Vietnam to feel the impact of Delta variant

Vietnam has felt the negative impact of the Delta variant. In August, Vietnam’s PMI dropped to 40.2pts, the lowest level since May 2020. For the first time since May 2020, the export value dropped 6.0% MoM and 5.4% YoY to about US$26.2bn in Aug 2021…

Vietnam’s August Index of Industrial Production (IIP) slumped 7.4% YoY (vs. a decline of 0.3% YoY in the previous month). Photo: Quoc Tuan

Both services and manufacturing were hit hard

According to General Statistics Office (GSO), gross retail sales of consumer goods and services witnessed the fourth consecutive month of decline, to VND279,843bn (-10.5% MoM and -33.7% YoY), and it was even 10.5% lower than that in April 2020 when Vietnam imposed the first nationwide lockdown for 3 weeks.

Wholesale and retail sales dropped 8.0% MoM (-25.3% YoY) as domestic demand slumped. The revenue of accommodation and catering services fell 26.3% MoM (-66.9% YoY) while the revenue of traveling service plummeted 78.8% MoM (- 97.6% YoY) amid the temporary shutdown of nonessential services in many provinces. VNDirect observed the downward pressure on the service sector was much heavier than that during the first lockdown last year.

For 8M21, gross retail sales of consumer goods and services slid 4.7% YoY (vs. a decline of 0.2% YoY in 7M21 and a 1.1% decrease in 8M20). If exclude the price factor, this figure declined 6.2% YoY, the strongest level since May 2020.

VNDirect expected revenue of the service sector to slightly recover in September as some localities could relax some social-distancing measures and restrictions applied to non-essentials services since 15 September.

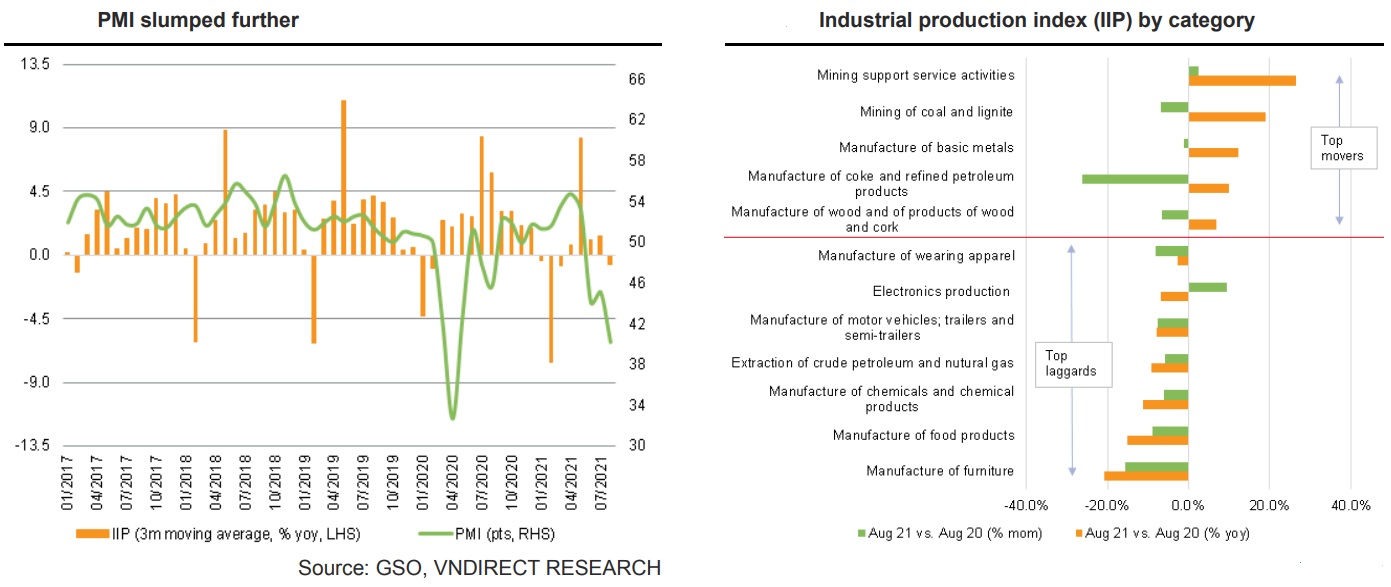

Regarding the industrial sector, the IHS Markit Purchasing Managers' Index (PMI) of Vietnam in August 2021 dropped to 40.2 points, the lowest level since May 2020, marking the third consecutive month the index fell below 50 points. Also, Vietnam’s Aug Index of Industrial Production (IIP) slumped 7.4% YoY (vs. a decline of 0.3% YoY in the previous month). These indicators have shown a further reduction in industrial activities as more factories have to be temporarily suspended.

Regarding sub-sector, very few industrial sub-sectors recorded growth over year-on-year basis, including mining support service activities (26.5% YoY), mining of coal and lignite ( 19.0% YoY), manufacture of basic metals (12.1% YoY), manufacture of coke and refined petroleum products (9.9% YoY) and manufacture of wood (6.8% YoY). On the other hand, VNDirect saw a strong contraction in the manufacture of furniture (-20.9% YoY), manufacture of food products -15.2% YoY), manufacture of chemicals and chemical products (-11.2% YoY), extraction of crude petroleum and natural gas (-9.1% YoY) and manufacture of motor vehicles (-7.8% YoY).

Import and export struggled with supply disruption

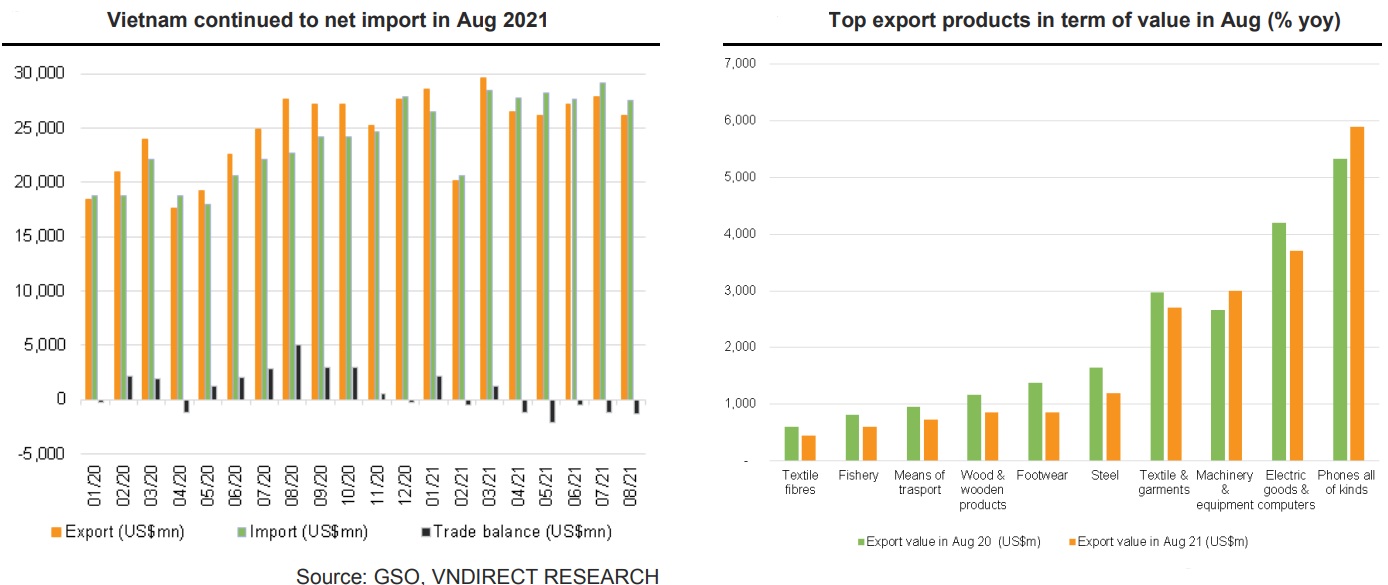

Per GSO data, export value dropped 6.0% MoM (-5.4% YoY) to about US$26.2bn in August 2021. This is the first time since May 2020 that Vietnam’s export value witnessed a year-on-year decline (excluding the seasonal factor). Export activities were hit last month as some seaports in Southern Vietnam had to limit their operation as required while other transports were tightly controlled. For 8M21, export value climbed to US$212.6bn (21.2% YoY).

Among Vietnam’s export products, the items that recorded the positive growth rate on Aug 21 include petroleum (172.9% YoY), steel (107.0% YoY), pepper (72.6% YoY), cassava and cassava products (54.4% YoY), and chemicals (47.5% YoY). On the other hand, some products saw a strong decline, including crude oil (-75.5% YoY), footwear (-38.5% YoY), bags, and suitcases (-37.9% YoY), non-wooden furniture (-37.2% YoY and rice (-30.4% YoY).

Basing on the actual performance of the manufacturing sector during June – August, VNDirect lowered its forecast for 2021F Vietnam’s export value growth to 15% YoY from the previous forecast of 16.6% YoY.

As for imports, Vietnam’s import spending rose 21.2% YoY to US$27.5bn in Aug 2021 (slower than an increase of 31.8% YoY in the previous month). For 8M21, import value climbed to US$216.3bn (33.8% YoY), and Vietnam net imported US$3.7bn in 8M21 (vs. a trade surplus of US$8.7bn seen in 8M20), according to GSO. Among Vietnam’s key import products, the items that witnessed the strong import growth rates in Aug 2021 include rubber (137.6% YoY), fertilizer (90.7% YoY), cotton (64.4% YoY), chemical products (62.2% YoY), and steel (51.8% YoY).

Due to the negative impact of the fourth outbreak on the manufacturing sector and export activities, VNDirect forecasted Vietnam's trade surplus would drop sharply in 2021 to US$0.3bn, from a trade surplus of US$18.9bn in 2020.

State investment slew down

Stricter social-distancing measures and construction material prices hike caused several delays in the implementation of public investment last month. Per GSO data, disbursement under state budget (public investment) in Aug dropped 20.9% YoY (-7.1% MoM) to VND34,874bn. For 8M21, disbursed state capital fell 0.4% YoY to VND244.9 trillion (below an increase of 28.0% YoY in 8M20), equivalent to 51.1% of the full-year target. To reverse the downward trend, the government issued Official Letter No. 1082/CD-TTg dated August 16 on speeding up the implementation and disbursement of public investment for the remainder of 2021. VNDirect expected the disbursement of public investment to accelerate since mid-September after several localities relaxing social-distancing policies, which is expected to be among the key drivers for economic recovery in 4Q21.

FDI saw positive signals

However, foreign indirect investment unexpectedly witnessed positive signals in Aug 2021. According to GSO, the registered capital of FDI projects surged 233% in Aug to US$2.4bn (vs. a 54% decline seen in the previous month). Last month, LG Display Vietnam registered to increase investment capital in Trang Due industrial park in Hai Phong city by US$1.4bn, thus lifting the total investment capital to US$4.7bn, and become the largest foreign investor in this locality. For 8M21, the registered capital of FDI projects slid 2.1% to US$19.1bn (vs. a decrease of 12.6% YoY in 8M20).

To be more specific, 1,135 newly licensed projects with a registered capital of US$11.3bn, an increase of 16.3% in terms of registered capital compared to the same period in 2020; 639 projects licensed in the previous years approved to adjust investment capital (incremental FDI) with a total additional capital of US$5.0bn (2.3% YoY); 2,720 turns of capital contribution and share purchases of foreign investors with a total value of the capital contribution of US$2.8bn, a drop of 42.9% over the same period in 2020. Regarding disbursement capital, the implemented capital of FDI projects reached US$11.6bn, increasing 1.6% YoY (vs. a 4.7% decrease in 8M20).

Inflation inched up but is still manageable

Vietnam’s headline inflation climbed to 2.8% YoY in August 2021 (vs. 2.6% in the previous month). On a month-on-month basis, headline CPI inched up 0.2% vs. July level, mostly driven by the 0.7% MoM increase in food and foodstuff price index, and the 0.2% MoM increase beverage and tobacco price index. On the contrary, the transport price index fell 0.1% MoM in August 2021.

As the inflationary pressure remained low in the remainder of 2021 as the government announced to reduce prices and fees of essential services such as electricity, water supply, and telecommunication for customers affected by the COVID-19 pandemic, VNDirect kept unchanged its forecast of the 2021F average headline CPI increase of 2.4% YoY (/- 0.2 percentage points).