The outlook for Vietnam's fertilizer industry remains positive

The Russia-Ukraine war, Russia and China's decision to halt fertilizer exports, and increased demand for fertilizer will all contribute to a favorable prognosis for Vietnam's fertilizer business in 2022 despite restricted availability.

Vietnam's fertilizer firms would profit from rising fertilizer exports and high selling prices.

Due to supply chain disruptions brought on by the Russia-Ukraine war, US and EU sanctions against Russia, and Belarus, which are allies, fertilizer prices have soared across many regions. Russia and Belarus are the world's top suppliers of fertilizer, accounting for 40% of all potash supplies.

The Russia-Ukraine conflict has increased the price of coal and gas, which are the two main sources of raw materials for fertilizer manufacture. As a result, many fertilizer producers in the EU have had to halt production, further limit ing fertilizer supplies in Europe. The three biggest shipping companies in the world also declared they will stop carrying cargo to and from Russia, further disrupting the supply chain.

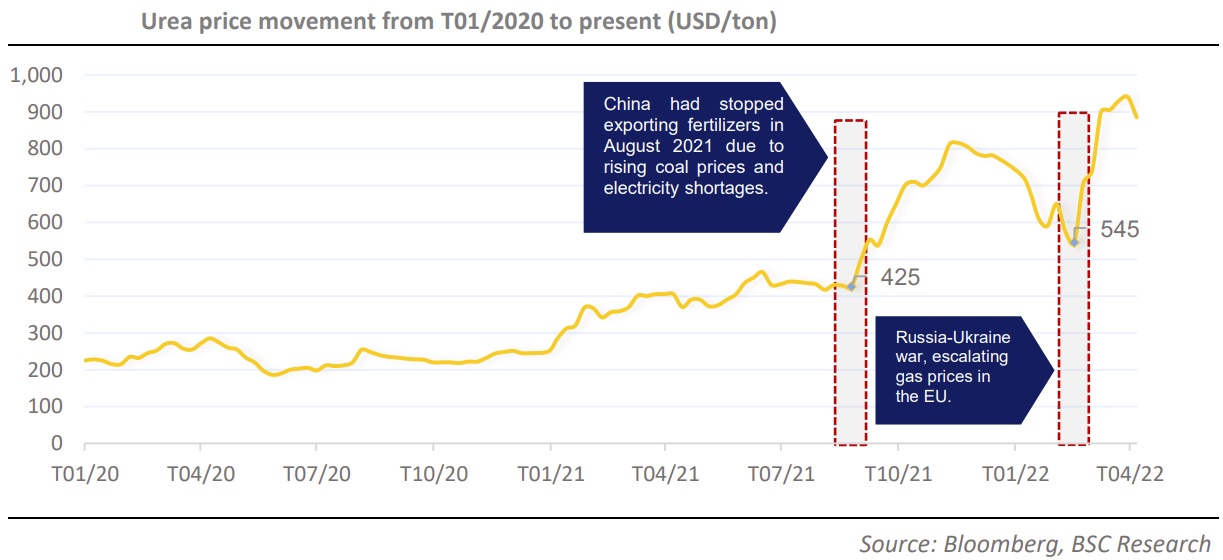

At the end of 2021, Russia and China, two nations that export significant amounts of fertilizer globally, will each have capped fertilizer exports, driving up the cost of urea fertilizer. In Q2 2022, fertilizer costs around the world are still high.

"The unexpected action from China and Russia opens a window of opportunity for fertilizer businesses, with the hope that both output and selling prices will increase as a result of the unanticipated global supply deficit. Fertilizer businesses will seize this chance to boost exports and the country's market share for fertilizers. According to BSC, this might boost the competitiveness of Vietnamese fertilizer firms, which could boost the competitiveness of Vietnamese fertilizer industries”, said BSC.

According to DTN, early April 2022 saw a huge price increase, particularly for DAP, urea, and other fertilizers. They all achieved more than anyone else in human history. Urea, for example, is at the top of the list with growth of 13% YTD, 53% compared to the lowest point in February, and 167% YoY; DAP saw growth of 34% YTD and 76% YoY.

According to BSC, supply difficulties that had not yet been resolved, preventing input material costs from falling quickly, and fertilizer prices remained to anchor at high levels.

Since the Russia-Ukraine war, the cost of seven out of the eight major fertilizers in Vietnam has increased—this is the third time since the year's commencement. Comparing the same period in 2021 to the end of 2021, the price of urea has increased by 80%, while the price of DAP unexpectedly increased sharply.

“The domestic Urea prices will remain stable around the current price zone and gradually cool down in the second half of the year as the world's Urea supply improves, while DAP and Potassium will increase prices in line with the upward momentum in international markets, due to: (1) Abundant domestic supply of Urea; (2) Good potassium imports at the end of 2021 will gradually dry up, domestic potash prices will adjust to world prices and (3) domestic DAP is in short supply due to China's application of export restriction measures”, said BSC.

The current domestic urea surplus is still present. Since harvest time is in the first quarter and the beginning of Q2, there is no immediate need for fertilizer. As a result, BSC anticipates that firms would profit from rising fertilizer exports and high selling prices.