Vietnam power snapshot: Big step forward for renewable energy

Vietnam’s renewable energy (RE) power capacity has accelerated from 5.5% of total capacity in 2015 to quadruple in 2020. It is expected to grab the largest capacity contribution of 40.6% of the power system by 2045F according to the PDP8.

Following the orientation in PDP8, wind power will surge 78% CAGR in the 2020-25F period from 630MW to 11,320MW and reach 60,160MW in 2045F.

Main drivers

Wind and solar power will be the main drivers, while biomass and small hydropower (<30MW) provide a smaller weight. RE power (excluding hydropower) experienced a flourishing year in 2020, rising by 232% YoY to 17,840MW. In which, solar contributes a major amount of 16,640MW (93.2% of total RE capacity), while wind and other renewable power contribute 6.8%. >experienced a flourishing year in 2020, rising by 232% YoY to 17,840MW. In which, solar contributes a major amount of 16,640MW (93.2% of total RE capacity), while wind and other renewable power contribute 6.8%.

Moreover, in 7M21, RE power companies also benefit from strong output growth, led by the prioritization from the government and attractive FIT prices. Particularly, RE cumulative total output increased sharply 274% YoY to 17.4bn kWh in 7M21, accounting for around 11% of total power output (three times larger than the ratio of 4% in 2020).

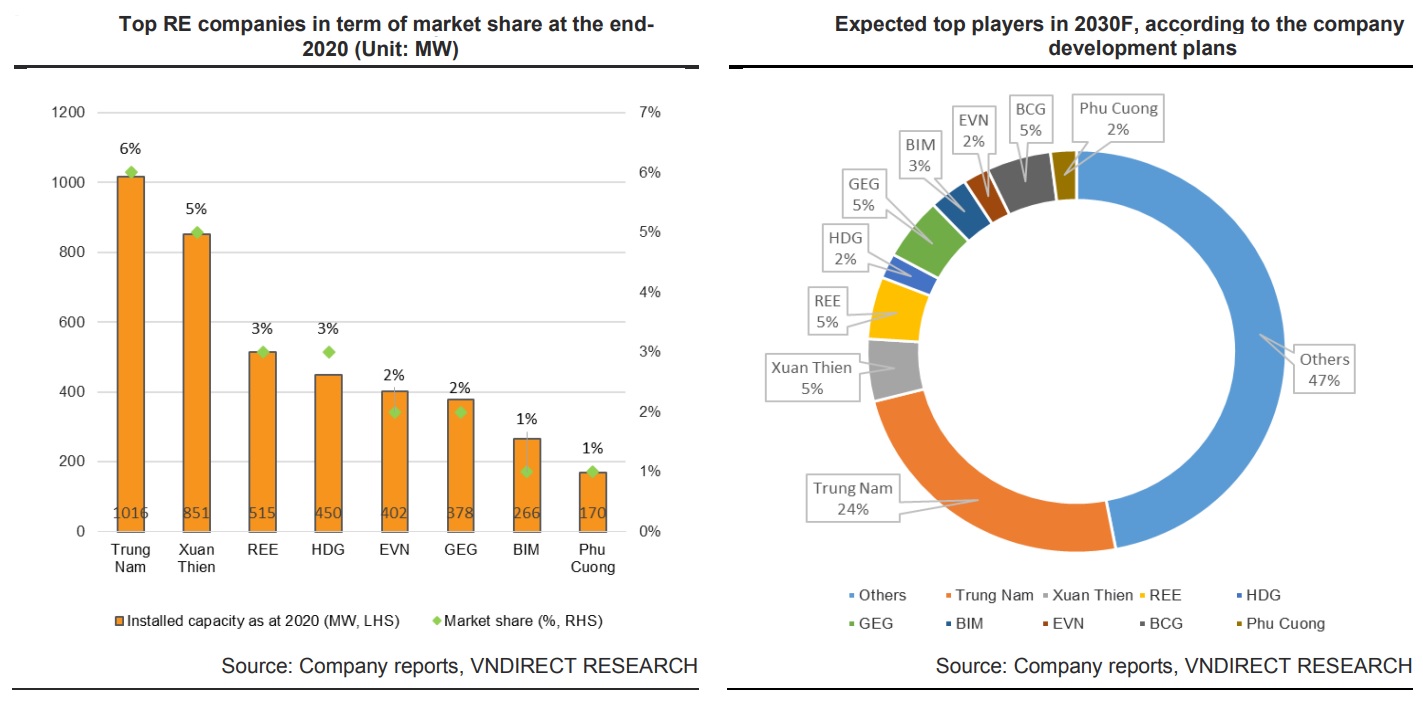

At the moment, some companies are currently the top players in the RE power market, led by Trung Nam, Xuan Thien, REE, and HDG. Besides, foreign investors are also exposed in this power segment, especially from Thailand and China. Some of the outstanding investors VNDirect can name, including Sermang Power Corporation Public (Thailand), Super Wind Energy Group (Thailand), Envision Energy Group (China), and Wind Energy Development (China). It believed the appearance of various investor groups would boost the development of RE (exclude hydropower) capacity in the future.

Following the development plans of several potential candidates in the RE market, VNDirect believed some of the current top players would continue to cement their position, such as Trung Nam Group, Xuan Thien, REE, GEG. It also looks forward to BCG joining the top tier in the future due to the strong rise in its RE power segment. Notably, BCG is preparing a pipeline of potential RE projects with the total capacity to reach 1.4GW in 2024F according to the company’s plan and is expected to grab 5% of the total market share in 2030.

Big players in wind power market

The PDP8 estimated that Vietnam would be suitable for developing wind power due to (1) Vietnam has a long coastline of over 3000km, (2) high wind speed of average 7m/s with total technical capacity reach 217GW for on-shore wind power and 162GW for off-shore wind power. Hence, it had caught government attention and started to grow when the authorities promulgated a mechanism to encourage wind power development (Decision No.37/2011 and Decision No.39/2018). At the end of 2020, total wind power capacity reached 630MW, doubled from 370MW in 2019, and edged up to 963MW in 8M21, with 24 plants going into commercial operation.

Following the orientation in PDP8, wind power will surge 78% CAGR in the 2020-25F period from 630MW to 11,320MW and reach 60,160MW in 2045F, accounting for the largest portion in total RE capacity and staying at the second-largest power source of Vietnam (22% energy mix). Regarding the price incentives and the government's support policies, VNDirect expected several wind power companies to have good opportunities to grow in the future, including Trung Nam, BIM, HDG, GEG, REE, PC1, and others.

According to Decision No. 39/2018, wind power projects that complete commercial power generation before October 31, 2021, can acquire FIT price for 20 years. At the end of August, EVN reported that 106 wind power plants had submitted documents for registering COD before the deadline of the FIT price on November 1, 2021, with a total capacity of 5,655MW. Among 963MW of 24 operated plants, Trung Nam Group contributed the largest with four projects of about 200MW. Besides, Tan Hoang Cau Group, HBRE, and EVN also benefit from FIT prices with their power plants operated before the deadline. Hence, if finishing COD on time, wind power investors will acquire a support FIT price of 8.5 cents/kWh for onshore wind projects and 9.8 cents/kWh for offshore wind projects.

At the moment, wind power investors are hustling to finish their projects on time, and EVN will update the process every month. VNDirects believed some of the listed companies would start commercial operation before the deadline to acquire FIT price, including PC1, GEG, HDG, TV2, VNE, and REE. Besides, several contractors will also benefit from the exciting construction activities of wind power plants, including PC1, FCN, TTA, and TV2.