Vietnam's economy is poised for recovery ahead

Vietnam is poised for a gradual recovery since 1Q22 driven by picking up vaccination, resuming exports and manufacturing expansion, and ongoing stimulus packages, said VNDirect.

Vietnam is reopening to revive economy. Photo: Quoc Tuan

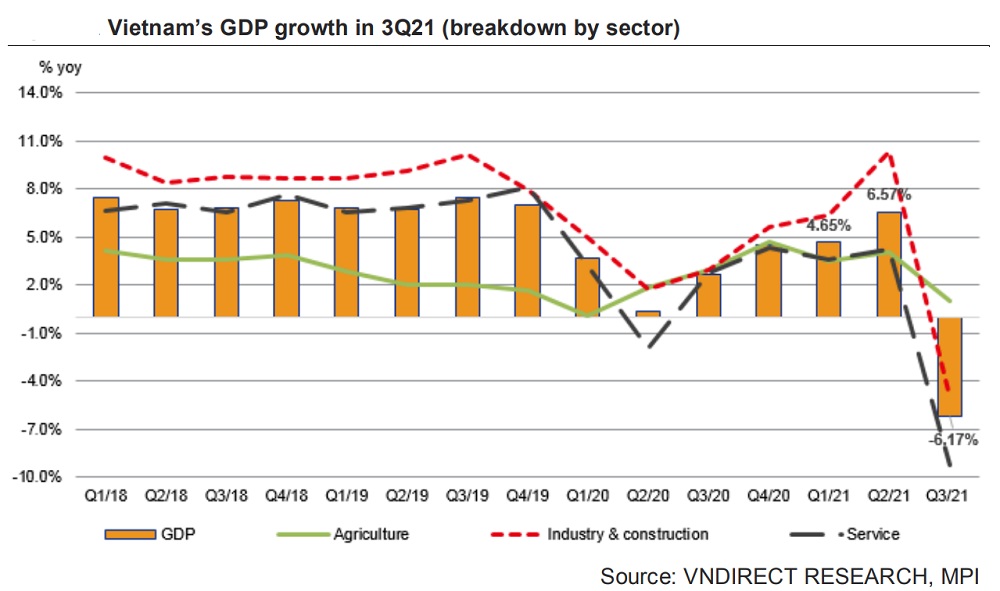

According to General Statistics Office (GSO), Vietnam’s real GDP fell 6.2% YoY in 3Q21, i.e. the slowest quarterly growth rate ever recorded by GSO. All aspects of the economy were under downward pressure in 3Q21. The agriculture, forestry, and fishery sector edged up 1.0% YoY in 3Q21, the lowest quarterly growth rate since 2Q20, due to lower domestic demand when many provinces applied strict social-distancing measures.

The industry and construction sector slid 5.0% YoY in 3Q21 (vs. a 10.4% YoY increase seen in 2Q21) due to lower domestic demand and disruption in the supply chain amid tighter social-distancing protocols. Many industrial parks and factories in southern provinces have to be temporarily suspended to prevent the spread of coronavirus, thus causing a reduction in industrial activities. Other key indicators also point to a dismal situation of industrial production in 3Q21. Vietnam’s 3Q21 index Index of Industrial Production (IIP) slumped 4.4% YoY (slowing from a 12.4% increase in 2Q21). The IHS Markit Purchasing Managers' Index (PMI) of Vietnam in Sep 2021 remained at 40.2 points, the fourth consecutive month the index fell below the 50 points. These indicators have shown a further reduction in industrial activities as more factories have to be temporarily suspended.

The service sector was hit the hardest and decreased 9.3% YoY in 3Q21 (vs. 4.2% growth rate seen in 1H21) amid the temporary shutdown of nonessential services in many provinces. 3Q21 gross retail sales of consumer goods and services slumped 21.4% QoQ to VND915,716bn (-28.3% YoY), of which wholesale and retail sales dropped 15.6% QoQ (-20.4% YoY) and the revenue of accommodation and catering services fell 42.7% QoQ (-55.7% YoY) while the revenue of traveling service plummeted 83.6% QoQ (-94% YoY).

VNDirect thinks the sharp decline in 3Q21 makes the economic growth hard to capture the previous forecast of 3.9%. Besides, it said there would be some obstacles that could hinder the strong recovery of Vietnam’s economy in the fourth quarter of 2021, including lower vaccination rate (especially in rural areas), lower people’s income amid prolonged pandemic, inconsistent anti-pandemic policies, and labor shortages in Southern provinces. Therefore, it lowered its 2021 GDP growth forecast to 2.2%.

Meanwhile, Vietnam’s headline inflation slowed to 2.1% YoY in September (vs, 2.8% YoY in the previous month. VNDirect lowered its forecast of the 2021F average headline CPI increase of 2.2% YoY (/- 0.2 percentage points). It expected inflation pressure to remain low in the next two quarters before rising since 2Q22 due to (1) the recovery of domestic demand and (2) no longer government price reduction for electricity, water, and telecommunications as in the second half of 2021 and (3) high energy prices expected in 2022F.

However, this stock company is optimistic about Vietnam’s economic outlook in 2022 thanks to (1) strong external demand amid on-track recovery of the global economy, (2) higher vaccination rate with 70-75% population fully vaccinated against coronavirus, (3) the resume of international commercial flight and the revival of tourism (4) loosening monetary and fiscal policies expected in 1H22. We project Vietnam’s GDP rising by 7.5% in 2022, with resilient growth in all sectors. By sector, the industry and construction sector is forecasted to rise by 8.6%, followed by the service sector (8.1%) and the agriculture, forestry, and fishery sector (2.8%).