Prospects for MWG in 2025

KBSV projected MWG’s NPAT for 2024F and 2025F at VND3,840 billion and VND5,214 billion, respectively, with net revenue estimated at VND133,528 billion for 2024F and VND142,652 billion for 2025F.

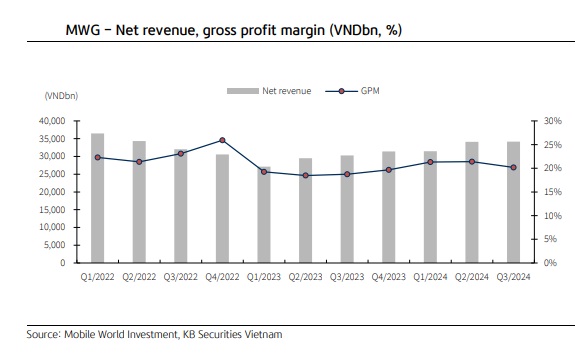

For 9M2024, MWG reported net revenue of VND99,767 billion (14.9% YoY), driven by growth across its major chains. TGDD and DMX achieved 5.2% YoY growth, fueled by double-digit growth in consumer electronics sales and robust demand for the iPhone 16 series, with 60,000 units sold within the first month at TGDD and TopZone, generating VND2,000 billion in revenue. BHX revenue surged 42.3% YoY, supported by a 25%-60% YoY increase in fresh food and FMCG sales and a 30% YoY rise in invoice counts. Meanwhile, the Erablue chain turned profitable, reporting a profit of VND147 million in 3Q2024.

In October 2024, revenue from the ICT&CE segment held steady at VND7.8 trillion, matching September's performance. This was supported by a 50% MoM surge in iPhone sales, offsetting the cooling demand in electronics and laptops following the back-to-school season. Management anticipates improved sales in 4Q2024 and 2025.

However, costs associated with COGS and SG&A are also projected to rise as the company invests in store upgrades, enhances aftersales services, and implement customer incentives to boost year-end and Tet holiday demand. Key initiatives include the "buy now, pay later" policy, featuring an approval rate of up to 80%. Through partnerships with manufacturers and financial institutions, MWG allows customers to acquire products with no upfront payment, spreading costs over up to 12 months without interest or hidden fees, such as insurance or processing charges. In 2025, the TGDDDMX chains do not plan significant expansion but will reopen select stores as replacements. KBSV estimates the ICT&CE segment to generate revenues of VND89,024 billion in 2024 and VND92,827 billion in 2025.

KBSV has adjusted its long-term assumption for BHX's expansion strategy, shifting focus from the northern region to the central region, with pilot openings in select Northern provinces starting in 2025, as per management's guidance. While the Northern market, with a population of 36.5 million, presents significant potential, BHX remains cautious in its expansion due to the following reasons:

First, its priority to enhance store-level revenue and minimizing logistics and operational costs;

Second, a strong preference for traditional markets offering fresh, affordable food among Northern consumers;

Third, difficulties in sourcing suppliers for highly seasonal products favored in the North. By the end of 3Q2024, BHX operates 1,726 stores, with 63.3% located in the Southeast region, 17.3% in the Central Highlands and 20.4% in the Mekong Delta. Under this revised strategy, KBSV estimates BHX could open 1,800 new stores in the Central region and select Northern provinces based on population density. BHX has already launched 15 stores in Da Nang, Quang Nam, and Quang Ngai, marking its entry into the Central market. KBSV forecasts BHX's revenue to reach VND41,568 billion in 2024 and VND47,653 billion in 2025, with NPAT of VND98 billion and VND500 billion, respectively, supported by optimized perstore profitability and the opening of 250 new stores.

The ICT&CE market in Indonesia is projected to reach VND453.4 trillion (Figure 10) in 2024, 1.6 times larger than Vietnam’s, driven by its large population of 284.3 million people. However, the CE segment remains underdeveloped, with a market size comparable to Vietnam’s and 3.38 times smaller than the ICT segment. This is partly due to historical limitations in electricity infrastructure.

Currently, only a few large chains such as Electronic City, Best Denki, and Hartono dominate the market, while 60% of sales are still controlled by traditional stores. Demand for home electronics is expected to grow, fueled an expanding middle class and Indonesia’s higher per capita GDP of USD4,940, compared to Vietnam. After its success in Laos with Bluetronics, MWG sees significant potential in Indonesia’s large and fragmented market size.

Erablue, or Erablue Electronics, a joint venture between MWG (45% ownership) and PT Erajaya Swasembada Tbk of Indonesia, is capitalizing on this opportunity. By the end of 3Q2024, Erablue had 76 stores, doubling its count from the start of the year, and recorded its first profit of VND329 million within less than two years of operation. Erablue's initial success is attributed to: 1) Strategic store locations: Unlike competitors focusing on shopping mall outlets, Erablue prioritizes street-level stores for convenience, aligning with Indonesian shopping habits and infrastructure that resemble Vietnam’s. The chain is concentrating on Java Island, a market comparable to Vietnam’s, thereby minimizing inter-island transportation costs. 2) Enhanced installation services: In Indonesia, most retailers act as showrooms, leaving delivery and installation to product manufacturers, leading to delays of up to a week. In contrast, Erablue completes the process within one day, offering a significant service advantage.

KBSV projects Erablue will expand to 86 stores in 2024 and 205 stores in 2025. MWG is expected to incur a loss of VND29.5 billion from the venture in 2024 but achieve a profit of VND129 billion in 2025, driven by its focused market strategy and competitive advantages .

This stock company combined free cash flow to equity (FCFE) and comparative valuation to determine a fair price for MWG at the horizon of 2025. 1) Free cash flow to equity (FCFE): Using the FCFE model with the assumptions outlined below, KBSV derived a price of VND78,410 per share for MWG. 2) Comparative method: KBSV applied P/E and P/S ratios for different chains. For the TGDD and DMX chains, it used a P/E ratio of 14.6x. For BHX, it applied a target P/S ratio of 1.1, based on the proceeds of nearly VND1,800 billion from the issuance of shares to non-controlling shareholders.

“This indicates that CDH Investments, a major Chinese alternative asset management firm, values the BHX chain at approximately VND35,500 billion, corresponding to a P/S valuation multiple of around 1.1x. As for the An Khang chain, which is currently not profitable, we used a P/S ratio of 0.6x, reflecting the typical range for pharmaceutical retail stores in Southeast Asia. Additionally, we included the Erablue chain in the valuation, acknowledging its longterm growth potential, with a P/S ratio of 0.6x. The target price for MWG based on this method is VND83,418 per share”, said KBSV.

With equal weighting assigned to both models, KBSV upgraded MWG to BUY for 2025, with a target price of VND81,000 per share, representing a 32.2% upside from the closing price on December 9, 2024.