NIM compression for many banks is unavoidable

Banks are facing higher cost of fund (COF) as a result of tightening liquidity and stricter monetary policies.

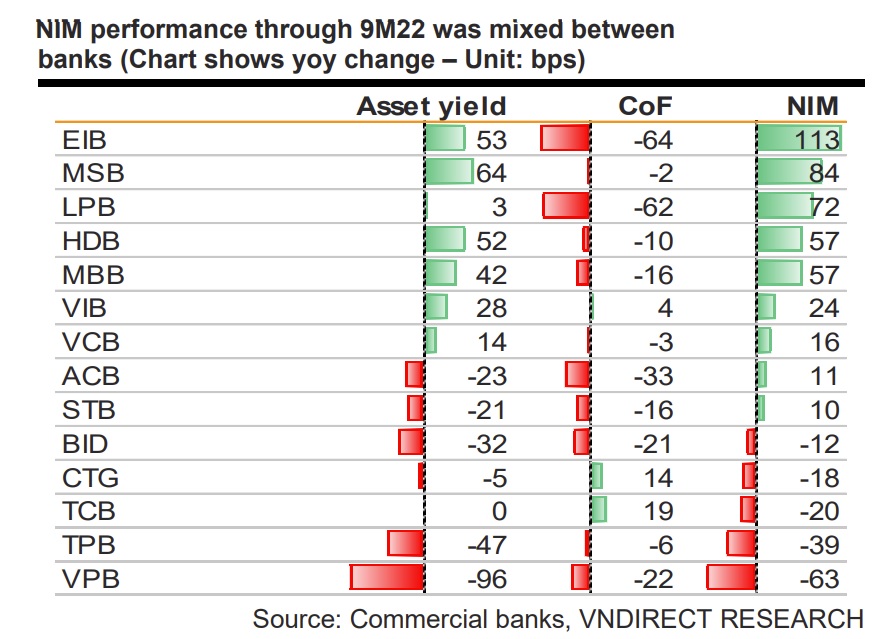

NIM performance through 9M22 varied widely between banks.

>> Banking sector suffers from difficulties

COF pressure is growing

VNDirect said the SBV would maintain tight monetary policy during 2023-24F due to ongoing macro uncertainties including (1) internal headwinds relating to property and c-bond markets, (2) a hawkish FED putting pressure on exchange rate and surging interest rate, and (3) inflationary pressure.

Banks are facing higher cost of fund (COF) as a result of tightening liquidity and stricter monetary policies. Interbank rates have spiked in recent months due to (1) SBV withdrawing VND from system to deal with FX pressure, (2) corporates buying back bonds, and (3) SCB event.

Although interbank rates have cooled down somewhat, VNDirect expects they will continue to hover around 5-6% for the overnight term in the coming months. With respect to deposit rates, after SBV raised policy rates by 200bps, commercial banks have quickly followed up with sharp increases to their deposit rates at both short and long maturities. 12-month rates at Stated-owned banks and private banks have risen by 190bps and 275bps ytd and are now 60 and 110bps above pre-pandemic levels, respectively.

Looking to 2023, given the rising funding pressure at both short and long terms, VNDirect expects COF for the banking sector to rise meaningfully over the next year, putting downward pressure on NIM. It doubts asset yields can pick up at the same pace to offset given it is unlikely banks can fully pass-through higher rates to customers amid government’s call for the sector to control operating expenses rather than increase lending rates to share the financial burden with borrowers.

Mixed NIM performance

NIM performance through 9M22 varied widely between banks. Within VNDirect’s coverage, LPB, HDB, and MBB registered the strongest yoy improvement at 60- 70bps. Credit growth outpaced deposit growth by a significant margin at MBB and HDB, which supported NIM expansion. For HDB, strong recovery of HD Saison also contributed to stronger NIM. For LPB, meaningful decline in COF was the main driver behind the bank’s NIM expansion as the company reduced the weight of costly valuable paper within its funding source.

>> Banks "release" preferential credit, enterprises still complain

CTG, TCB, TPB, and VPB recorded the biggest yoy declines in 9M22 NIM. For CTG, VNDirect believes NIM compression has been driven by continued interest relief for customers affected by Covid-19 in 1H22. TCB and TPB experienced large declines in their corporate bond balances due to regulatory tightening on bond issuance, which weighed on NIM, because c-bonds typically carry higher yields than loans. Lastly, for VPB, it believes weak credit growth at consumer finance arm FE Credit drove the decline in consolidated yield and NIM.

VIB, VCB, and ACB are in the middle of the pack with yoy changes in NIM at 24/16/11bps, respectively. VIB and ACB appeared to be able to maintain their NIM thanks to strong exposure to retail lending where banks can more easily pass-through higher COF to customers. For VCB, VNDirect attributes solid NIM performance to robust credit growth and strong CASA levels.

Who will mitigate the NIM compression?

VNDirect believes banks with high retail lending exposure and strong CASA are bestpositioned to navigate through NIM headwinds. Regarding the retail lending criterion, VIB and ACB score the highest with 87% and 64% of retail weights. CTG, VPB, TPB, MBB are also noteworthy names thanks to successfully increasing the retail component within their credit mix this year.

With respect to CASA, TCB, MBB, and VCB are the best positioned in our coverage in term of CASA ratio at end-3Q22. “VCB particularly impresses us as one of the few banks to have improved CASA ratio ytd, which we would attribute to its success with the “zero-fee” program introduced earlier this year”, said VNDirect.