Vietnam braces for a trade winter

In 3Q22, Vietnam’s GDP rose 13.7% y-o-y, thanks to a resilient external sector and robust domestic demand. That said, the growth outlook is now clouded by increasing trade headwinds.

The expected value of products exported in October 2022 was $30.27 billion USD, an increase of 1.5% over the previous month.

The expected value of products exported in October 2022 was $30.27 billion USD, an increase of 1.5% over the previous month. While the FDI sector (which includes crude oil) reached 22.72 billion USD, up 0.7%, the domestic economic sector saw gains of 7.55 billion USD, or a rise of 8.7%. Export turnover climbed by 4.5% in October compared to the same month last year, with FDI (including crude oil) increasing by 8.1% and domestic economic activity declining by 4.9%.

In general, the export turnover was estimated at 312.82 billion USD in the first 10 months of 2022, up 15.9% from the same period in 2021. Of this amount, the domestic economic sector accounted for 25.7% of the total export turnover at 80.36 billion USD, up 13.4%; the FDI sector (including crude oil) reached 232.46 billion USD, up 17%, and shared 74.3%.

32 products with an export turnover of over $1 billion in the first 10 months of 2022 made up 92,8% of all exports (6 products with an export turnover of over $10 billion made up 64,1%).

Regarding the composition of export products in the first ten months of 2022, fuel and mineral products represented 1.3%, an increase of 0.1 percentage points over the same period in the previous year; processed industrial products represented 89.1%, an increase of 0.1 percentage points; agricultural and forestry products represented 6.6%, a decrease of 0.6 percentage points; and aquatic products represented 3%, an increase of 0.4 percentage points.

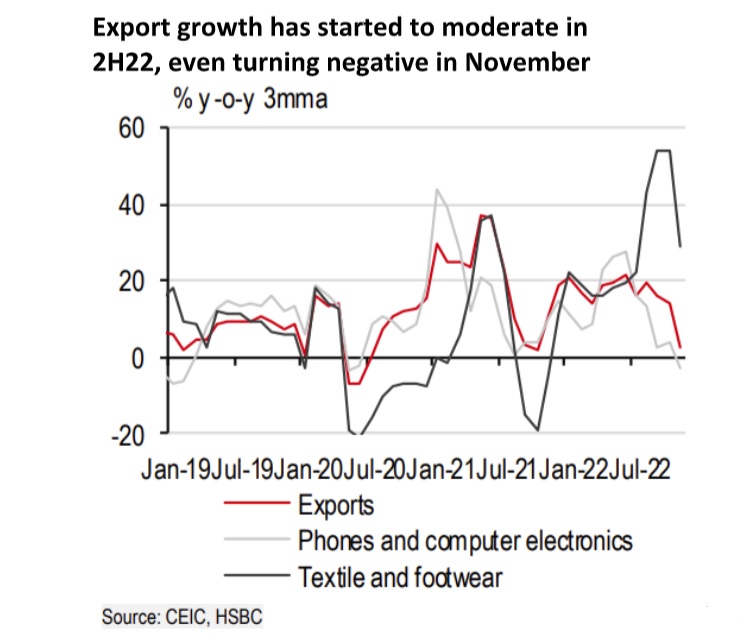

After expanding by over 17% y-o-y in the first three quarters of 2022, export growth abruptly slowed down in October. The first significant y-o-y fall in two years occurred in November. Electronics shipments, which make up around 35% of all Vietnam's exports, were the main cause of the decline. However, recent data indicate that the downturn in exports is more widespread and includes goods like wood, equipment, and textiles and footwear. The difficulties have been made worse in particular by the US economic slowdown, as the US is the country to which Vietnam exports the majority of its goods.

HSBC said the biggest downside risk to Vietnam’s growth is intensifying trade headwinds. Vietnam is not immune to a notable global trade slowdown – in other words, “pay-back” time has arrived. Since the advent of the US-China trade tensions Vietnam has been one of the biggest beneficiaries in terms of both trade and FDI diversion, boosting its export share in the US market in particular. As a result, Vietnam has become increasingly vulnerable to a US economic slowdown.

Weak goods export demand has already led to a marked decline in Vietnam’s exports, with November marking the first meaningful y-o-y decline in two years. The manufacturing PMI in November was also in contractionary territory for the first time in 2022. New orders, selling prices, and employment all came in lower, highlighting negative sentiment. Goods that benefited from strong demand during the pandemic, electronics and textiles/footwear, are seeing a “pay-back” period as demand shifts to services and global growth slows down.

“The US and the EU encompass more than 40% of Vietnam’s total exports. Some major export categories are also dominated by the US, with almost half of Vietnam’s machinery exports sent to the US. Another major export category highly exposed to US demand is wooden products (roughly 60%). Slowing property market activity in the West brings further downside risk to Vietnam’s exports. Not all is gloomy”, said HSBC.