Vietnam’s exports continued at a slower pace

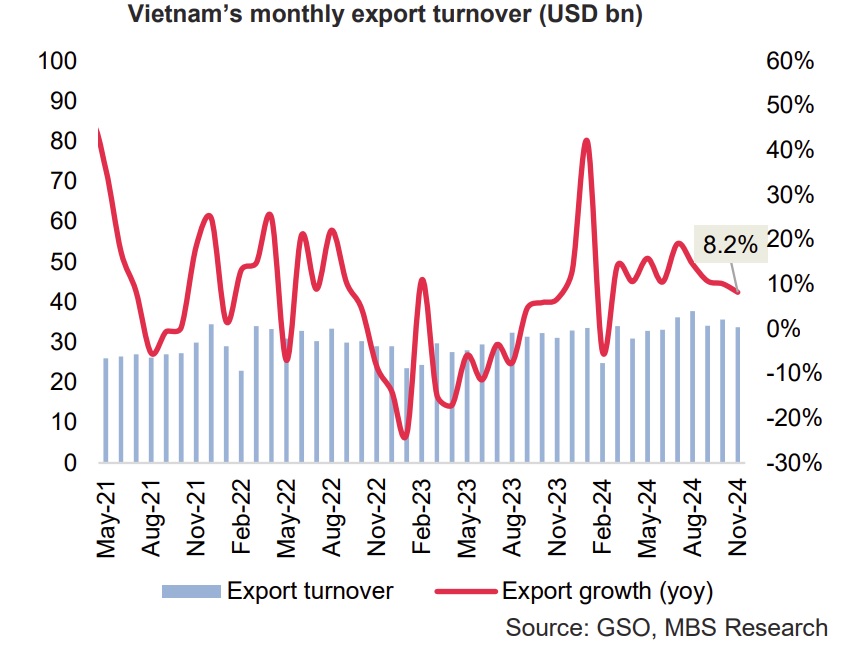

Vietnam’s export turnover in November decreased by 5.3% compared to the previous month, reaching USD 33.7bn.

Compared to the same period last year, exports grew by 8.2%, ending the double-digit growth rates observed in the past nine months, as key commodities experienced significant drops: mobile phones (-13.9%), cameras and camcorders (-41.3%), etc. Nevertheless, other key commodities continued to maintain strong export value, including textile fibers (68.7% yoy), pepper (37.3% yoy), and furniture made of non-wood materials (33.8% yoy).

For 11M24, Vietnam's export turnover accelerated to USD 369.9bn (14.4% yoy). The top largest export products that witnessed a significant drop across the board include clinker and cement (-14.3% yoy); cassava and products (-10% yoy); and paper and paper products (-0.1% yoy). Nonetheless, exports still have some bright spots in terms of growth, such as plastic products (29.8% yoy); electronic goods, computers, and their parts (26.3% yoy); and machinery, instruments, and accessories (21.6% yoy).

In terms of export markets, the US named Vietnam’s largest export market in 11M24, with export turnover reaching USD 108.9bn, up 23.9% yoy. Whilst exports to the EU rose 18.1% yoy to USD 47.3bn, exports to China amounted to USD 55.2bn (-0.9% yoy).

The import turnover of goods is estimated at USD 32.7bn (9.8% yoy, -2.8% mom) in November and USD 345.6bn in 11M24 (16.4% yoy). China was still Vietnam’s largest exporter with a turnover of USD 130.2bn (29.7% yoy). As of Nov, electronic devices, computers, and their parts, along with machinery, instruments, and accessories; fabrics; iron and steel; and plastics, are the 5 import commodities with a value of over USD 10bn (accounting for 51.4% of the total import turnover).

MBS forecasted that Vietnam’s exports would increase by 15% in 2024, with a trade surplus of USD 31 billion based on the following factors: First, according to the World Bank‘s forecast, global trade in goods and services is projected to expand by 2.5% in 2024 and 3.4% in 2025 as inflation pressures are expected to abate this year, allowing real income to bounce back—especially in advanced economies—and therefore encouraging the consumption of manufactured goods. Second, positive signs of FDI in Vietnam are anticipated to play a crucial role in commercial activities. Additionally, recent trade and customs policy reforms have enhanced the efficiency of import-export management, streamlined administrative processes, and reduced costs and time for enterprises.

However, Vietnam’s export growth in 2024 still faces certain obstacles, including potential spikes in transportation costs due to geopolitical conflicts and rising competition from rival exporting countries such as China, Indonesia, and Thailand. Moreover, uncertainties surrounding the escalating trade tensions between the U.S. and China under a new Trump presidency may indirectly impact Vietnam's export activities, particularly for products exported to the US that contain raw materials imported from China. Consequently, key industries with significant export turnover, such as textiles, wood, and electronics, could face substantial trade volatility.