is a greater rebound in manufacturing and export activity. VNDirect predicts that rising foreign orders, low inflation, and declining inventory levels in developed countries will hasten the recovery from very low levels in 2023. It expects that Vietnam's export turnover would climb 7.5-8.0% year on year next year, up from the (anticipated) drop of 4.5% in 2023.

Demand for imported raw materials, machinery, and equipment is further boosted by the resurgence of industrial operations. As a result, we predict Vietnam's import turnover to climb by 9.0-9.5% year on year next year, up from the (planned) drop of 9% in 2023.

Furthermore, an increase in FDI inflows to Vietnam in the second half of 2023 and the following year will contribute significantly to the recovery path of manufacturing and export operations in 2024.

The second factor is the increasing local consumer demand. Following the industrial sector's recovery, employment and earnings will rise in 2024, contributing to stronger domestic demand. Furthermore, the government's implementation of wage reform beginning July 1, 2024, will have a significant impact on persons receiving state budget salaries and subsidies.

As a result, the government intends to spend VND499 trillion (USD20.5 billion) on wage changes during the next three years (2024-2026), with salary increases costing VND470 trillion (USD19.3 billion). Furthermore, VND11 trillion (USD450 million) will be used to boost pensions, and VND18 trillion (USD740 million) will be utilized to increase subsidies for persons who have rendered outstanding service to the revolution. Last but not least, the administration will maintain numerous fiscal stimulus initiatives to help the economy, including a 2% drop in VAT in the first half of 2024.

>> Strengthening growth momentum for 2024

The third factor is the revival of the real estate market. According to real estate professionals, legal concerns account for 70-80% of the present challenges in the real estate industry. To promote the real estate sector, the government and municipal governments are aggressively addressing legal issues associated with real estate developments. Ho Chi Minh City claims to have addressed 30% of real estate projects with legal issues, whereas Hanoi claims to have resolved 60% of real estate projects with legal issues. Simultaneously, another real estate market challenge is that several real estate firms are experiencing financial difficulties.

The Government and the State Bank of Vietnam (SBV) have put in place the essential measures to facilitate financing for the real estate industry. According to the SBV, total outstanding credit in the real estate sector reached VND2.74 billion (USD112 billion, 6.04% year on year) and accounted for 21.46% of total outstanding credit in the economy as a whole. Credit for real estate business operations (for real estate developers) climbed by 21.86% year on year, above the overall credit growth rate of 7.39% year on year.

Furthermore, a 2-3 percentage point fall in lending interest rates compared to early 2023 levels will enhance demand for mortgage loans and strengthen real estate firms' financial position in 2024. Furthermore, in the future years, the progressive warming of the corporate bond market will be an important component to resolving financial challenges for real estate developers.

The fourth factor is an increase in private investment. VNDirect anticipates a recovery in private investment in 2024 for the following reasons: (2) Lower loan rates, looser global financial conditions in the second half of 2024, and the revival of the real estate market will encourage a fresh wave of private investment.

Prior to the COVID-19 epidemic, private investment was the major growth engine of the economy, with an average annual growth rate of roughly 15%. However, due to decreased export orders and a slow real estate market, private investment capital expanded by just 2.3% year on year in the first nine months of 2023.

"Downside risks to our outlook include: 1) higher-than-expected inflation in the US and Europe would cause the Fed and ECB to maintain hawkish monetary policies; 2) a stronger-than-expected DXY, which could put more pressure on Vietnam's exchange rate; and 3) Slower-than-expected growth of Vietnam's major trading partners will slow the recovery of the manufacturing sector" , VNDirect said in a statement.