Vietnam’s exports to the US surged amid tariffs

In a year with tariffs dominating the news headlines, Vietnam has seen rather strong export growth to the US. This has raised the US’ share in Vietnam’s export portfolio to 32%, thanks to sustainably high electronics shipments.

Vietnam’s exports to the US surged amid tariffs

We did not enter 2025 expecting tariff to be the dominant buzz word. Vietnam, which runs the third-largest bilateral trade surplus with the US, is widely regarded as the ASEAN country with the highest tariff risk. That’s why Vietnam has been proactively engaging with the Trump administration, even before his presidential inauguration.

The tariff typhoon shocked the market, with Vietnam facing 46% tariffs by the US in April. But, after rounds of negotiations, Vietnam is in the same 20% tariff camp as other ASEAN EMs, all making it back to the same starting line. But what is the initial tariff impact on Vietnam’s economy? As we approach 2026, we take this opportunity to examine some key indicators.

First and foremost, have tariffs deterred Vietnamese exporters from exporting? In HSBC’s view, the answer is not just a firm no. Vietnam’s export growth is even faster at 28% y-o-y on average in 2025 YTD. Yes, it is aided by frontloading trade, particularly in 2Q when exporters rushed to ship goods, but the impact has not faded as fast as expected.

While most regional peers have seen notable moderation in their exports to the US, Vietnam’s export growth remains close to 30% y-o-y on a 3-month-moving-average basis. Thailand is the other country that has seen rather surprising resilience in its exports to the US.

Amid tariffs imposed by the US, ASEAN policymakers have strived to accelerate free trade agreements to seek more diversified trade opportunities elsewhere. But it is a long-term gain versus short-term pain, as the US is arguably a key exporting destination that is hard to ignore in the near term.

Vietnam, in particular, is heavily dependent on the US as its end-consumer market. Now, the dependency ratio is even higher, as 32% of Vietnan’s exports ship to the US. HSBC has previously flagged how trade diversification is hard, using the EU-Vietnam Free Trade Agreement (EVFTA) as a case study.

But Vietnam’s heavy dependence on the US is not only in exports but also in the trade balance. The US has consistently been a key source for Vietnam’s trade surplus. After the monthly trade surplus almost halved to USD1.3bn in 1H25 from 2024, it widened to USD3bn in 3Q25. A large part of the trade boom to the US is thanks to Vietnam’s sustainably high electronics shipments.

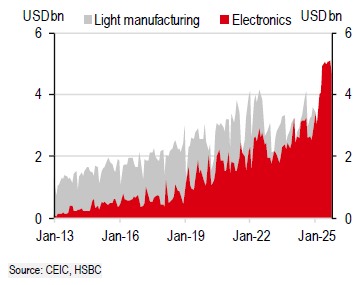

This introduces the question: why have Vietnam’s exports to the US been stronger than peers? To answer the question, in HSBC’s view, it is important to dissect the composition of goods. In 2013, 60% of Vietnam’s goods exports to the US were in light manufacturing sectors, like textile, footwear and toy products. Back then, electronics products only accounted for a marginal 13%.

However, the trend has shifted rather swiftly and electronics exports have seen an exponential surge. On a monthly basis, electronics have grown from accounting for only 1/7th of light manufacturing products in 2013 to almost on par in 2024. Since the beginning of 2025, electronics products have exceeded light manufacturing to be the top exports to the US market.

Vietnam’s main composition of goods exports to the US per month

“This echoes Vietnam’s progress in climbing up the tech value chain. Since US-China trade tensions, Vietnam has elevated its importance in final electronics assembly, specialising in finished consumer electronics. Thanks to Samsung’s consistent investment as early as 2007, Vietnam has been transformed into a major manufacturing centre, producing half of Samsung’s smartphones”, said HSBC.

Despite still being overshadowed by China, Vietnam’s share of phone-related exports has seen a notable jump from almost zero in less than 15 years, though it has seen some recent moderation. Besides consumer electronics, Vietnam is also becoming increasingly important in producing processor ICs – a higher value-add segment than just electronics assembly. This is almost entirely thanks to investment from Intel, which produces 90% of global processor chips.

In addition to trade, the other indicator that is worth significant attention is the performance of FDI, as Vietnam has benefited handsomely from the FDI-driven export boom. While FDI has seen an 8% y-o-y decline in 2025 YTD, the magnitude of FDI remains sizeable. In particular, FDI inflows to manufacturing are around the pre-pandemic average level, though seeing a y-o-y decline from last year’s high base. Interestingly, the FDI composition paints a picture of shifting dynamics. FDI from Korea fell by an astonishing 72% y-o-y, but inflows from mainland China and the US picked up notably to partially offset this.

All in all, it looks like the tariff impact on Vietnam’s economy has been less than initially feared. That said, HSBC is mindful of the lingering downside risks to trade, and this is perhaps too early a stage to assess the impact. Not to forget that the verdicts on the 40% transshipment tariff and sectoral tariffs on semiconductors have not yet been delivered.