Russia-Ukraine conflict: Indirect impacts on Vietnam

In the short term, the most indirect spillover from the Ukraine-Russia conflict is inflation, FDI, and FII inflows.

Manufacturing activities at Mtex Vietnam

>> Russia-Ukraine conflict: Minor direct effects on Vietnam

Inflation pressure

Inflation in Vietnam remained moderate in February 2022, with headline CPI rising only 1.4 percent year on year, down from 1.9 percent in January 2022. Inflation remained modest in February, thanks to lower food and educational service prices compared to the same month last year. In February 2022, the foodstuff price index fell by 1.8 percent yoy, causing the headline CPI to fall by 0.37 percent points, with pork prices falling by 21.9 percent yoy and processed meat prices falling by 4.7 percent yoy.

Furthermore, because to the COVID-19 epidemic, certain provinces excused or lowered tuition costs for the first semester of the school year 2021-2022, lowering the headline CPI by 0.24 percent points. Meanwhile, the steep rise in fuel prices pushed the transport price index up 15.5 percent year over year, pushing up the headline CPI by 1.4 percent points.

Mr. Dinh Quang Hinh, a VNDirect analyst, sees inflation concerns on the rise as a result of the Russia-Ukraine conflict. First, crude oil and natural gas prices have skyrocketed significantly due to Russia-Ukraine crisis. The high anchor crude oil price will put upward pressure on inflation in Vietnam, particularly in the transportation price index. Second, rising input material prices such as coal, steel, copper, aluminum, and transportation rates may have an impact on Vietnam's manufacturing costs. The longer the conflict lasts, the higher the impact on enterprises' production costs will be. Third, rising fertilizer and agricultural commodity prices (wheat, corn, and barley) may put upward pressure on domestic food and food-related prices, albeit the effect will be minor.

"From March onwards, inflationary pressures could skyrocket. However, we remain optimistic that the government will be able to control inflation in 2022. In Vietnam, taxes and fees currently account for more than 40% of the retail price of gasoline. In order to combat inflation, the National Assembly resolved to lower the environmental tax on gasoline by VND 2,000 per litre. Meanwhile, the government can control inflation by lowering the prices of necessary commodities and services such as energy, tuition, and medical services. Overall, we keep our average CPI prediction for 2022 at 3.45 percent yoy. It is under control and on track to reach the government's goal of maintaining the average CPI below 4% by 2022", Mr. Dinh Quang Hinh stated.

Effects on FDI and FII

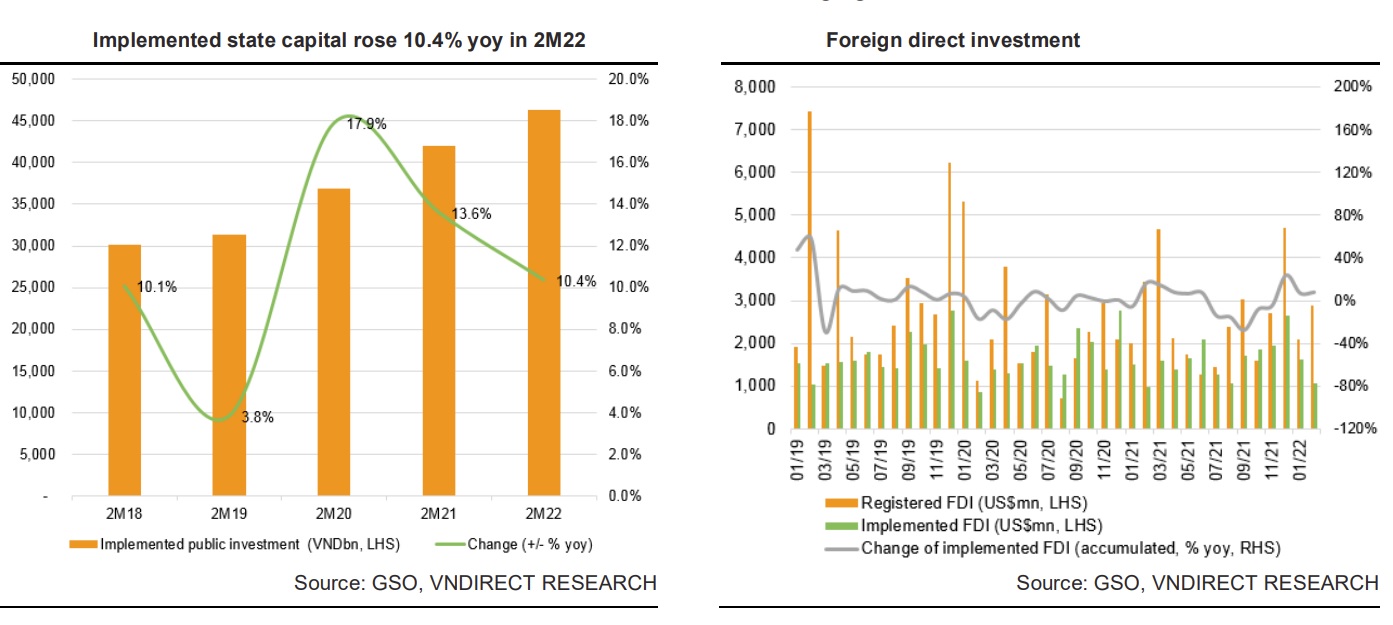

The pace of FDI project implementation accelerated in February, with disbursed capital increasing 7.8% year on year to US$1.1 billion. The implemented capital of FDI projects increased 7.2 percent year on year to US$2.7 billion in 2M22. In February 2022, however, the pledged capital of FDI projects slowed, totaling US$2.9 billion (-16.0 percent yoy). The pledged capital of FDI projects fell 8.6% year on year to US$5.0 billion in 2M22. To be more specific, there were 183 newly licensed projects in 2M22 with a total registered capital of US$0.6 billion, a decrease of 80.9 percent compared to the same period in 2021; 142 projects licensed in previous years approved to adjust investment capital (incremental FDI) with a total additional capital of US$3.6 billion (123.8 percent yoy); 400 turns of capital contribution and share purchases of US$3.6 billion; and 400 turns of capital contribution and share purchases of foreign investors with a total value of US $0.8bn, a surge of 41.7% over the same period in 2021.

Mr. Dinh Quang Hinh believes the Russia-Ukraine issue will have little influence on the investment environment and FDI flows into Vietnam because direct investment from Russia and Ukraine accounts for only 0.4 percent of total foreign direct investment in Vietnam. Furthermore, the Russia-Ukraine conflict is less likely to affect the manufacturing industry's supply chain (in which the main imports are steel and coal) because imports from these nations account for only 0.8 percent of Vietnam's overall imports. However, as the price of basic commodities rises sharply due to the crisis, Vietnamese companies may experience greater input cost pressure.

>> Indirect threats from Russia-Ukraine conflict are broad

Regarding FII, Mr. Dinh Quang Hinh stated that Vietnam would witness a short-term FII retreat as global financial investors tend to sell off risky assets to capitalize on safer assets like gold or the US dollar due to the RussiaUkraine crisis. Besides, in the short term, the expectation of higher US dollar yields due to the Fed's plan to raise policy rates also causes indirect investment flows to withdraw from emerging and frontier markets to return to the US.

Some noticeable FDI projects in 2M22 include: The VSIP Bac Ninh (Singapore) adjusted to increase its investment capital by nearly US$941m; Samsung Electro-mechanics Vietnam Co. Ltd (Korea), adjusted to increase investment capital by US$920m in Thai Nguyen’s plant; Expansion project of factory in manufacturing electronic equipment, network equipment and multimedia audio products (Hong Kong), adjusted to increase investment capital by nearly US$306m in Bac Ninh province; The project of manufacturing electronic products, network equipment and multimedia products of Goertek Group (Hong Kong, China) in WHA Industrial Park, Nghe An province, increased its investment capital by US$260m; Commercial and service projects of GE Vietnam (Korea) adjusted to increase investment capital by nearly US$217m; Electronic component factory project (JNTC - Korea) adjusted to increase investment capital by US$163m in order to expand the production line of tempered glass for car and watch screens; cover glass for camera.