Perfecting legal framework to revive corporate bonds

When bank credit is subject to numerous restrictions, the market for corporate bonds has a chance to expand. However, there are still some legal voids to be filled.

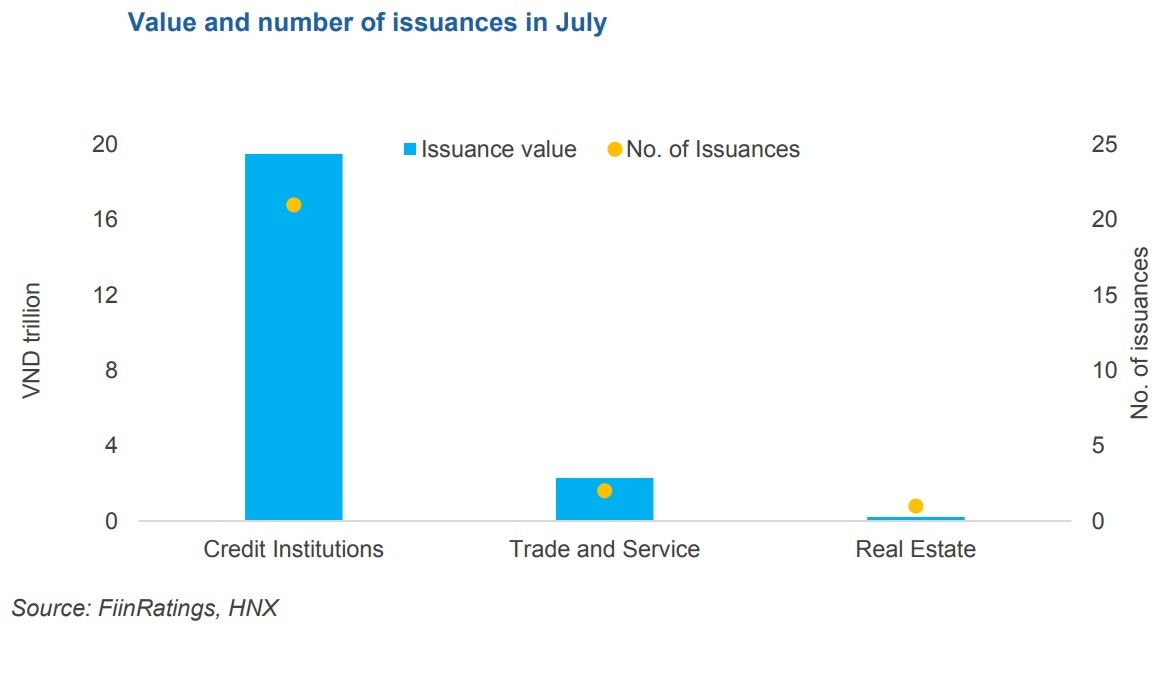

There were 26 private placements and 1 public placement with a combined value of more than VND 14,200 billion in August 2022.

The opportunity for the bond market

According to the Vietnam Bond Market Association (VBMA), there were 26 private placement issuances and 1 public placement issuance in August 2022, totaling more than VND 14,200 billion.

In that list, real estate firms were ranked second, right behind commercial banks. Just VND 1,800 billion was spent in the two placements made by Khang Dien Housing Investment and Business JSC and Fuji Nutri Food.

In general, real estate businesses came in second in bond issuance during the first eight months of this year, accounting for VND 47,000 billion, or 21.3% of the total. These companies' average annual bond yield is close to 10.2%.

According to Dr. Trinh Quang Anh, Chairman of the Vietnam Inter-bank Research Association, the current credit amount of VND 11,500,000 billion divided by 8,000,000 billion GDP implies macroeconomic growth of 144%, while corporate bonds represent 17% growth. Corporate bonds will flourish as more people who can't get bank loans issue bonds to raise funds. A handful of banks also mandated that their investors purchase corporate bonds from businesses that were issuing bonds through commercial banks.

"Many people still dream of "cheap currency" despite the quick changes to the current monetary system. It's possible that the FED funds rate will rise to 3.95% very soon. Therefore, in order to warrant retention, the VND needs to be valued more. The VND specifically depreciates by just 3%, although other currencies depreciate considerably more quickly, yet Vietnam must pay a higher interest rate in exchange. We were merely returning to our new normal, even though it might have been unsettling to us", stated Dr. Trinh Quang Anh.

From the view of business, Mr. Dang Tran Phuc, Chairman of AzFin Shares, said the bond market has recently had so many issues that investors haven't reclaimed their assets as anticipated. These issues forced competent authorities to tighten the bond market, hurting those who were properly running. It matters what the bond issuers must do and what the competent authorities must do. Since our corporate bond market has not yet matured, many businesses see it as an opportunity to "feast" on investors' money.

>> Ordinary citizens face higher risk in buying corporate bonds

Bond issuers need to be more accountable to their investors, to their own workforce, to the expansion of the finance industry, and to themselves.

There’s still a legal gap

The bond market's legal regulations have not been made transparent enough while Decree No. 153 under revision is not yet ready to be released, or in the words of the experts, the framework for regulating and operating the bond market has not been completely operational.

In his research on the status of investors in general and individual investors in particular, Lawyer Nguyen Thanh Ha discovered that investors do not fully comprehend the macroeconomy and instead just focus on the yield on bonds. When a controversy in the bond market happens, the competent entities are always involved, but their engagement is improper due to a lack of legislative regulations.

"First, a lot of investors want to withdraw funds from bonds. How the imprisoned business executives are released to handle the debt concerns is still unclear. Sincerely, the Vietnam justice system makes this nearly impossible. Second, some business owners want to sell projects to refund investors' money to protect their legal rights, but present regulations prohibit that unless a court rules otherwise", said Mr. Ha.

Additionally, Mr. Ha suggests that in the near future, the government should establish strong penalties for businesses that are unable to pay their bond payments on time. The modified Decree No. 153 must expressly address the need for a committee in order to guarantee investors' rights. Future plans for the amendement to Decree No. 153 include not only directing the management responsibilities of competent authorities, but also carrying out its obligation to promote the expansion of the corporate bond market.

"I am aware of many legal infractions when I offered consulting services to a number of corporate and private investors. The law restricts access to the bond market to professional investors only. The high interest rates in the bond market, however, have attracted a substantial share of retirees and small-business owners who want to invest. They use a number of ways to break the law. The securities business can make any person a professional investor for about VND 4 to 6 million. To get around the regulation, certain organizations can instead purchase the entire bond amount and then enter into co-investor arrangements. The law must therefore explicitly anticipate this truth, even though doing so is challenging", said Mr. Ha.

Mr. Ha added: "More stringent regulations have been added as a result of Decree No. 153's revision, which puts bond issuers in a difficult situation. For instance, businesses are not permitted to issue bonds for the purpose of investing in shares. In my opinion, this restriction is inappropriate for holding firms. Additionally, we must specify what to do if a state ruling orders the suspension of a bond issue while the enterprise leader is being investigated by the law. Therefore, it is necessary to safeguard investors' rights".