Many factors to support Vietnam's GDP growth in 4Q23

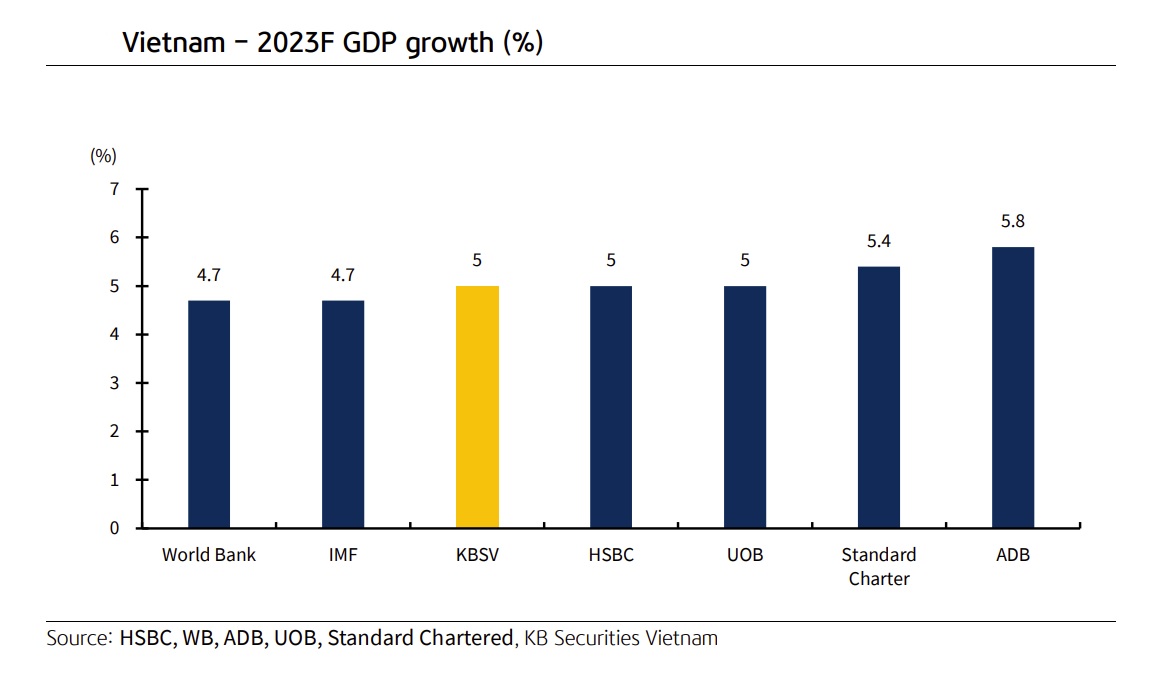

KB Securities maintains its 5% GDP growth prediction for 2023 as macroeconomic conditions improve as predicted.

Export operations are one of the key drivers of Vietnam's GDP development.

>> Vietnam’s economic performance in the first 9 months of 2023

Factors supporting GDP growth in 4Q23 include: 1) a comeback in exports, which helps the manufacturing industry; 2) increased public investment at the end of the year; 3) government initiatives to assist economic development; 4) stable FDI capital flow; and 5) anticipation of a rebound in domestic consumption.

Export operations are one of the key drivers of Vietnam's GDP development. However, by 2023, this industry would have declined because to sluggish demand in key economies such as the US, EU, and China, resulting in stagnating domestic output. Exports totaled USD259.7 billion in 9M23, an 8.2% decrease year on year. However, we believe that this drop is due in part to the significant export quantities last year when nations reopened following the Covid-19 epidemic.

In general, exports continue to rise, hitting USD31.4 billion in September. This is much higher than the USSD23.56 billion in January, lowering the 3Q drop to 1.2% YoY (vs 11.8% in 2Q). Electronics, computers, and accessories (15.1% QoQ); phones and accessories (37.7% QoQ); and textiles (14.3% QoQ) were among the important goods that expanded considerably compared to the previous quarter. In terms of export markets, the United States leads with 27% of total export turnover, followed by China (16%) and the European Union (13%).

Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, anticipates Vietnam's export activity to revive in the fourth quarter due to supportive factors from both local and international markets: (1) Global economic growth is stronger than predicted. (2) Holidays enhance the end-of-year peak consumption season in all three markets, the US, China, and the EU. (3) The retail inventory value in the United States (not adjusted for inflation) has bottomed out, which may assist Vietnamese exports revive in this market. (4) An increase in the exchange rate will cut the prices of Vietnam's export goods while allowing export firms with USD income to benefit from recording revenue and profits in VND.

Following encouraging signals from exports, industrial production activity resumed. After two quarters of negative growth, 3Q IIP increased by 3.5% year on year. Each month, all of the major industries improved (Figure 16). Processing and manufacturing increased 5.9% year on year in September, above the overall industry average.

Furthermore, the PMI topped 50 points in August before falling slightly to 49.7 points in September. However, the quantity of new orders continued to rise, owing primarily to export orders. This is good news for Vietnam's manufacturing and export sectors.

Public investment remains an important tool for stimulating the economy since it has long-term spillover effects on other sectors. According to the GSO, realized public investment capital in the first nine months of the year is estimated at VND415.5 trillion, a 23.5% increase year on year and 57.4% of the Government's target. Disbursement progress is deemed fairly favorable because it is increasing month after month.

"If this pace is maintained, we expect the disbursement rate in 2023 to be equivalent to 2022 at 85% of the plan, implying that the average disbursement rate in the last quarter should be around VND67-70 trillion per month." We currently do not perceive any dangers that may impede building progress. "We anticipate that public investment will be promoted by the end of the year and will become a fulcrum for the economy," Mr. Tran Duc Anh stated.

Vietnam's overall registered FDI capital climbed 7.7% year on year to USD20.21 billion in 9M23, thanks to numerous significant newly registered projects and constantly expanded investment capital. Disbursed FDI capital increased 2.2% year on year to USD15.91 billion in 9M23, the highest amount during the period 2017-2023. Furthermore, the consistent increase in the number of projects indicates that FDI businesses that have invested in Vietnam are steadily recovering and growing production and commercial operations.

>> Overcoming headwinds, Vietnam finds new opportunities: Insiders

Thus, Mr. Tran Duc Anh predicts that FDI capital flows into Vietnam will remain stable and may even exceed the results of 2022, owing to both domestic and international causes. Internally, Vietnam is still aggressively recruiting international investment by offering attractive assistance packages and building a suitable business climate. Furthermore, it makes effective use of various competitive advantages such as a stable economic and political climate, a convenient location for investment activity, several signed free trade agreements, and a large labor population.

In terms of external forces, Vietnam benefits from the trend of moving manufacturing bases away from China. The stability of the VND in relation to the CNY has provided Vietnam an edge in terms of developing trust in the business climate. (2) Improving the overall strategic partnership with the United States is projected to draw significant FDI inflows from this nation to Vietnam. (3) Business confidence among European firms in Vietnam grew again in 3Q, with the BCI rising to 45.1 points (according to EuroCham).

“We expect the catering and tourism services to continue to be busy. In the first nine months of the year, international visitors to Vietnam were estimated at nearly 8.9 million people, 4.7 times higher than 9M22 but still only 69% compared to 9M19. This means that the industry has not yet fully recovered to the pre-Covid-19 levels, so there is still much room for growth in the near future. It is highly likely that the tourism industry will reach and even exceed the target of 110 million tourists, bringing in VND650 trillion in revenue and directly contributing 6.4% of GDP for the whole year. We believe that the Government and SBV’s stimulus policies (such as reducing VAT, increasing basic salaries, and lowering policy rates) will take effect by 4Q23. Thanks to that, the retail sector is expected to make a stronger improvement and become one of the growth forces of the economy”, said Mr. Tran Duc Anh.

The government is assisting companies and increasing consumption through fiscal measures like as tax cuts and fee increases, wage increases, and the issuance of circulars to promote the real estate market and corporate bonds. Furthermore, the SBV's sustained monetary easing has led deposit and lending interest rates to fall relative to the beginning of the year. As a result, credit growth surged in the third quarter, reaching 6.92% YTD at the end of September.

Given the policy lag, Mr. Tran Duc Anh anticipates that the fourth quarter will be the time when the economy more clearly reflects the beneficial impacts of supporting policies than prior quarters.