Room for 2025 fiscal policy changes

Vietnam may have limited monetary flexibility but still have opportunity for fiscal changes if the tariff policies of Trump 2.0 administration expand, according to Hoàng Huy, CFA, and Nguyễn Hoàng Minh, CFA, FRM, of Maybank Investment Bank.

Many countries, including Vietnam, are closely monitoring the potential policies of Donald Trump’s administration (Trump 2.0). Various solutions exist to mitigate pressures. For Vietnam, from a monetary and fiscal perspective, several noteworthy aspects emerge:

Limited Monetary Policy Room

Trump’s tax and tariff policies, aimed at boosting domestic investment and consumption amid rising costs, could slow the U.S. inflation trajectory toward the Federal Reserve's (Fed) 2% target.

Experts forecast a milder Fed rate-cutting path, with reductions of 75 basis points and 50 basis points in 2025–2026E, compared to the 100 and 50 basis-point cuts projected in the Fed’s September 2024 “dot plot.”

This would keep exchange rate pressures elevated, limiting Vietnam’s central bank from adopting more accommodative monetary policies. Huy predicts the VND will depreciate slightly against the USD from 25,100 VND/USD at the end of 2024 to 25,200 VND/USD by the end of 2025 before strengthening to 24,800 VND/USD by the end of 2026.

Additionally, rising credit demand could impact local interest rates. Sectoral credit growth is projected at 14% in 2024 and 15% in 2025. Maybank also forecasts deposit rates to rise by 50 basis points in the next 6–12 months, with part of the increase passed on to borrowers. However, rates would only return to levels seen during the COVID period, remaining low enough not to disrupt economic recovery.

Leveraging Fiscal Space

While monetary policy space is limited, the government has greater capacity to adjust fiscal leverage.

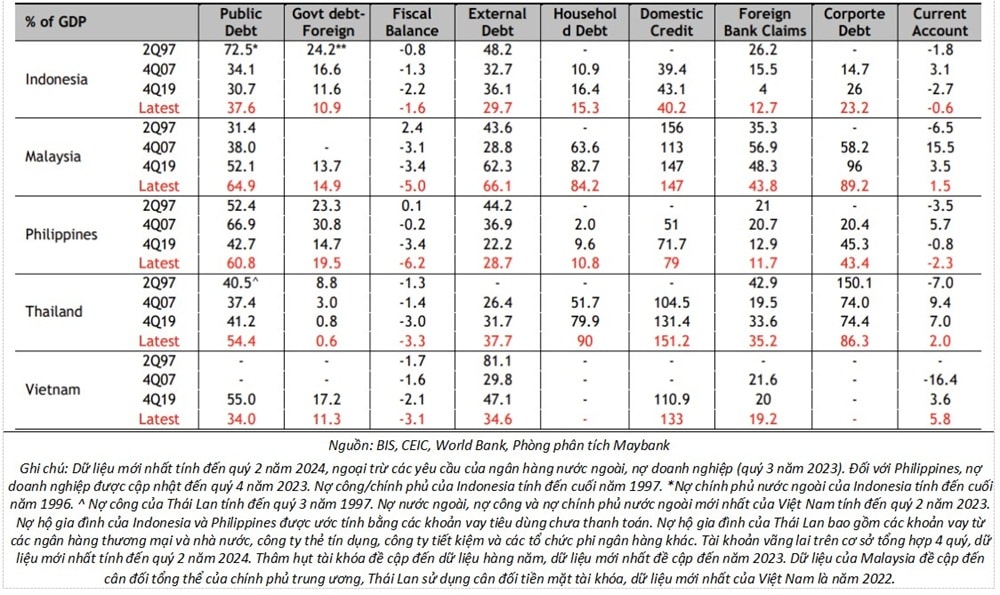

Vietnam’s public debt and government spending remain healthy compared to regional peers.

First, in comparison to other countries in the region, Vietnam's budget deficit and public debt are still low. By the end of 2022, Vietnam's budget deficit was 3.1% of GDP, while the country's public debt was 34% of GDP, barely over half of the 60% statutory ceiling. Since the nation still needs to create a large amount of infrastructure, including highways, airports, seaports, and even high-speed trains, experts think that the government's financial standing is strong enough to borrow more money for spending.

Second, Vietnam’s government is preparing for its quinquennial election in 2026. Historically, public spending tends to rise significantly one or two years before elections. Current senior officials may seek to boost public spending and accelerate economic growth to deliver the best performance outcomes. This time, the National Assembly approved a budget of VND 790 trillion, a 17% year-over-year increase, for public infrastructure spending in 2025, though it is 8% lower than in 2024.

In the long term, beyond 2025, fiscal policy, particularly infrastructure investment, will remain a key driver of Vietnam’s economic growth. Under the highway development plan for 2021–2030 and vision to 2050, approximately 800 km of new highways will become operational by 2025, compared to 1,000 km completed during 2021–2024. Vietnam plans to build nearly 2,700 km of highways between 2026 and 2030, a 50% increase from 2021–2025. Meanwhile, Hanoi and Ho Chi Minh City are expediting urban rail projects. Following the 14-km Cat Linh-Ha Dong line in 2021 and the 20-km Ben Thanh-Suoi Tien line by the end of 2024, these economic hubs plan to construct over 80 km of rail by 2030 and more than 450 km afterward, with a total investment of USD 55 billion.

The National Assembly also recently approved the country’s largest-ever infrastructure project, a national high-speed rail system. This project aims to construct a new North-South rail system with a speed of 350 km/h spanning 1,541 km (potentially extendable to 1,871 km) over 10 years, with an investment of nearly USD 67 billion. A feasibility study will be prepared in 2025, construction will start in 2027, and the project will be completed by 2035.

Meanwhile, air transport is also slated for significant improvement by 2030. Tan Son Nhat Airport’s Terminal 3 will become operational by mid-2025, adding capacity for 20 million passengers annually to the current 28 million, which operates at 150% of its designed capacity. The first phase of Long Thanh Airport, with a capacity of 25 million passengers annually, is set to commence operations in 2026, diverting international flights from Tan Son Nhat. In the north, Hanoi’s Noi Bai Airport recently began expanding Terminal 2, increasing capacity by 5 million passengers annually to 30 million. Future expansions aim to double the airport's capacity to 60 million passengers by 2030. Nationally, airport capacity is projected to triple to 283 million passengers annually by 2030 from the current 99 million.

Many analysts argued that the government needs to be more aggressive in encouraging domestic investment and consumption in the face of the geopolitical uncertainties that are expected to arise from the Trump 2.0 administration and its effects on Vietnam's trade and foreign direct investment. Although there is little flexibility for monetary policy, Vietnam's large fiscal space presents chances to enact policies that will help it accomplish its goals.