Red Sea disruptions: Wary of upside risks to inflation

Three months after the Red Sea disruptions started, caution is warranted given the potential for rising global oil prices, as inflation in ASEAN is sensitive to this, according to HSBC.

ASEAN’s import exposure to the EU and the Middle East is also not sizeable

>> Red Sea disruptions: Limited risks to exports

Similarly, ASEAN’s import exposure to the EU and the Middle East is also not sizeable, as it is at most at 20%. In fact, mainland China is the single largest importing destination for each regional economy, and which can reach as high as 35%. That said, one key commodity that warrants a close watch is ASEAN’s crude oil imports from the Middle East, as most of the region is highly sensitive to volatility in oil prices.

While ASEAN’s overall exposure to the Middle East is minimal, the former imports a lion’s share of its oil from the latter. With the exception of Indonesia, the exposure is at least above 50% for the rest. But a closer look at oil exporter profiles may offer at least partial comfort. The UAE and Saudi Arabia are two dominant oil exporters to ASEAN, with a massive share that exceeds 70%. However, the oil flows in the Strait of Hormuz are not disrupted.

Therefore, after adding in the smaller oil exporters, close to 70% of ASEAN’s oil imports from the Middle East are not impacted by the Red Sea disruptions. Even for the ones in the Red Sea area, not all carriers are affected by the same extent. In fact, many crude carriers have been diverting, and transits are only 6% lower by end-February compared to the first half of December.

“The good news is that global oil prices have not moved significantly, therefore it is too early to worry about a déjà vu of the 2022 energy shocks after the Russia-Ukraine tensions. However, the longer the disruptions drag, or if new geopolitical tensions surfaced, this would nonetheless push up freight import costs. In particular, Singapore is the most exposed, as freight costs account for 14% of its goods imports. Thailand is the second-most vulnerable, with the cost as high as 10%, though the rest of the region appears to have a modest freight cost range of slightly above 4%”, HSBC said.

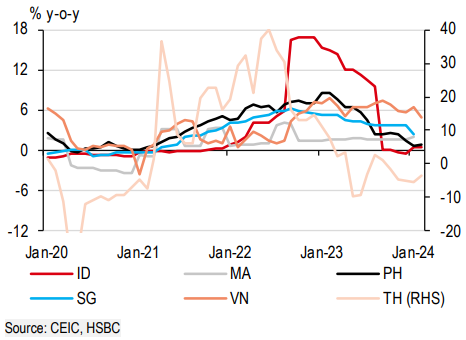

Despite a limit ed impact so far, it is still important to be reminded of how sensitive ASEAN is to oil prices. Except Malaysia, ASEAN’s economies are large net energy importers. In particular, the Philippines and Thailand are sensitive to soaring energy prices, pushing their headline inflation above their respective central bank’s targets by a wide margin back in 2022. Recall that, back then, Thailand faced its most severe rise in energy prices, up as much as 40% y-o-y.

Energy disinflation is still ongoing in ASEAN

Meanwhile, Malaysia and Indonesia also have higher shares of energy-related components in their CPI basket. That said, the extent of energy pass-through varies, depending on local price adjustments and/or the level of taxation on fuel. For example, Malaysia’s generous subsidies in the past three years kept a lid on inflation, though the government has committed to introducing subsidy rationalisation, possibly from 2Q24.

Broadly speaking, energy disinflation continues to be the dominant theme in ASEAN, providing policymakers some relief. Given the magnitude of price hikes in 2022, Thailand was the first one in the region to see energy CPI turn negative from 2023. On top of that, the new government is now subsidising diesel, gasoline, and electricity. In the rest of ASEAN, energy inflation has significantly moderated, pushing prices back down to each of the central bank’s targets. So far, oil prices have remained relatively stable. But caution is warranted, in our view, as the prolonged Red Sea disruptions may add upside risks to regional inflation dynamics, and risks delaying easing cycles – though this is not our central case.

“All in all, we see no imminent risks to trade and inflation, but caution is warranted”, HSBC emphasized.