Vietnam power snapshot: Leverage for gas-fired power

VNDirect believed that gas-fired power will develop quickly in the following years and plays a vital role in Vietnam electricity.

Drop in gas-fired output

Gas-fired power output recorded a decreasing trend from 2016 when domestic gas fuel became rarer while the new gas fields such as Blue Whale, Block B, and Sao Vang Dai Luc require a higher price due to complex exploiting conditions. Besides, the sharp rise in international oil prices is the resonance reason, leading to the increase in gas prices. Hence, the high gas-fired power price reduces its competitiveness, and the energy source has suffered lower quantity assigned by EVN over the years.

In 7M21, gas-fired output continues to sink 20% YoY due to some reasons. First, the oil price has increased sharply since 4Q20 to around 69-70USD/barrels in August-21, leading to higher gas prices and making the plants push their power price up since gas fuel accounts for 80% of the total cost. Second, EVN prioritized to mobilize from cheaper power sources such as hydropower when ideal weather conditions have supported it since 4Q20. Third, low electric load in the South and industrial areas forced EVN to consider more carefully between different energy sources.

VNDirect noted down some promising factors that will support gas-fired output to rebound in 2022F, including Brent oil price is forecasted to stabilize and move around 69- 71US$/barrel, reducing the stress for gas-fired price hike from 2022F; Hydropower will come out of its peak period from 2022F when the La Nina phase weakens; Power consumption will recover, and the growth rate will return to the planned level, especially in the South and industrial areas when Vietnam reaches a solid vaccination rate.

LNG-to-power is the most promising segment

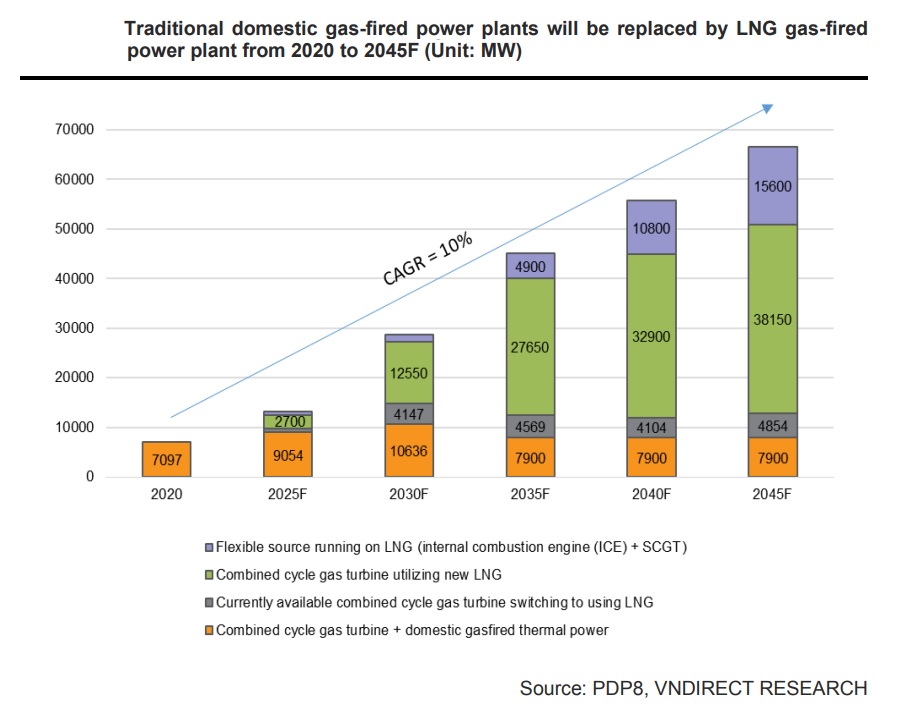

Along with RE power, the PDP8 also stressed the importance of gas-fired power for Vietnam's capacity development plan in the 2020-45F period. Domestic gas input is exhausting over the year, while international LNG prices might decrease due to lower demand in the following year. Therefore, it provides an excellent opportunity for Vietnam to develop gas-fired power using imported LNG - a more stable source. According to the PDP8 draft, the total capacity of domestic gas-fired thermal power will increase from 7GW to 9.1GW in the 20-25F period but slow down to 10.6GW in 2030F and start switching to LNG power plants. The total installed capacity of gas-fired plants using LNG will increase sharply from around 4.4GW in 2025F to 22.8GW in 2030F and keep its increasing trend to reach 78GW in 2045F.

VNDirect believed that gas-fired power will develop quickly in the following years and plays a vital role in Vietnam electricity. Notably, gas-fired power using LNG will become the primary trend, and Nhon Trach 3&4 are the pioneers as the first plants using imported LNG in Vietnam. Regarding its stable nature, this stock company believed the new gas-fired plants would be prioritized, boosting up its power output, and gas-fired power plant investors will be benefited.

VNDirect also believed POW would be one of the first companies who benefit from the LNG trend as it owns two first gas-fired power plants using imported LNG. Besides, gas suppliers such as GAS also benefit from the pressing demand for natural gas amid the growing electricity demand in Vietnam. GAS is now in the investment phase to set the stage for the company growth in the long-term, in which LNG-related projects (Thi Vai terminal...) and some major E&P projects (Block B, Blue Whale...) would be the key driver for GAS in long-term.