New opportunities for modern retail consumption

The inclusion of retail, including e-commerce, into standardized regulations will create a fair and transparent market, enhancing competitiveness for modern retail chains.

The WinMart/WinMart retail chain remains a bright spot in Masan's business performance.

Government standardization of retail market

Since early 2025, the Government has taken multiple actions to regulate and standardize the retail market:

First, a series of product violations have been cracked down on, including the production of counterfeit milk under more than 400 labels with an estimated value of around VND 500 bn, and health supplement products showing signs of violating food advertising regulations.

Second, mandatory connection of e-invoices for businesses with annual sales revenue exceeding VND 1 bn. This requirement helps to make transactions more transparent, reduce smuggling and undocumented goods, and ensure the rights of consumer goods manufacturers and retailers.

Third, e-commerce platforms are required to collect VAT on each order, creating a fairer competitive environment between offline retail stores and e-commerce.

Fourth, several laws have been or will be enacted during 2025-2027, including: (1) Resolution 68 on Private Sector Development, which also mentions eliminating the presumptive tax for retail and service businesses; and (2) the development of a new E-commerce Law. MBS believes these initiatives will foster a more transparent and level playing field in the retail market, ultimately strengthening the competitiveness of modern retail chains. This is particularly positive, as modern retailers already incur higher costs due to transparent supply chains and full tax compliance compared to informal players.

A positive catalyst for modern retail chains

Makeshift markets have long been embedded in Vietnamese consumer habits, valued for their convenience, low prices, and speed. Since 2009, authorities have made multiple attempts to eliminate these informal markets to (1) prevent the occupation of sidewalks for trading, and (2) protect the rights of small vendors within officially planned, professional markets. However, these efforts have largely been unsuccessful, as formal markets often lacked the same level of convenience, affordability, and speed.

In 2025, Hanoi issued Official Letter No. 4373/UBND-KT to implement the City Council’s Resolution on eliminating markets inconsistent with urban planning, informal trading spots, and small-scale livestock slaughtering across the city. The goal is to fully eradicate makeshift markets in Hanoi. Compared to 2015- 2018, the key difference today is that modern retail chains are now capable of replacing makeshift markets in meeting shopping needs, thanks to (1) Lower prices for clean food at modern retail models compared to the past; (2) Compact, modern, and comprehensive retail formats that cater to diverse consumer needs; (3) Integration of physical retail with online sales channels (websites, Zalo, iMessage, etc.), allowing consumers to shop conveniently even when busy; and (4) A wide, diverse, and reliable supply of daily food products with clear origins and health benefits.

Therefore, MBS sees a high likelihood that informal street markets will be maximally phased out. As a result, the modern grocery/minimarket retail model, already widely spread in both rural and urban areas, will benefit significantly. In its assessment, large enterprises with professional supply chains and extensive coverage will be the biggest winners, and it particularly highlights MSN and MWG as key beneficiaries.

E-commerce retail is entering a consolidation phase

In 2025, platform fees for sellers increased by 5-10% yoy, creating significant cost pressure, especially for small-scale sellers. In addition to fixed fees per order, sellers also need to pay for affiliate marketing fees and advertising costs to generate sales. As a result, the average selling cost on e-commerce platforms has reached 20-25% (labor and office expenses not yet included). This level is now equal to or even higher than the average SG&A (Selling, General & Administrative) expenses of retail and consumer businesses, specifically SG&A/Revenue of consumer goods manufacturers 23-26% and SG&A/Revenue of retailers 17–20%.

After a period of rapid growth, platform policies have begun to tighten through (1) rising selling fees and (2) direct collection of VAT and Personal Income Tax (PIT) on successful orders. Additionally, the development of e-commerce regulations, which aim to formalize operating conditions and tighten product origin requirements, creates a favorable opportunity for transparent businesses. Strict controls on product origins will benefit domestic manufacturers while putting competitive pressure on hand-carried goods, unbilled products, counterfeit, and low-quality items.

MBS assesses that MSN, SAB, VNM, and QNS - leading domestic consumer goods manufacturers - stand to benefit most from this trend. Moreover, professional retail enterprises listed on the stock market are expected to benefit from rising costs and stricter conditions on e-commerce platforms. MBS believes that MWG, FRT, and DGW will gain advantages thanks to their professional sales processes and transparent product sourcing.

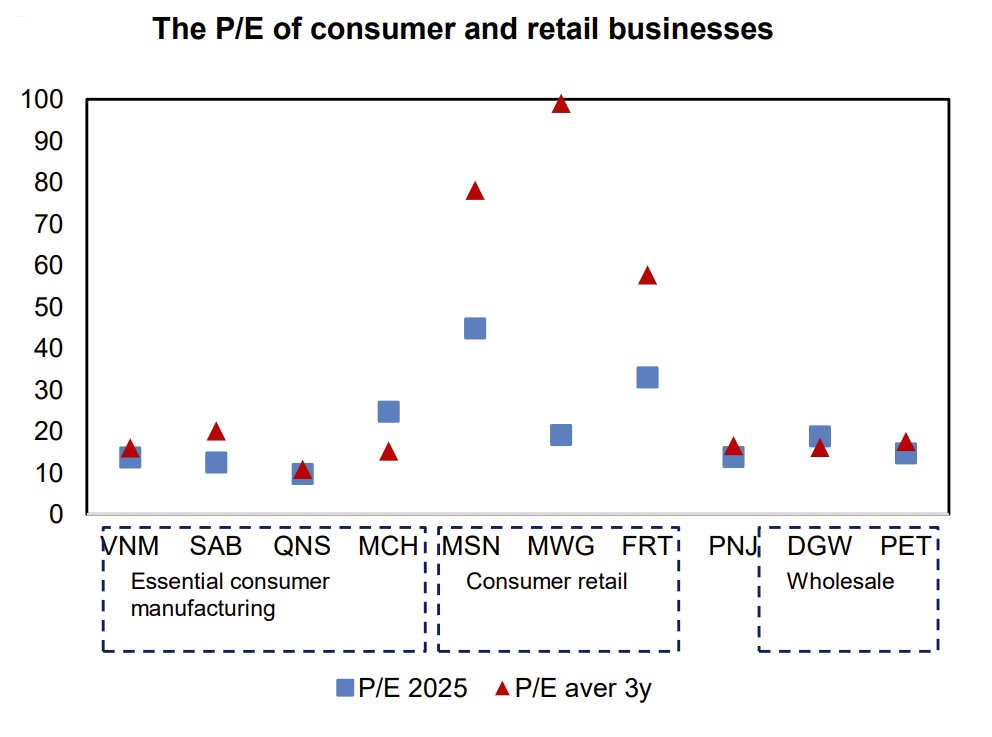

MBS believes that the government’s efforts to standardize the retail market, including e-commerce and the removal of informal markets, will create a level playing field and enhance the competitiveness of modern retail chains, which have already adopted transparent management practices. Within its retail sector investment strategy, MBS favors companies with attractive valuations and high growth potential, notably MWG and MSN. For consumer goods companies, stricter enforcement against products of unclear origin will be a positive catalyst for domestic producers such as VNM, MCH, SAB, etc.