Potential of GVR stock as rubber land is converted to industrial parks

Vietnam Rubber Group's GVR stock will gain from the conversion of big rubber fields into industrial parks (IPs).

According to SSI analysts, GVR and other industrial park (IP) equities would profit from IP land banks as FDI projects migrate into the Vietnamese market, particularly following the re-election of US President Donald Trump.

GVR's stock price has lately climbed and is presently trading between VND 30,000 and 32,000 per share, although it has yet to break through its prior base level. Foreign investors, on the other hand, have recently showed a strong interest in GVR shares, constantly acquiring them.

On November 14, GVR will finalize shareholders' dividend rights. As anticipated, GVR would put aside VND 1.2 trillion for dividends (equal to 3% of charter capital) and VND 254 billion for funds according to rules. Each shareholder will get VND 300 per share.

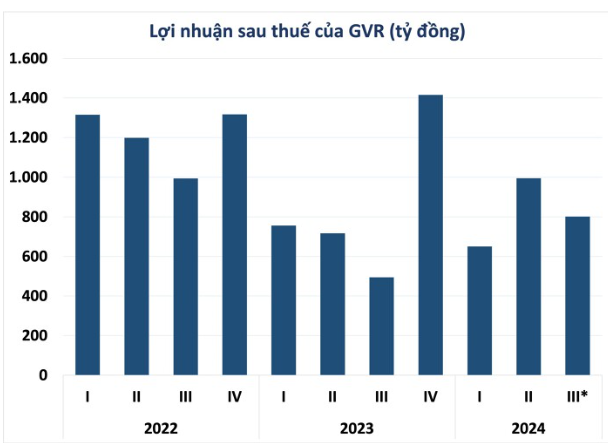

In terms of business success, GVR recorded VND 16,207 billion in revenue for the first nine months of 2024, meeting 65% of its year objective. Profit after tax is anticipated to be VND 2,386 billion, up 22% year on year. GVR's earnings after tax is expected to reach VND 801 billion in Q3 2024, up 62% from the same time the previous year.

According to Mr. Le Thanh Hung, CEO of GVR, the group is implementing its 2024 objective.

GVR’s Net Profit After Tax (Billion VND)

Evaluating GVR stock, an SSI Securities report highlights significant potential with various factors expected to drive price increases. In the short term (Q4/2024 – Q1/2025), new land prices in Binh Duong, Binh Phuoc, Ba Ria – Vung Tau, and Tay Ninh provinces will be announced. SSI expects new land prices to increase by 20% to 3 times the current rates. This is expected to be a short-term price driver for GVR shares.

According to SSI estimates, a 1% increase in rubber prices will boost GVR's rubber production gross profit margin by 0.22% (rubber production accounts for 60% of total pre-tax profit). Hence, the 2024 profit growth is projected to reach 29% year-on-year. Recently, the Bau Can – Tan Hiep IP (fully owned by GVR) received investment policy approval from the Prime Minister, reinforcing the conversion of 2,800 hectares of rubber land into an IP by 2025.

GVR's revenue and profit after tax are expected to be VND 26.15 trillion and VND 4.05 trillion, respectively, in 2024, according to SSI. Revenue from natural rubber production is predicted to reach VND 13.8 trillion, with rubber output forecast at 371 million tons and selling prices rising by 18% (to VND 36.4 million per ton). Rubber prices are high due to a global supply constraint caused by illness and weather, including the change from El Niño to La Niña. As a result, the rubber gross profit margin is expected to increase by 25% as average selling prices climb. In 2025, SSI expects after-tax profit to increase by 33.2%, with compensatory earnings from rubber land in IPs estimated to reach VND 1.7 billion (up 112%).

SSI anticipates the new land price list to be approved in 2024-2025, supporting income growth from rubber land conversion to IPs. Additionally, the land conversion process is expected to be expedited by provincial authorities due to high occupancy rates in Binh Duong and Dong Nai, exceeding 92%.

GVR has an advantage due to its enormous rubber land bank, which spans many provinces, including Binh Duong, Dong Nai, Ba Ria - Vung Tau, and Tay Ninh. In the long run, converting nearly 23,000 hectares of rubber plantations to IP land between 2025 and 2030 would enable the corporation earn large earnings from land conversion, as SSI has incorporated into its predictions.

While the prognosis for GVR stock is positive, investors should be aware of concerns such as probable delays in converting rubber farms to IPs and diminishing rubber demand owing to global economic issues.