Unpredictable export outlook for VHC amid tariff chaos

In 1Q25, Vinh Hoan Corporation (HoSE: VHC) logged VND2,648 billion in revenue, down 7.3% YoY as 1Q fell into the low season of pangasius and fishery export. Its earnings gained 14% YoY to VND193 billion.

VHC’s export volume in 1Q25 decreased mainly because the inventories in countries have remained high after an import binge recorded in 3Q and 4Q of the year before. Although revenue lost 7%, its gross profit margin rose 343bps YoY thanks to the cooldown in feed prices.

With production accounting for about 80-90% of the global output, Vietnamese pangasius has a big advantage in terms of scale and cost. This item does not have many direct substitute products but mainly competes with other cheap fish from China. KBSV believes that pangasius exporters can still pass the price increases on to importers and consumers because the prices in 2024 have hit the bottom of the 2020-2024 period. At the 2025 AGM, VHC's Management Board also stated that importers and consumers may have to bear the impact from reciprocal tariffs as the company finds it difficult to further cut the prices.

In KBSV’s view, this will put VHC's output in the US at high risk of declining in the coming time due to increased competition from domestic production in the US and other countries with lower tariffs (despite currently accounting for a small proportion). However, it believes the outlook will be bright thanks to the government’s efforts to balance trade and reduce origin evasion from Chinese goods, which could potentially result in a much lower effective tariff than the 46% rate. The 90-day tariff deferral is likely to spur partners to increase imports early at the end of 2Q if the tariff negotiations do not yield positive results. The US inflation rate falling to 2.3%, close to the Fed’s 2% target, could partly support US domestic consumption in the coming time.

Tilapia, pollock, and cod are the three main products from China competing in the low-cost frozen fisheries segment and are subject to a 50% tariff in the US (after the US slashed the additional tariff on Chinese goods from 145% to 30%). In the context of cheap goods from China being the focus of tariffs, KBSV believes that the US tariff on China will be higher than on Vietnam in the long term, helping to support the demand for Vietnamese pangasius. In the US, the five producers and exporters of fillets and frozen fish with the largest market share include Chile, China, Vietnam, Canada, and Norway with high output from 90,000 - 200,000 tons/year/country and accounting for about 67% of the import market share (according to ITC). Of that, Canada, Norway, and Chile primarily export salmon with a much higher price than pangasius. Other potential whitefish suppliers, such as Brazil and Indonesia have modest output and scale, respectively contributing 2.8% and 3.3% of import output in the period 2024-1Q25.

In contrast, the US has increased the catch limit for Alaska pollock by 6%, and the new government's moves to boost domestic production and fishing will raise competitive pressure in this market.

Tariffs and negative prospects in China will increase competition in the country’s domestic market, making the export prospects of Vietnamese pangasius relatively bleak. This is not a key market for VHC because low standards make VHC have no competitive advantage over Vietnamese and Chinese enterprises with lower production and compliance costs. In addition, this market has increasingly favored importing whole and large-sized fish, with the import rate increasing from 20% in 2022 to 46% in 2024, reducing profit margins due to higher farming costs. KBSV believes that the high price of raw fish (estimated to increase by 17% compared to 2024) makes VHC keep higher prices to cushion profit margins, hence lower sales volume. This may cause VHC to lose market share to other businesses but still maintain its GPM.

Europe is VHC's traditional market, accounting for about 15% of pangasius export revenue with high standards and prices. According to the European Central Bank (ECB), real GDP growth (adjusted slightly due to the impact of tariffs) is expected to have a significant recovery thanks to the expansionary fiscal spending policy and lower interest rates. Low inflation at 2.2% and the ECB lowering the operating interest rate to 2.25% in April (the lowest level since the end of 2022) are expected to boost consumption and labor productivity in the coming time.

KBSV expects VHC's pangasius consumption in Europe to improve slightly thanks to more stable demand, while consumers in this region do not favor tilapia, helping to limit the pressure from China. Pangasius demand in Europe is also supported by the reduction of wild fishing quotas, with a 20-25% reduction for cod quotas (according to SeafoodSource). In addition, the 10% increase in EUR/VND exchange rate compared to early 2025 will partly support VHC's export sales.

“We have lowered our forecasts for VHC’s consumption volume and average price in 2025-2026 as shown in Table 10. We expect prices to bottom out in 2024-2025 as the global trade uncertainty is gradually resolved. We expect consumption volume in 2025/2026 to decline slightly by 4.5%/0% with average price improving to USD2.78/kg (1.4% YoY)”, said Nguyen Duc Quan, analyst at KBSV.

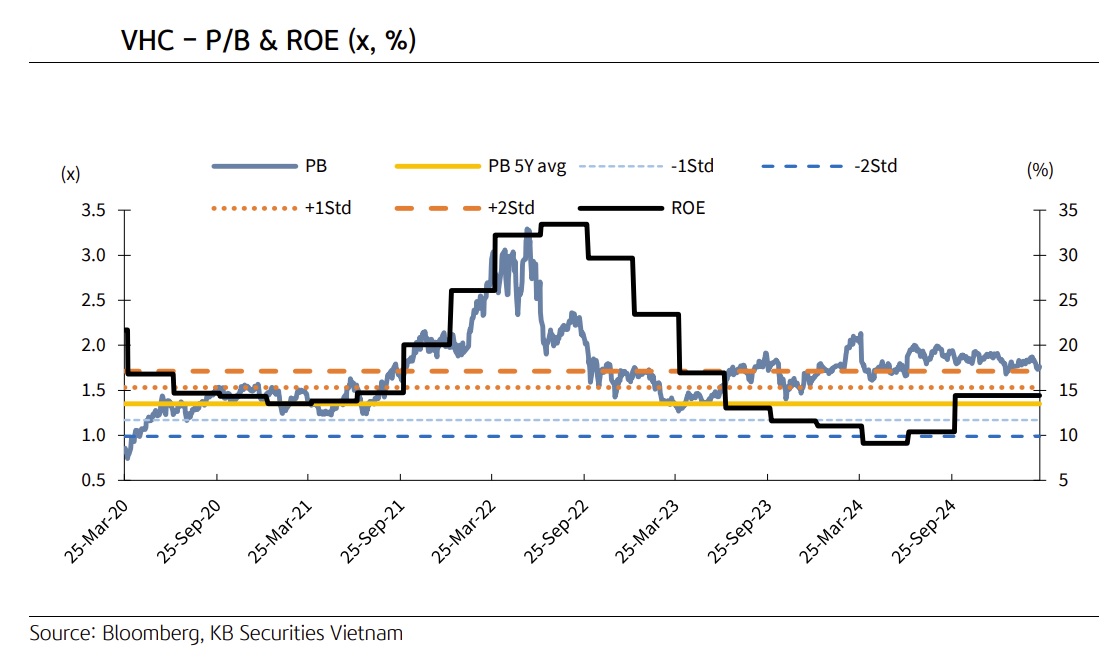

Given the cyclical nature of pangasius exports and tax uncertainties, KBSV valued VHC shares using a PE target of 10x, a 20% discount to its previous report and above the company’s five-year average of 8x. Its fair value for VHC at the end of 2025 is VND54,500, 3% higher than the closing price on May 16, 2025. All things considered, it recommended investors to keep neutral for VHC.