Real estate companies struggle to secure funds for bond maturity

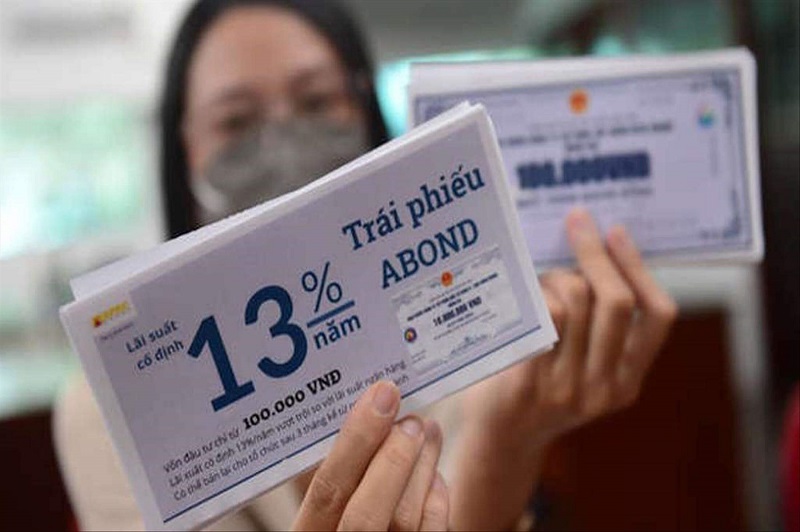

The huge drop in corporate bond issuance in March 2024 suggests that real estate corporations would experience difficulties in managing funds for bond maturities.

According to Hanoi Stock Exchange data, only two companies have successfully issued bonds as of March 25, 2024: Viet An Trading Investment and Development Company Limited (1.25 trillion VND) and Hai Dang Investment and Real Estate Development Company Limited (two issuances totaling 2.5 trillion VND).

The total value of real estate corporate bonds due for the remainder of 2024 is about 99.234 trillion VND.

Decrease in corporate bond issuance

It is clear that in the first 25 days of March (from the date of announcement), the amount of corporate bonds issued was only 3.75 trillion VND, a fall of 85.5% from the same time in 2023. The total amount of corporate bonds issued in the first three months of the year (until March 25) was 10.715 trillion VND, a 61.5% reduction from the same period last year.

This suggests that investors' and corporations' trust in the bond issuance channel has yet to fully revive. One of the causes is the ongoing strain to meet bond maturities in 2024.

According to data, the overall value of corporate bonds maturing for the rest of the year is 258.239 trillion VND, with 38% of bonds nearing maturity belonging to the real estate industry, totaling around 99.234 trillion VND. Although there has been some progress since the forecasts for 2023, this remains a major amount for the financial health of the firms.

Experts think that, despite encouraging signs in the real estate market, enterprises in this sector would face significant challenges owing to the pressure of bond maturity in 2024.

Challenges are not easy to overcome

In truth, the real estate market is currently recovering slowly, with the "warm" segment mostly focused on flats. The sluggish pace of project licensing makes it difficult to increase supply in the short term. This causes an imbalance between supply and demand, which weakens the financial health of developers.

Duong Duc Hieu, Director of Advanced Analysis at VIS Ratings, stated that the developers' debt repayment capacity is at its lowest point in many years as of the end of 2023, and this capacity has not shown any clear improvement in 2024, especially given the financial leverage these companies are using, particularly in terms of corporate bond maturity.

The pressure is enormous, but the ongoing removal of policy barriers can help restore investor confidence, resulting in healthy and effective market development. The most significant responsibility remains with the corporations.

Dr. Can Van Luc, a member of the National Financial and Monetary Policy Advisory Council, remarked that real estate businesses must have detailed and achievable strategies for repaying maturing corporate bond debts, particularly in 2024. They should also strive for clarity in tax returns, credit applications, and securities issuing documentation.

However, others believe that the real estate bond market will be settled. According to VIS Rating's projection, real estate businesses may enhance their debt repayment capabilities in the near future as a result of increased commercial activity, cash flow generation, and access to new financing sources. This is projected to delay the accumulation of bad debt and reduce the amount of new potentially problematic bonds at banks beginning in 2024.

From a more positive perspective, Mr. Hieu believes that real estate companies will not face any liquidity shocks in 2024, thanks to other capital access channels like bank credit or favorable stock issuances. Since the beginning of the year, credit for real estate businesses has grown positively, despite a negative growth in overall credit. In addition, many real estate companies have successfully issued stocks to increase capital.