Vietnam rolls out incentives to encourage public-private innovation

Eligible entities may benefit from tax incentives and land rents under land laws.

Public-private partnerships are open to high-tech industries, digital infrastructure, digital platforms, and workforce training, with participants eligible for incentives including tax breaks and land-use benefits.

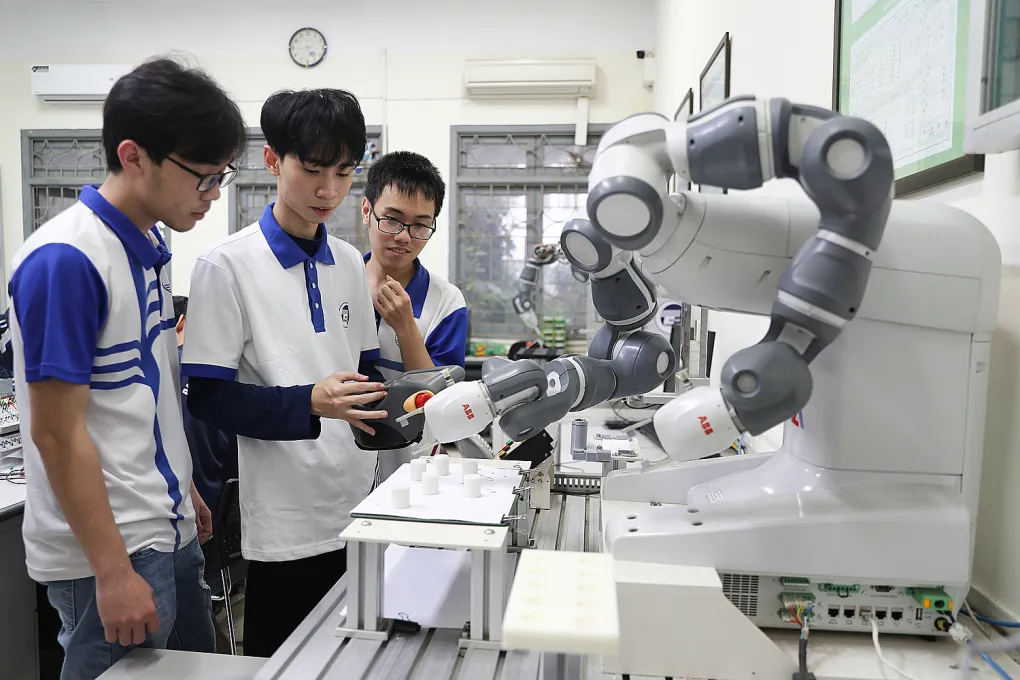

A class at the Vietnam National University. Photo: VNU

These incentives are outlined in the government's Decree No. 180 issued on July 1 that sets forth policies for public-private partnerships (PPPs) in developing science, technology, innovation, and digital transformation.

The decree applies to domestic and foreign organizations and individuals involved in investment, scientific research, technology development, innovation, and digital transformation. It also affects ministries, central agencies, local authorities, and public service units.

The decree covers four key areas, including high technology and related infrastructure. Specifically, it includes strategic technologies and infrastructure supporting research, development, and application of high-tech and strategic technologies.

The second area involves digital infrastructure, which refers to facilities that support the development of the digital economy, society, and government in accordance with the prime minister's decisions on national digital infrastructure strategies.

The third area concerns shared digital platforms, including those defined under National Assembly Resolution No. 193, which outlines pilot mechanisms to promote breakthroughs in science, technology, innovation, and national digital transformation.

The fourth area includes workforce training and infrastructure, with PPP-eligible activities such as developing online education, digital higher education, and societal digital capacity; upgrading strategic training institutions; and expanding programs for digital and industrial technology professionals.

Furthermore, the decree outlines other technologies, products, services, and activities that align with the objectives of scientific research, technological development, innovation, and digital transformation.

A key highlight of the decree is the range of government incentives and support measures provided to encourage PPPs in the aforementioned fields.

Eligible entities may benefit from tax incentives and exemptions or reductions in land use fees, land rents, and investment incentives under land laws. In addition, they are entitled to own the outcomes of scientific research and technology development projects.

The decree includes detailed provisions on ownership, intellectual property rights, data access, profit sharing, and asset management in PPPs and publicly funded science, technology, and innovation projects, which take effect on October 1.