Vietnam's economic outlook for 2022: Three challenges ahead

Although the Vietnamese economy is expected to recover strongly in 2022, it will also face some key macro risks.

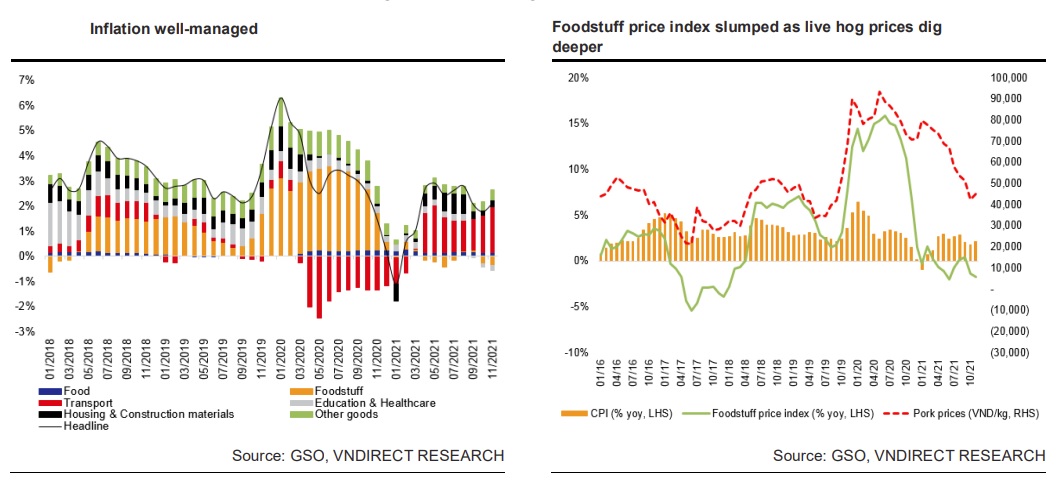

Vietnam's inflation remains under control and meets the government’s target of keeping the 2022F average CPI below 4.0% yoy, said VNDirect.

Inflation pressure

VNDirect sees inflation picking up in 2022: First, the recovery of domestic consumption and a tighter pork supply in 2H22 could lead to a stronger increase in the food and foodstuff price index.

Second, energy prices are expected to remain at a high level in 2022, with Brent crude oil prices averaging at USD 80 per barrel in 2022F (14.3% yoy). VNDirect also expects a strong recovery in mobility in 2022 as the government eases social distancing measures and resumes international flights from 1Q22. These are bullish catalysts for the transportation price index.

Third, it can be clearly seen that the prices of many inputs for the production of goods have increased sharply in 10M21, such as the prices of gasoline, chemicals, fertilizers, coal, iron, steel... These factors will be reflected in the prices of consumer goods in 2022 when consumer demand recovers.

Fourth, inflationary pressure could increase due to expected high money supply and large-scale fiscal support packages in 2022.

However, VNDirect is not too concerned about the inflation risks in 2022 because consumer demand takes time to fully recover. Besides, the government's good record of controlling inflation over the past few years would lower inflation expectations. Notably, the government is able to control the rise of the CPI by stabilizing the prices of essential goods and services such as petrol, retail electricity, fertilizers, pesticides, essential foods (rice, sugar, salt),... "The 2022F average headline CPI would increase by 3.45% yoy (vs. our forecast of a 2021F average CPI of 2.1% yoy). It remains under control and meets the government’s target of keeping the 2022F average CPI below 4.0% yoy", VNDirect said.

China's threats

The global economy and markets took notice of China’s market selloff and economic slowdown in 2H21, but there was little spillover. According to the International Monetary Fund (IMF), the recovery of the Chinese economy could slow down to 5.6% yoy in 2022F, from a level of 8.0% yoy in 2021F. VNDirect concerns that a further correction in China, coming from a pandemic resurgence, regulatory crackdown, power shortages, or the rising bad debts of Chinese property developers, could put a major dent in Vietnam's exports and investor sentiment. It is noted that China is currently Vietnam's largest trading partner, accounting for 17% of Vietnam’s export value (second after the US) and 33% of Vietnam’s import value (ranked first) in the first 10 months of 2021. In addition, China ranked fourth among foreign direct investors in Vietnam in 11M21.

Effect of QE tapering

The normalization of monetary policy by several central banks, such as the FED, ECB, and others, should not be seen as a tightening of global monetary policy. VNDirect believes that the QE tapering is unlikely to have much impact on Vietnam's monetary policy as well as its financial markets.

Regarding monetary policy, this stock company believes that the SBV will maintain a loose monetary policy until at least the end of 2Q22 to support the economic recovery. Any monetary tightening will only take place in the second half of 2022, and major rate hikes will be limit ed to 0.25-0.5%.

Due to the impact of the taper tantrum, foreign indirect investment (FII) may continue to be net withdrawn in 1H2022 due to the taper tantrum. However, foreign investors have been net sellers on Vietnam's stock market in the last 2 years, so the impact of foreign net selling will be moderate because the market has prepared in advance.

Considering the USD/VND exchange rate, the upcoming QE tapering could have less impact on foreign investment flows into Vietnam in 2022. Besides, VND is also strongly supported by a higher trade surplus and foreign reserves in 2022. Therefore, VNDirect believes that the coming QE tapering will have minimal impact on the VND exchange rate.