Vietnam’s Textile Industry: Charting a Resilient, Diversified Future

Beyond Familiar Borders: Embarking on a Strategic Journey of Market Diversification and Financial Resilience.

Vietnam’s textile and garment industry is bouncing back in 2025, with double-digit export growth. Yet, beneath these impressive figures, the industry faces a pivotal challenge: how to diversify into new markets and reduce dependence on traditional partners like the United States. While market diversification is essential for long-term success, it also brings new threats, including tariff that could disrupt trade and threaten competitiveness.

According to the General Department of Customs, Vietnam’s textile and garment export turnover reached USD 11.76 billion in the first four months of 2025, marking a 12.8% increase year-on-year. The United States still leads as the top export market, accounting for 43.9% of total turnover. However, new tariffs of up to 25% on certain product categories are putting pressure on exporters to adapt quickly.

Market Concentration Risks

Industry leaders echo these concerns. Overdependence on a single market like the U.S. exposes businesses to policy fluctuations. Market diversification is an inevitable trend, but it must be accompanied by robust risk management capabilities, says Mr. Cao Huu Hieu, CEO of Vietnam National Textile and Garment Group (Vinatex).

This warning is supported by evidence. In 2023, more than 1,300 textile enterprises in Vietnam were forced to shut down or declare bankruptcy, primarily due to an 80% drop in orders. Today, the industry is proactively seeking new opportunities in emerging markets such as Halal markets in Southeast Asia and the Middle East, South America—where consumer demand is rising—and trade partners under CPTPP, EVFTA, and RCEP frameworks.

However, market expansion also introduces new risks. According to Atradius, a leading global trade credit insurer, 50% of businesses in Asia anticipate an increase in B2B customer insolvency in the coming months (source: Atradius Payment Practices Barometer – Asia 2025). Additionally, 44% of B2B credit sales are affected by late payments, with bad debts averaging 5% of total B2B invoices.

Common key risks when entering new markets include: lack of customer credit information, legal and cultural differences, unfamiliar payment practices, challenges in international debt collection, and prolonged payment delays or bankruptcies.

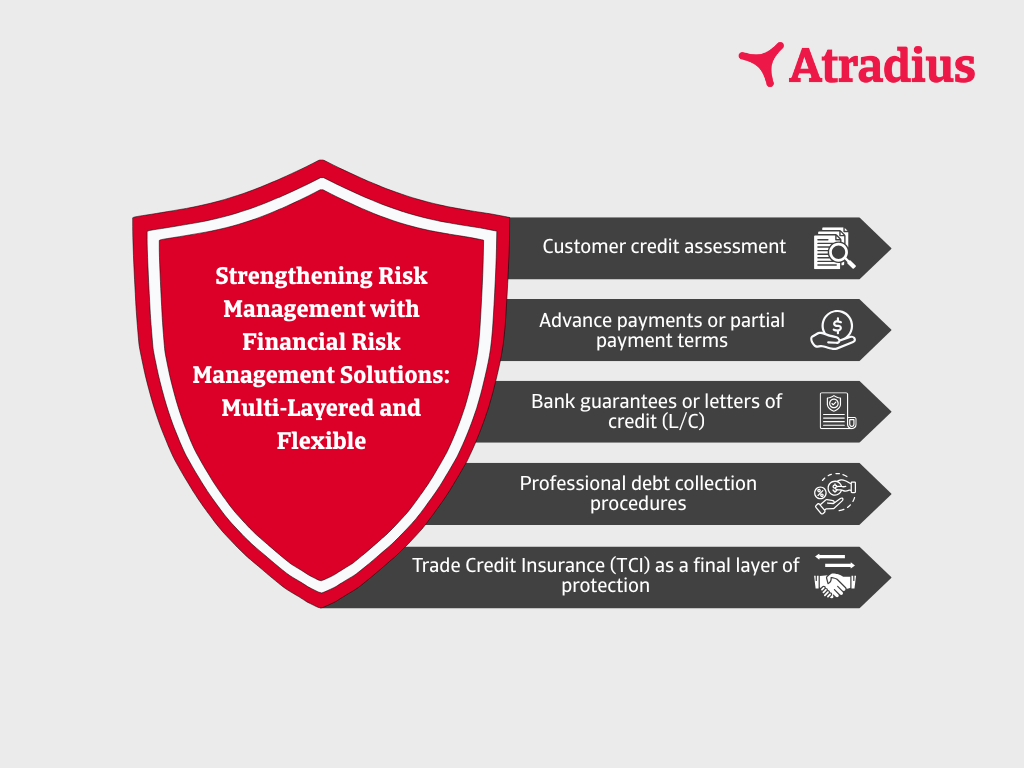

Strengthening Financial Risk Management: A Multi-Layered Approach

To ensure stable cash flow during periods of market expansion, it is recommended that businesses implement comprehensive financial risk mitigation strategies. These may include conducting thorough customer credit assessments, requiring advance or partial payments, utilising bank guarantees or letters of credit (L/C), establishing formalised debt collection procedures, and securing trade credit insurance (TCI)—which serves as an additional safeguard against customer non-payment.

In Vietnam, trade credit insurance products are offered by reputable providers such as Bao Viet Insurance Corporation and Tokio Marine Insurance Vietnam, in partnership with Atradius—a global trade credit insurer operating in over 50 countries.

As Mr. Patrick Chan, Risk Director at Willas-Array, shared: “Trade credit insurance gives us the confidence to expand into new markets without worrying about payment risks. It’s not just a protective tool—it’s a growth enabler.”

Success in new markets requires more than risk management. Vietnamese textile enterprises must focus on technological innovation and ESG compliance, including functional fabric development, eco-friendly dyeing, recycling, and smart manufacturing with AI and automation. Additionally, they should manage financial risks effectively to protect every order.

Conclusion: A Comprehensive Repositioning for Sustainable Growth

Vietnam’s textile industry is at a turning point. Market expansion is imperative, but must be supported by technological advancement, ESG adherence, and sound financial risk management. A strategic combination of market diversification, multi-layered financial solutions, trade credit insurance, and sustainable investment will be key to helping businesses navigate volatility and maintain stable growth in 2025 and beyond.