Ties upgrade will boost Vietnam-Australia cooperation

Vietnam and Australia agreed to upgrade their bilateral relationship to a Comprehensive Strategic Partnership. This will boost Vietnam-Australia cooperation.

Prime Minister Pham Minh Chinh and his Australian counterpart Anthony Albanese announced the elevation of the bilateral relationship to a Comprehensive Strategic Partnership between Vietnam and Australia.

>> Vietnamese, Australian PMs announce elevation of ties to comprehensive strategic partnership

The upgrade of the Vietnam-Australia relationship to a comprehensive strategic partnership aims to deepen cooperation between the two countries across fields such as climate change adaptation, energy transition, digital transformation, innovation, trade and investment, agriculture, defence, and education - training.

From providing Vietnam with key commodities, to exploring new areas of cooperation, we discuss how Australia has supported Vietnam’s growth story and the potential pathways for the bilateral relationship.

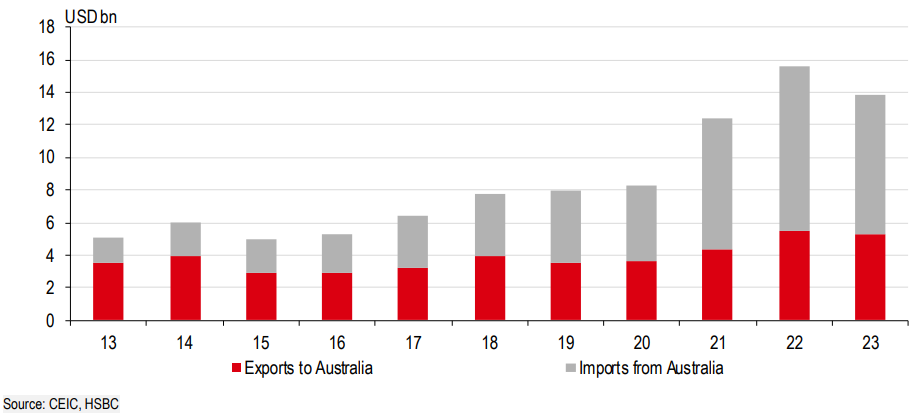

First and foremost, trade. Bilateral trade has boomed over the decade, more than doubling to USD13.8bn in 2023. That said, part of the expansion in trade value since the pandemic has been due to high global commodity prices. In particular, two categories stand out: coal and cotton.

“Vietnam is now Australia’s single largest cotton export market, accounting for 40% of its total exports, doubling its share from 2020. Likewise, Australia accounts for nearly 40% of Vietnam’s cotton imports. While as a percentage of total exports (15%), Vietnam’s textile and garment industry has seen its share dwindle in recent years as electronics shipments have risen to 35%, it is expected to remain a tailwind for Australian cotton exporters”, said HSBC.

That said, the boom in trade is not solely in manufacturing. Vietnam’s structural rise in household discretionary spending has also lifted demand for certain Australian exports. In particular, Australia’s beef exports have boomed, thanks to the elimination of tariffs under the AANZFTA in 2018. What is even more encouraging is the potential of Vietnam’s beef consumption. According to the OECD-FAO, Vietnam is expected to consume the most beef per capita in ASEAN by 2030, leaving room for further trade flows.

Vietnam’s imports from Australia have picked up in recent years, in part thanks to support from commodity prices

The relationship is not as one-sided as the above might suggest, however, as Vietnam’s exports to Australia are also expanding. Agricultural goods are leading the way, with nuts and seafood making up the majority. Australia’s imports of cashew nuts come almost entirely from Vietnam, according to ITC data. To further leverage trade agreements between the two countries, including AANZFTA, CPTPP, and RCEP, it will be equally important for Vietnam to heighten quality control on its agricultural exports, especially considering Australia’s quality standards and regulations are stricter than those of the US and EU in some areas. Currently, only four fresh fruits are allowed market access into Australia: mangoes, dragon fruit, lychee, and longan, but this also indicates significant opportunities for market expansion.

>> Australia’s strengthening ties to ASEAN economies

In HSBC’s view, exports of goods are not the only area with potential opportunities; services are another area for expansion, albeit only gradually. ASEAN welcomed 4 million Australian tourists last year, but less than 10% of these visited Vietnam. Part of the reason may relate to visas, as Australia is not visa-exempt and flight capacity constraints still exist. Encouragingly, an expansion in the visa exemption list is under consideration, and new flight routes have been introduced. These are important initiatives, as Australian tourists tend to have a relatively high propensity to stay and spend during their holidays.

What about investments? In HSBC’s view, Vietnam has the second largest rare-earth deposits in the world, which remain largely untapped. Australian firms with expertise in the mining and processing industry are looking to capture this opportunity, with steady FDI inflows into the industry in ASEAN generally. For Vietnam specifically, one such example is Blackstone Minerals, which is currently running two facilities—a nickel mine and a refinery—in Son La Province.

Beyond critical minerals, Australia’s role as a major supplier of energy for Vietnam puts it in a strategic position to help accelerate Vietnam’s energy transition. Subsequently, the Australian government has committed to providing related support worth AUD105m to Vietnam.

In addition to trade and FDI, other forms of cooperation also matter. While Indonesia has long been Australia’s dominant recipient of official development assistance (ODA), Vietnam has also seen steady flows of development aid (Chart 9). Meanwhile, human capital is closely intertwined. Australia has long held the educational milestone of establishing the first foreign-owned international university (RMIT University) in Vietnam as early as 2000. Reflecting its ongoing commitment, the Vietnamese branch of the Royal Melbourne Institute of Technology (RMIT) was further supported by an additional AUD250 million investment last year, contributing to the launch of the Innovation Hub to help support up-skilling of the workforce.

For years, Australia has supported and enabled Vietnam’s growth story. Going forward, new demand-driven opportunities look to provide the grounds for the next stage in Vietnam and Australia’s relationship.