Upbeat about Vietnam corporate bond market

Although the market for corporate bonds in Vietnam narrowed in 2022, a recovery was anticipated for 2023.

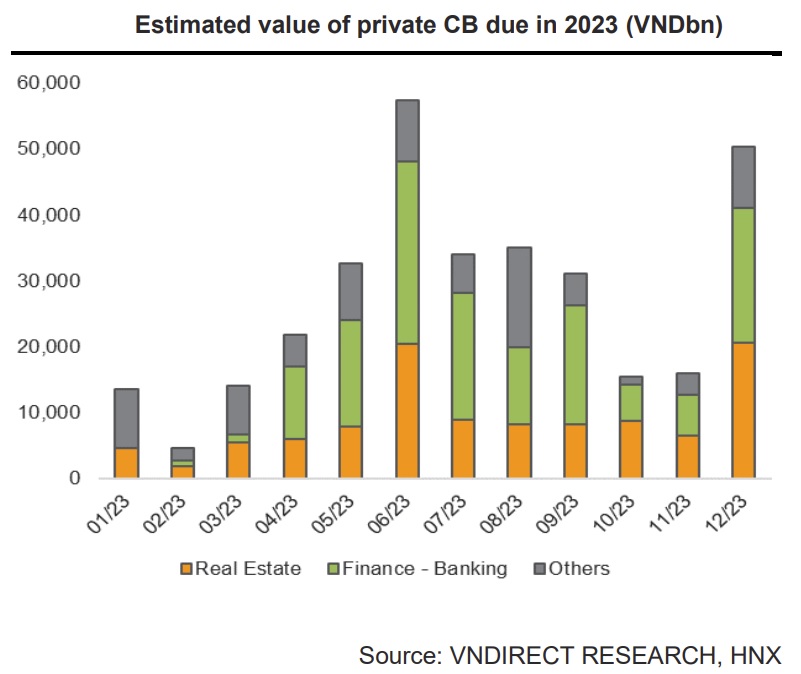

About VND300 trillion (90% yoy) worth of private corporate bonds are due in 2023, of which 30% and 40% are related to real estate and banking and finance, respectively.

>> Efforts to bring the corporate bond market to the "rails"

More stringent rules

The Vietnam corporate bond market saw a boom in 2020–2021, but several fraud instances in early 2022 highlighted investment and legal problems. The private placement of corporate bonds is subject to stricter regulations under Decree 65/2022, which became effective on September 16, 2022.

A consequence of this is that an issuer is no longer allowed to use corporate bonds to restructure its capital resources (except for the restructuring of its own debt, which remains permitted). If either the bond value or the bond/equity ratio surpasses a specific threshold, credit ratings are necessary.

The new rule also relaxes the requirements for bond investors in cases where non-professional investors suffered because they made high-risk bond investments without doing adequate due diligence. As a result, the market for corporate bonds had a 50% year-over-year decline in issuance value in 2022.

Pressure on maturing private bonds

About VND300 trillion (90% yoy) worth of private corporate bonds are due in 2023, of which 30% and 40% are related to real estate and banking and finance, respectively. In order to meet the short-term commitment, some issuers discovered that their options for refinancing were limit ed due to tightening monetary policy, rising financing costs, and tighter corporate bond issuance. Risks related to payment capabilities are concentrated in a few distinct industries with high leverage and high vulnerability, such as the real estate sector.

Concerns about default risks have grown as a result of several arrests for irregularities in the issuance and trading of corporate bonds by major issuers Tan Hoang Minh Group and Van Thinh Phat Group.The confidence of retail investors in private business bonds has fallen to such a low level that many were compelled to sell bonds from any issuer at any cost in order to profit from a significant discount. It is reported that around one-third of the volume of corporate bonds was purchased by individual investors.

According to market research conducted by VNDirect, a number of private bonds were sold below par value by 4-5%, with bond yields ranging from 10% to 12%, indicating that bond sellers were willing to take a discount of 14-17%.

>> Corporate bonds market sees large withdrawals

Authorities have since sent a message to calm the market's panic, but there have been no clear-cut steps to be taken to regain trust. One positive development is that, according to the Ministry of Finance, VND152 trillion worth of corporate bonds were repurchased before maturing in 10M22, helping to reduce the pressure of approaching maturities and the gloomy mood in the market.

Measures for sustainable growth

In VNDirect’s view, it will take some time for market participants (issuers, underwriters, and investors) to adapt to the new rules. As the property market tightens and consumer demand weakens as a result of rising financial costs, corporations tend to delay or postpone business expansion, reducing the demand for funding. Thus, the corporate bond market will experience muted performance in 1H23 due to low supply volume.

"Issuance volume will recover meaningfully in 2H23 from a low base in 2022, supported by earnings resilience, a stable interest rate, and a better market regime," said VNDirect.

Currently, Vietnam's outstanding corporate bond volume to GDP is 15%, with private corporate bonds accounting for 13%, which is relatively low when compared to regional peers. The government aims to grow the corporate bond market to 20% of GDP by 2025 and 30% by 2030.

Recently, Finance Minister Ho Duc Phoc has pointed out some measures to revive the bond market, including: speeding up the process for developers to get legal rights to develop land; Decrease borrowing costs for companies and help with restructuring debt payments, boost investor confidence following recent anti-graft measures, ensure bond issuers are offering buyers accurate information; and repay the bond on time when it's due to build up investors’ trust.